Keywords: Kings New York Living Trust, Husband and Wife, No Children, Types A King's New York Living Trust for Husband and Wife with No Children is a legal document designed to safeguard assets and ensure their efficient distribution after the death of both spouses. It provides a flexible and convenient way for couples without children to control their assets during their lifetime, protect their estate, and designate beneficiaries to inherit their assets upon their passing. 1. Joint Living Trust: The Joint Living Trust is the most common type of living trust for a married couple without children. It allows both spouses to create a single trust document to manage their assets jointly. This trust facilitates seamless management and distribution of their estate upon the passing of either spouse. 2. Separate Living Trusts: Alternatively, each spouse can choose to establish an individual living trust, known as a Separate Living Trust. It allows both partners to maintain total control over their respective assets, even though they are married. Separate Living Trusts are particularly useful when spouses have different beneficiaries and estate planning goals. 3. Revocable Living Trust: Both the Joint Living Trust and Separate Living Trusts can be revocable, meaning they can be modified or revoked during the lifetime of either spouse. With a Revocable Living Trust, couples can make changes to their trust provisions, assets, beneficiaries, and trustees as circumstances or wishes change. 4. Irrevocable Living Trust: In contrast, an Irrevocable Living Trust is one where the trust terms cannot be altered or revoked after it is established. This type of trust offers potential tax benefits and asset protection. It may be a suitable option if the couple wants to protect their assets from potential creditors or minimize estate taxes. 5. Testamentary Trust: While not specifically a Kings New York Living Trust, a Testamentary Trust is worth mentioning. It is created through a last will and testament and becomes effective upon the death of the second spouse. This trust type allows couples to provide for their chosen beneficiaries after both spouses pass away while maintaining control over their assets during their lifetime. In conclusion, a Kings New York Living Trust for Husband and Wife with No Children offers various options to ensure efficient estate planning and asset distribution. Couples can opt for a Joint Living Trust or choose to establish Separate Living Trusts according to their unique circumstances and individual goals. Additionally, the trust can be revocable or irrevocable, depending on their desired level of control and asset protection. Testamentary Trusts are also available for couples using a will-based planning approach. Consulting with an experienced estate planning attorney is crucial for tailoring these trust options to individual needs and ensuring all legal requirements are met.

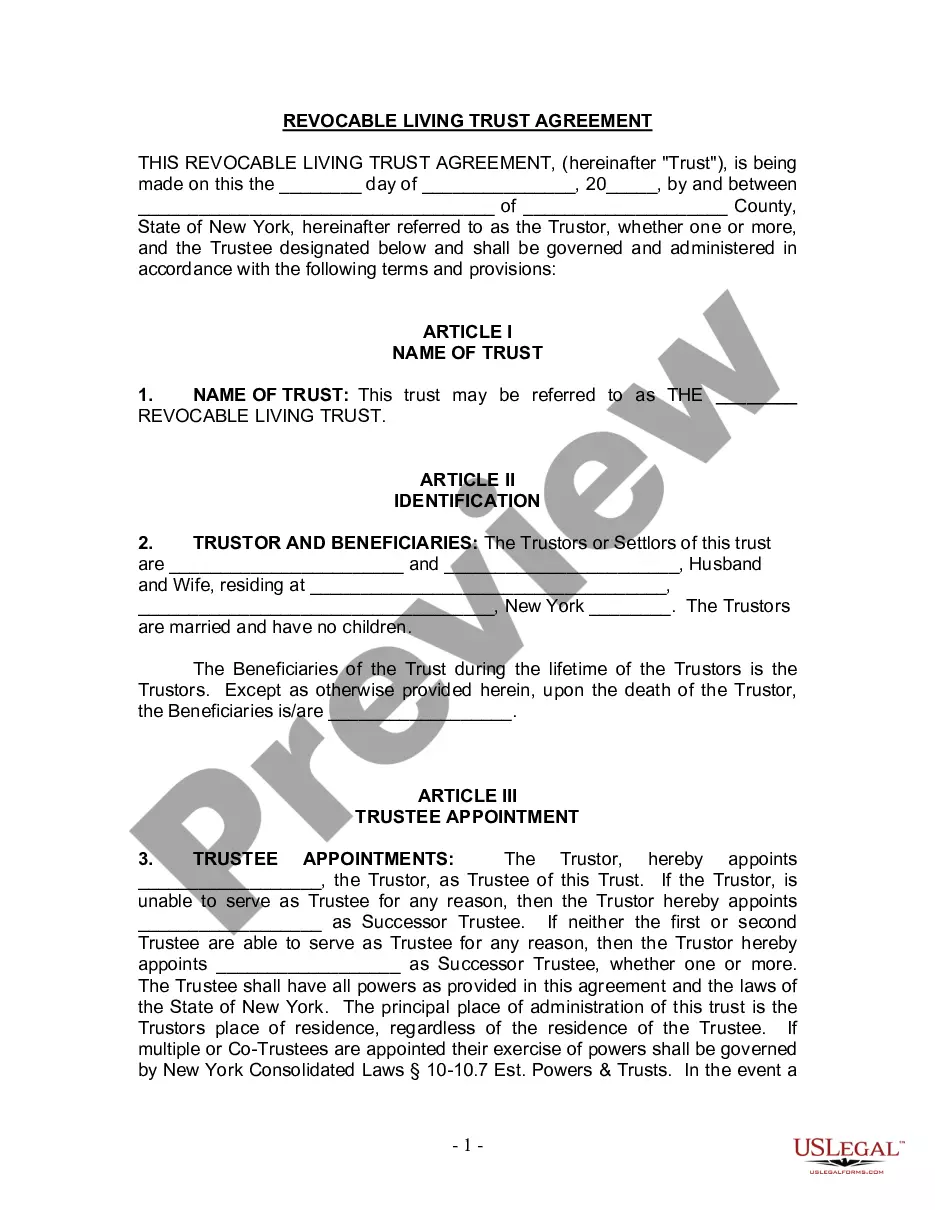

Kings New York Living Trust for Husband and Wife with No Children

Description

How to fill out Kings New York Living Trust For Husband And Wife With No Children?

Are you looking for a reliable and affordable legal forms supplier to get the Kings New York Living Trust for Husband and Wife with No Children? US Legal Forms is your go-to option.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Kings New York Living Trust for Husband and Wife with No Children conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is intended for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Kings New York Living Trust for Husband and Wife with No Children in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online for good.