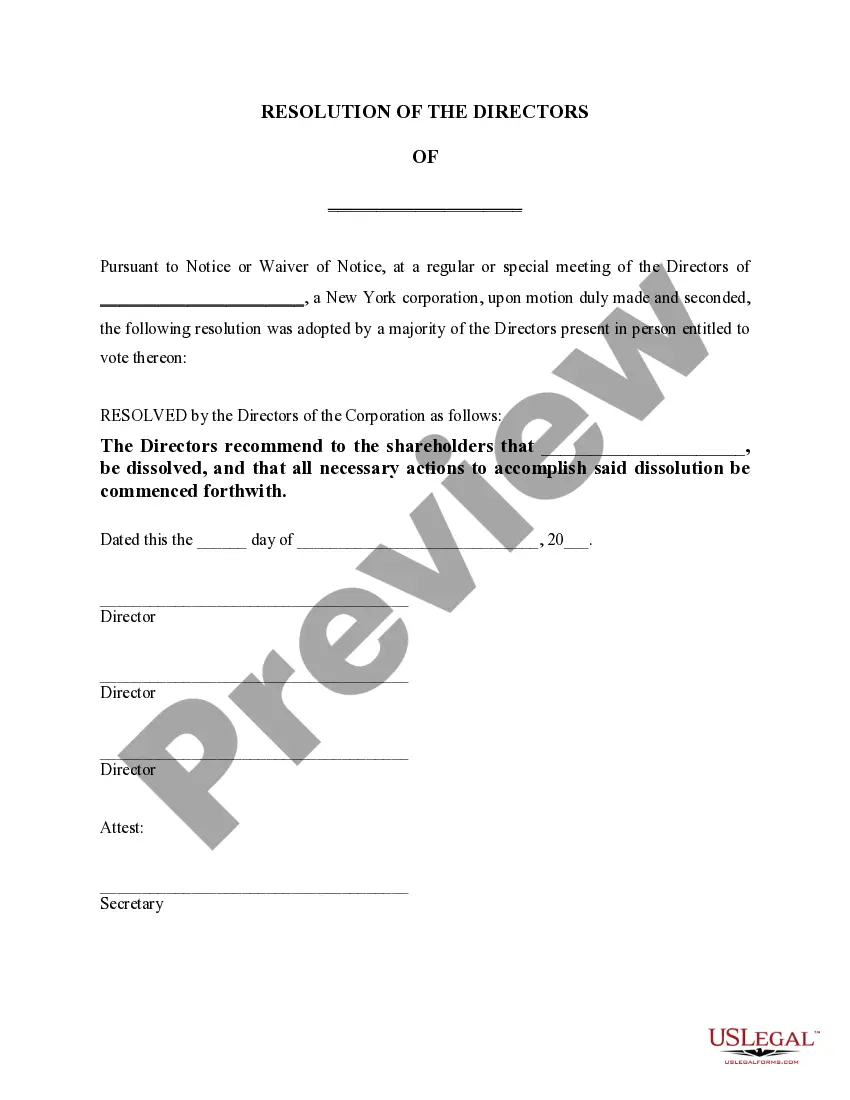

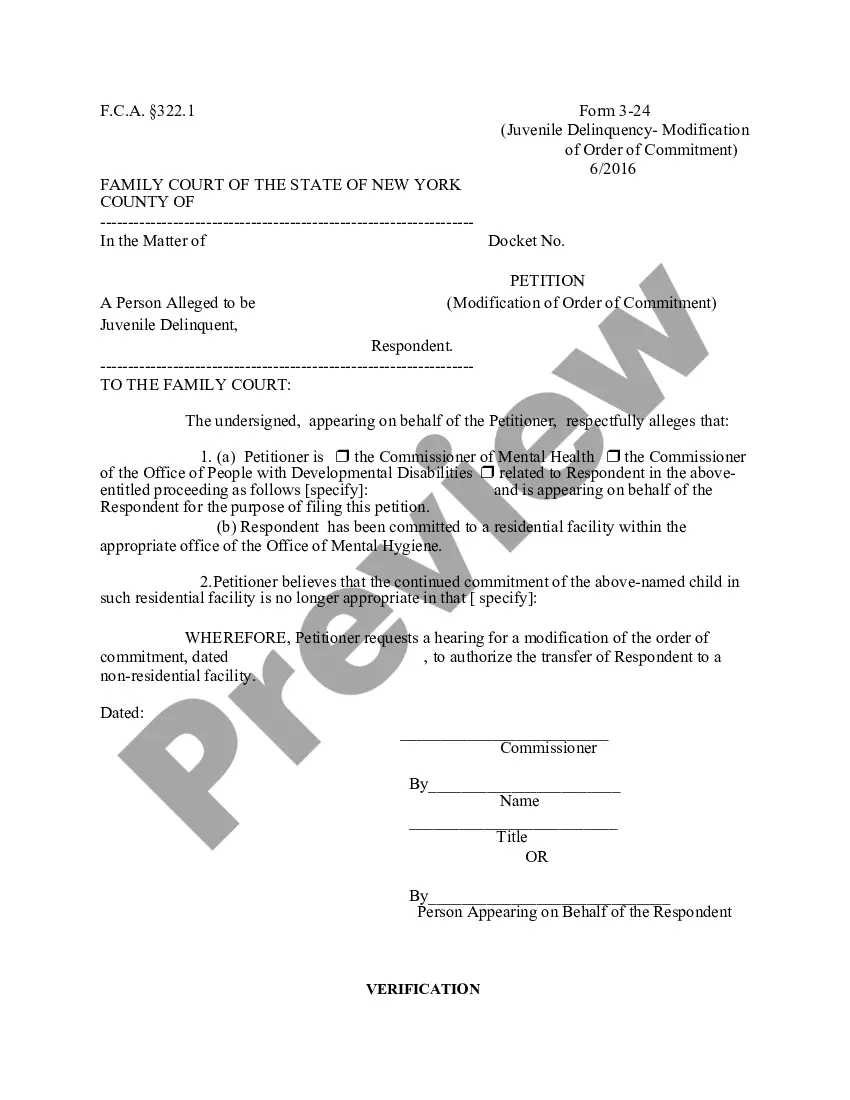

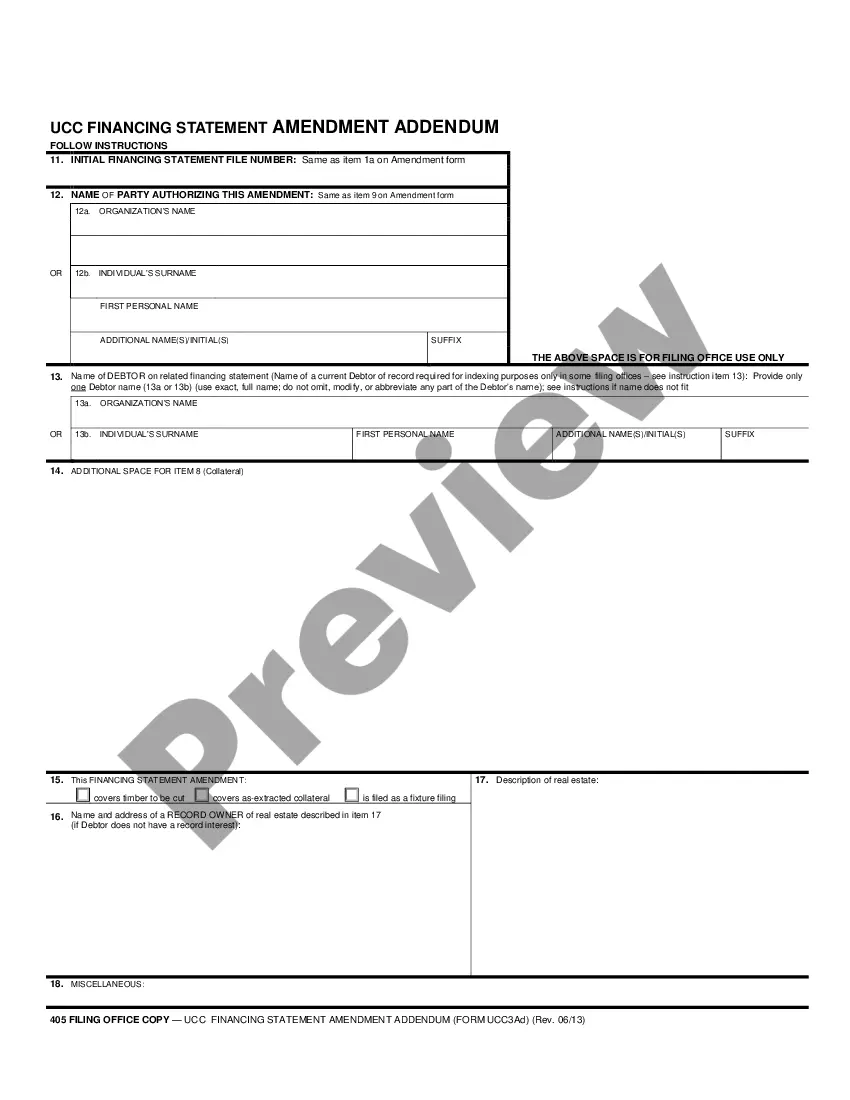

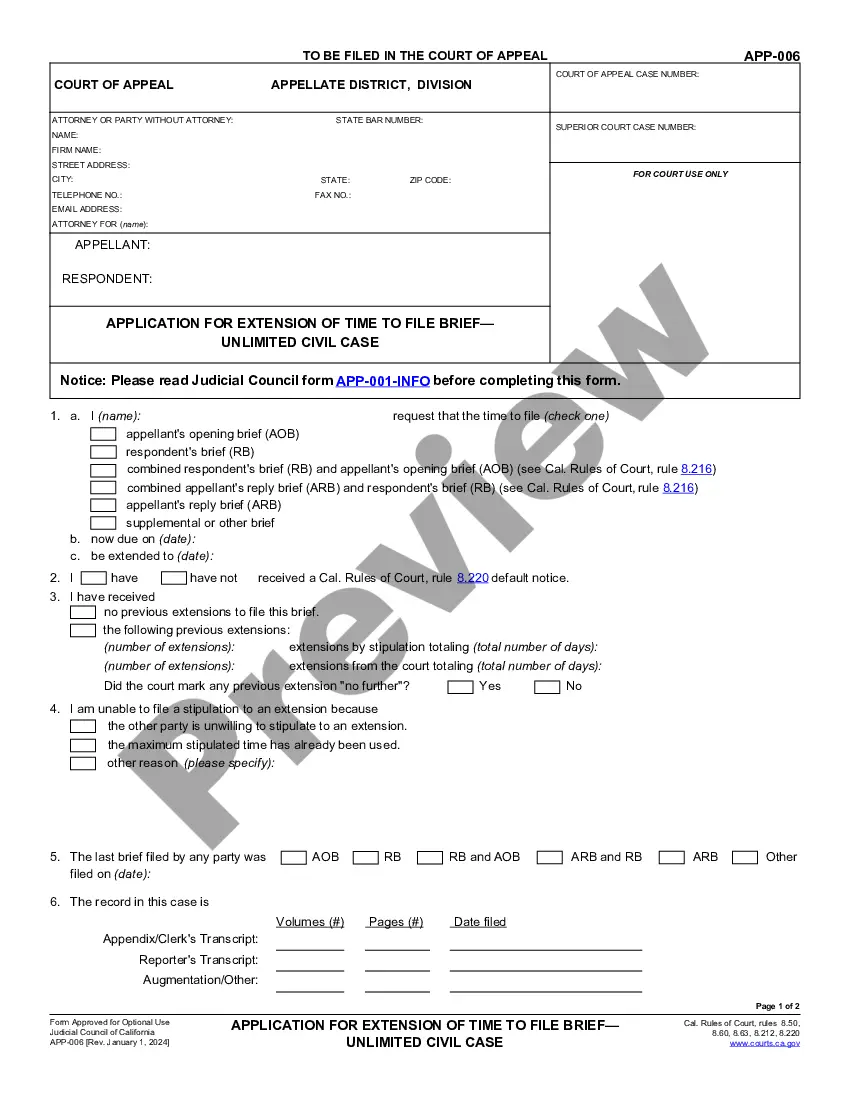

The Suffolk New York Dissolution Package is a comprehensive set of legal documents and services designed to facilitate the dissolution process of a corporation in Suffolk County, New York. This package provides the necessary tools and guidance for business owners and shareholders seeking to formally and legally terminate a corporation's existence. The dissolution package includes all the essential forms, templates, and instructions required to dissolve a corporation in accordance with the laws and regulations of Suffolk County, New York. These documents cover crucial aspects such as filing for dissolution, the distribution of assets and liabilities, notifying shareholders and creditors, and complying with all legal obligations. There are different types of Suffolk New York Dissolution Packages available, which cater to various situations and needs: 1. Standard Dissolution Package: This package is designed for corporations looking to dissolve their business in a straightforward manner, without any complex issues or disputes. It includes all the necessary forms and instructions to complete the dissolution process efficiently. 2. Contested Dissolution Package: This package is intended for corporations encountering disputes or disagreements among the shareholders or directors. It provides additional documentation and guidance to address these conflicts and resolve them in a legal manner. 3. Asset Liquidation Dissolution Package: For corporations that need to liquidate their assets as part of the dissolution process, this package includes additional forms and instructions specific to asset distribution, sales, or transfers. 4. Voluntary Dissolution Package: This package is suitable for corporations that have fulfilled their business goals or are no longer in operation due to various reasons. It enables such corporations to dissolve voluntarily and in compliance with the legal requirements. Irrespective of the type of dissolution package chosen, each package ensures that the corporation follows the necessary legal procedures, protects the rights of shareholders and creditors, and avoids any potential liabilities or legal troubles arising from an incomplete or improper dissolution. The Suffolk New York Dissolution Package to Dissolve Corporation is an essential resource for business owners seeking a seamless conclusion to their corporation's existence while adhering to the legal requirements and maintaining transparency throughout the process.

The Suffolk New York Dissolution Package is a comprehensive set of legal documents and services designed to facilitate the dissolution process of a corporation in Suffolk County, New York. This package provides the necessary tools and guidance for business owners and shareholders seeking to formally and legally terminate a corporation's existence. The dissolution package includes all the essential forms, templates, and instructions required to dissolve a corporation in accordance with the laws and regulations of Suffolk County, New York. These documents cover crucial aspects such as filing for dissolution, the distribution of assets and liabilities, notifying shareholders and creditors, and complying with all legal obligations. There are different types of Suffolk New York Dissolution Packages available, which cater to various situations and needs: 1. Standard Dissolution Package: This package is designed for corporations looking to dissolve their business in a straightforward manner, without any complex issues or disputes. It includes all the necessary forms and instructions to complete the dissolution process efficiently. 2. Contested Dissolution Package: This package is intended for corporations encountering disputes or disagreements among the shareholders or directors. It provides additional documentation and guidance to address these conflicts and resolve them in a legal manner. 3. Asset Liquidation Dissolution Package: For corporations that need to liquidate their assets as part of the dissolution process, this package includes additional forms and instructions specific to asset distribution, sales, or transfers. 4. Voluntary Dissolution Package: This package is suitable for corporations that have fulfilled their business goals or are no longer in operation due to various reasons. It enables such corporations to dissolve voluntarily and in compliance with the legal requirements. Irrespective of the type of dissolution package chosen, each package ensures that the corporation follows the necessary legal procedures, protects the rights of shareholders and creditors, and avoids any potential liabilities or legal troubles arising from an incomplete or improper dissolution. The Suffolk New York Dissolution Package to Dissolve Corporation is an essential resource for business owners seeking a seamless conclusion to their corporation's existence while adhering to the legal requirements and maintaining transparency throughout the process.