Bronx New York Living Trust for Husband and Wife with One Child: A living trust is a legal document that allows individuals to designate how their assets will be managed and distributed during their lifetime and after their death. In the case of a husband and wife with one child residing in the Bronx, New York, establishing a living trust can benefit their estate planning by providing seamless management and efficient transfer of assets. In this particular scenario, there are two main types of living trusts that can be considered: 1. Revocable Living Trust: A revocable living trust is a flexible estate planning tool commonly utilized by married couples with one child in the Bronx, New York. With this type of trust, both spouses can serve as the granters and trustees, maintaining control over their assets while they are alive. They can transfer their various properties, bank accounts, investments, and other valuable assets into the trust. This step helps avoid probate, enabling a smoother transfer of assets in case of disability, incapacity, or death. The surviving spouse and child can benefit from and manage the trust's assets without facing the delay and expenses associated with the probate process. 2. Testamentary Trust: A testamentary trust comes into effect after the death of one or both parents. It is established through a will and provides instructions on how the remaining assets should be managed and distributed for the benefit of the surviving spouse and child. The testamentary trust will usually specify a trustee who will be responsible for administering the trust until the child reaches a designated age or milestone, such as turning 18 or graduating from college. This type of trust allows for more flexibility while still offering asset protection and management benefits. When establishing a Bronx New York Living Trust for Husband and Wife with One Child, it is crucial to consider various key aspects such as asset protection, minimizing estate taxes, ensuring the financial stability of the surviving spouse and child, and providing clear instructions on the management and distribution of assets. Seeking guidance from an experienced attorney specializing in trusts and estates is highly recommended ensuring the trust is tailored to the individual needs of the family and complies with the specific regulations in the Bronx, New York. In summary, a Bronx New York Living Trust for Husband and Wife with One Child involves the creation of either a revocable living trust or a testamentary trust. Each type serves different purposes, and their suitability depends on the family's needs and priorities. Properly establishing and maintaining a living trust ensures that the family's assets are protected while allowing for efficient transfer and management, ultimately providing peace of mind and financial security for all involved parties.

Bronx New York Living Trust for Husband and Wife with One Child

Description

How to fill out Bronx New York Living Trust For Husband And Wife With One Child?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bronx New York Living Trust for Husband and Wife with One Child becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Bronx New York Living Trust for Husband and Wife with One Child takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

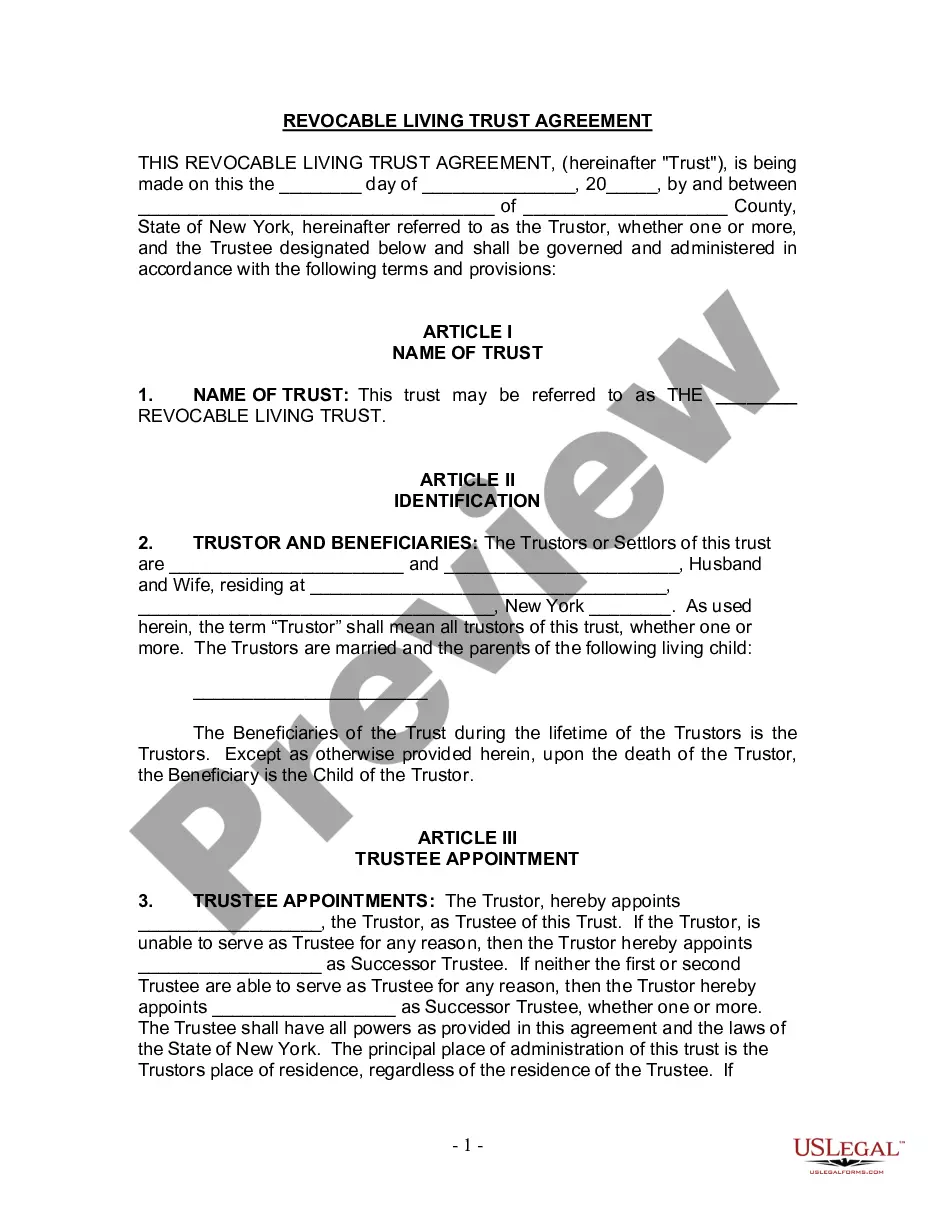

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Bronx New York Living Trust for Husband and Wife with One Child. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!