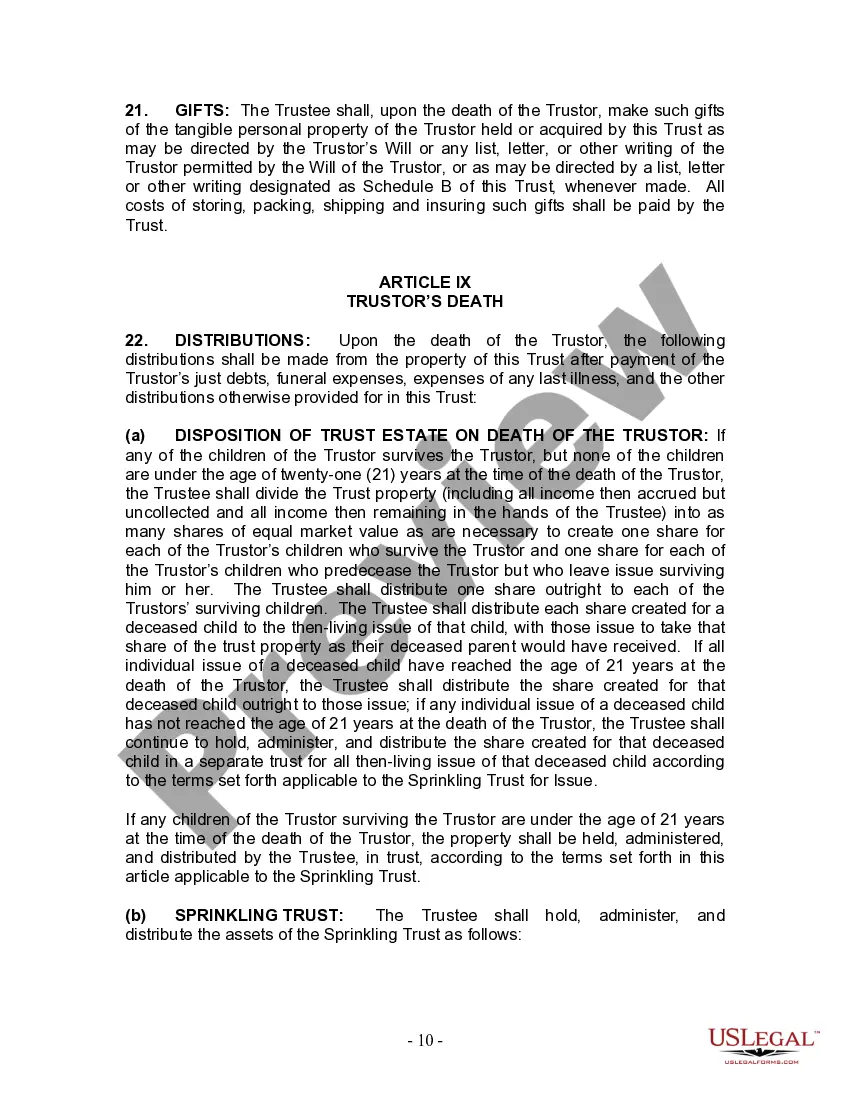

Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out New York Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

Are you in need of a reliable and economical legal documents provider to acquire the Kings New York Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children? US Legal Forms is your perfect answer.

Whether you need a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce proceedings in court, we have you covered. Our website provides over 85,000 current legal document templates for both personal and business needs. All the templates we offer are not generic and are designed in compliance with the regulations of specific states and regions.

To obtain the document, you must sign in to your account, find the required form, and click the Download button next to it. Please remember that you can re-download your previously acquired document templates any time from the My documents section.

Is this your first visit to our website? No need to worry. You can establish an account in just a few minutes, but first, ensure you do the following.

Now you can establish your account. Then choose a subscription option and proceed to payment. Once the payment is processed, download the Kings New York Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children in any offered file format. You can return to the website whenever you wish and download the document at no additional cost.

Locating up-to-date legal documents has never been simpler. Try US Legal Forms today, and eliminate wasting your valuable time familiarizing yourself with legal documents online once and for all.

- Verify if the Kings New York Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children meets the requirements of your state and locality.

- Review the form’s details (if available) to understand who and what the document is intended for.

- Restart your search if the form does not suit your legal situation.

Form popularity

FAQ

To file a living trust in New York, you first need to create the trust document, outlining your wishes and details. You can then work with an attorney or utilize a platform like US Legal Forms to ensure everything complies with state laws. After creating the trust, you'll need to formally transfer your assets into it, ensuring your wishes are fully realized under the Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children. Finalize the process by signing the necessary paperwork and making sure that your trust is valid and enforceable.

While there are many advantages to placing assets in a trust, there are some downsides to consider. The Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children can limit personal control over assets after they are transferred, which can be uncomfortable for some individuals. Additionally, the initial setup and ongoing administration may require professional help, leading to added costs.

Deciding whether your parents should establish a trust, such as the Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, can depend on their financial situation and estate planning goals. A trust can help manage assets during their lifetime and ensure a smooth transition after passing. It's wise to consult with an estate planning professional to assess their unique needs.

Trust funds can come with high setup and maintenance costs, which may not be feasible for everyone. Moreover, the Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children may entail restrictions on how and when beneficiaries can access their funds, possibly leading to family disputes. It's vital to weigh these downsides against the potential benefits.

A family trust, including the Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, may have limited flexibility regarding asset management. Trusts can be difficult to modify if family circumstances change over time. Additionally, asset transfer to a trust can involve legal fees and may complicate tax situations.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly communicate their intentions to their children. Creating a Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children is an important step, but without discussing the terms and goals with heirs, misunderstandings may arise. Open dialogue ensures that your family understands your wishes and helps prevent conflicts down the road.

To avoid inheritance tax, setting up a living trust with thoughtful planning is vital. A Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children can protect your estate from excessive taxation by transferring ownership of assets before they enter probate. Consulting professionals can help you identify tax-saving strategies that align with your individual situation.

When one spouse dies, a living trust facilitates the smooth transition of assets to the surviving spouse or beneficiaries without court involvement. For those using a Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, the trust document outlines how assets are distributed, helping to manage the estate efficiently. This process not only eases the burden on the grieving family but also safeguards the wishes of the deceased.

The 5-year rule for trusts primarily refers to the timeframe within which assets transferred to a trust can affect eligibility for government benefits, like Medicaid. When you establish a Kings New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, any assets transferred may be excluded from your estate after five years. Understanding this timeframe is essential for effective estate planning.

Yes, an irrevocable trust can be subject to the 5-year rule, particularly in cases where Medicaid eligibility is a concern. When setting up a Kings New York Living Trust for Individuals Who are Single, Divorced or Widows or Widowers with Children, it is crucial to understand that transferring assets into an irrevocable trust can impact your eligibility for certain benefits. It’s wise to consult a legal expert to navigate these rules effectively.