A Syracuse New York Non-Foreign Affidavit Under IRC 1445 is a legal document used in real estate transactions involving the sale or transfer of a property by a foreign seller. This affidavit serves as proof that the seller is not a foreign person under the Internal Revenue Code (IRC) Section 1445, and therefore exempt from certain withholding taxes. In Syracuse, New York, just like in other parts of the United States, the IRC 1445 requires buyers to withhold a specific percentage of the gross sales price when acquiring a property from a foreign individual or entity. However, if the seller can establish their non-foreign status, this withholding requirement may be waived. There are different types of Syracuse New York Non-Foreign Affidavits Under IRC 1445, depending on the specific circumstances of the transaction. These may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual seller, who is not a foreign person as defined by the IRC Section 1445, is transferring the property. 2. Entity Non-Foreign Affidavit: In cases where the seller is not an individual but rather a non-foreign entity, such as a corporation or partnership, an entity non-foreign affidavit is utilized to confirm this status. 3. Multiple Sellers Non-Foreign Affidavit: In situations where there are multiple sellers involved in the sale or transfer of a property, and all sellers are non-foreign, a multiple seller non-foreign affidavit may be required. This affidavit ensures that each seller's non-foreign status is acknowledged. The Syracuse New York Non-Foreign Affidavit Under IRC 1445 typically includes essential information such as the seller's name, contact details, and citizenship status, along with details regarding the property being sold or transferred. Additionally, the affidavit certifies that the seller is not considered a foreign person under the IRC Section 1445 and is fully compliant with all relevant tax laws. By submitting the Syracuse New York Non-Foreign Affidavit Under IRC 1445, the seller provides the necessary evidence to the buyer and relevant authorities that they are exempt from the withholding tax requirements. This affidavit helps streamline the transfer process and ensures that all legal obligations are met in real estate transactions involving non-foreign sellers in Syracuse, New York.

Syracuse New York Non-Foreign Affidavit Under IRC 1445

Description

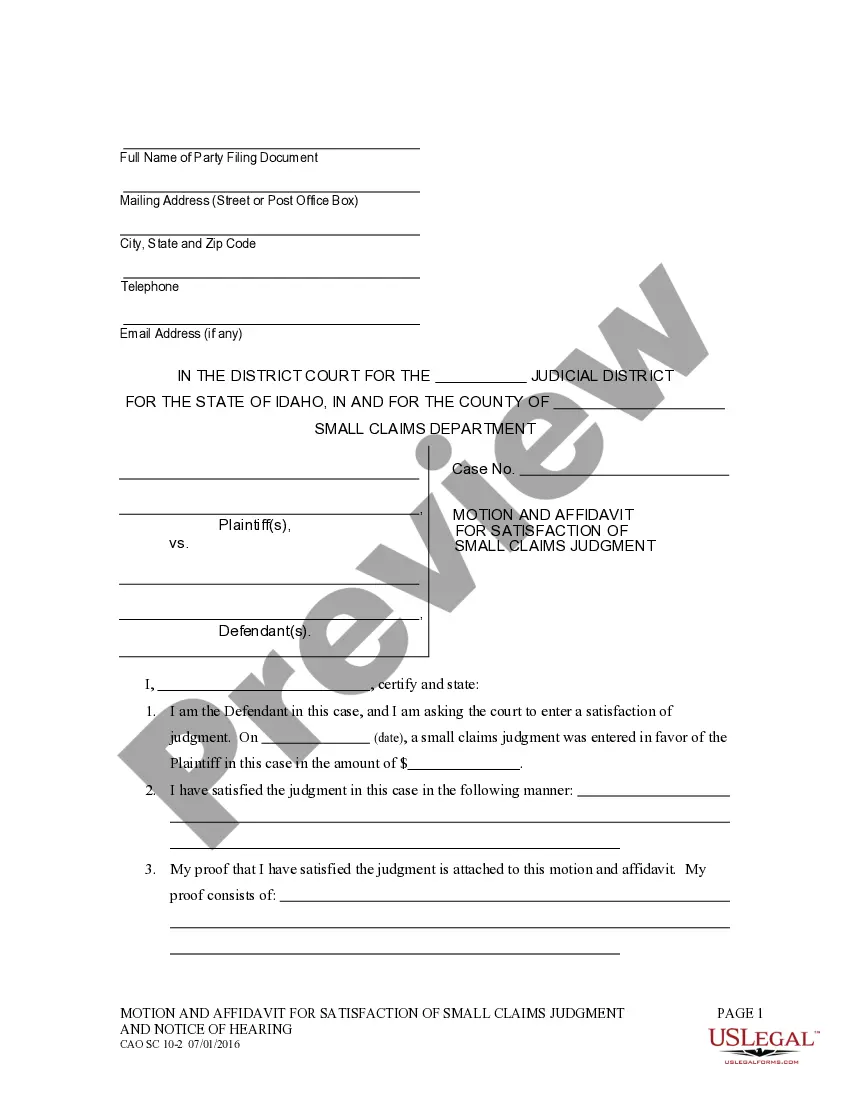

How to fill out Syracuse New York Non-Foreign Affidavit Under IRC 1445?

If you are searching for a pertinent form template, it’s unlikely you’ll find a superior platform than the US Legal Forms website – arguably the most comprehensive libraries on the internet.

With this collection, you can access a vast array of form samples for both business and personal needs categorized by types and states, or keywords.

Thanks to the advanced search capability, locating the most recent Syracuse New York Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Retrieve the form. Choose the format and download it to your device.

- Moreover, the validity of each document is confirmed by a team of proficient lawyers who routinely evaluate the templates on our site and update them to comply with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Syracuse New York Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have located the form you require. Review its details and utilize the Preview function to inspect its content. If it doesn’t align with your needs, employ the Search box at the top of the screen to find the suitable document.

- Validate your choice. Click on the Buy now button. Afterwards, pick your desired pricing plan and provide your details to register for an account.

Form popularity

FAQ

To avoid FIRPTA tax, sellers can provide a valid certificate of non-foreign status, indicating they are not subject to the withholding. This process often involves the use of the Syracuse New York Non-Foreign Affidavit Under IRC 1445, which helps sellers demonstrate their compliance with IRS regulations. Consulting with professionals or platforms like uslegalforms can ensure you properly navigate your responsibilities and optimally complete your transaction.

Typically, the seller of the real estate property signs the FIRPTA certificate to affirm their non-foreign status. If the seller is a corporation or partnership, an authorized representative may sign on their behalf. In Syracuse, New York, using the Syracuse New York Non-Foreign Affidavit Under IRC 1445 makes it easier for buyers and sellers to fulfill their legal obligations.

A Section 1445 affidavit is a formal declaration that states a seller's status as a non-foreign individual or entity during a real estate transaction. This affidavit is crucial for tax compliance under FIRPTA laws in the United States, particularly in Syracuse, New York. By signing this document, sellers can ensure they're abiding by the requirements of the Syracuse New York Non-Foreign Affidavit Under IRC 1445.

A certificate of non-foreign status serves as documentation that confirms a seller is not a foreign person, thus exempting them from FIRPTA withholding. This certificate simplifies transactions involving real estate in Syracuse, New York, making it easier for buyers and sellers to navigate the tax implications. By utilizing the Syracuse New York Non-Foreign Affidavit Under IRC 1445, sellers can assert their non-foreign status effectively.

To obtain a FIRPTA withholding certificate, you must submit IRS Form 8288-B to the Internal Revenue Service. On this form, you will provide details about the sale of your property in Syracuse, New York, and outline your reasons for requesting the certificate. By including the information required, you can streamline the process and potentially reduce your withholding tax under the Syracuse New York Non-Foreign Affidavit Under IRC 1445.

A 1445 form is a document used to report the sale of U.S. real property interests by foreign sellers. This form is critical for ensuring compliance with the FIRPTA withholding requirements. By submitting a Syracuse New York Non-Foreign Affidavit Under IRC 1445, sellers can authenticate their non-foreign status and avoid unnecessary tax withholdings. Understanding and completing this form accurately is key to a successful real estate transaction.

Internal Revenue Code IRC section 1031 allows for tax deferral on the exchange of like-kind properties. This means you can defer paying capital gains taxes when you reinvest the proceeds into a similar investment property. It is crucial to consider the implications of FIRPTA and use a Syracuse New York Non-Foreign Affidavit Under IRC 1445 if you are a foreign seller involved in a tax-deferred exchange. Working with knowledgeable professionals will ensure you navigate these provisions effectively.

IRC Code section 1445 outlines the requirements for withholding tax on transfers of U.S. real property interests by foreign sellers. This section aims to ensure that all taxes owed are collected when foreign individuals conduct real estate transactions in the U.S. To simplify this process, buyers can request a Syracuse New York Non-Foreign Affidavit Under IRC 1445 to confirm the seller's non-foreign status, allowing for a smoother transaction process. Being informed about these regulations can save you from unexpected tax liabilities.

IRC code 1445 refers to the Internal Revenue Code provision that requires withholding on certain transactions involving foreign persons. Specifically, it pertains to the sale of U.S. real property interests by foreign individuals. By completing a Syracuse New York Non-Foreign Affidavit Under IRC 1445, sellers can affirm their non-foreign status and avoid unnecessary withholding. Understanding this code is vital for navigating real estate transactions.

To avoid paying FIRPTA, you may need to establish your status as a non-foreign person. This involves submitting a Syracuse New York Non-Foreign Affidavit Under IRC 1445, which confirms your non-foreign status. When you provide this affidavit during the closing of a real estate transaction, it helps exempt you from FIRPTA withholding. Always consult a tax professional to ensure you have the correct documentation.