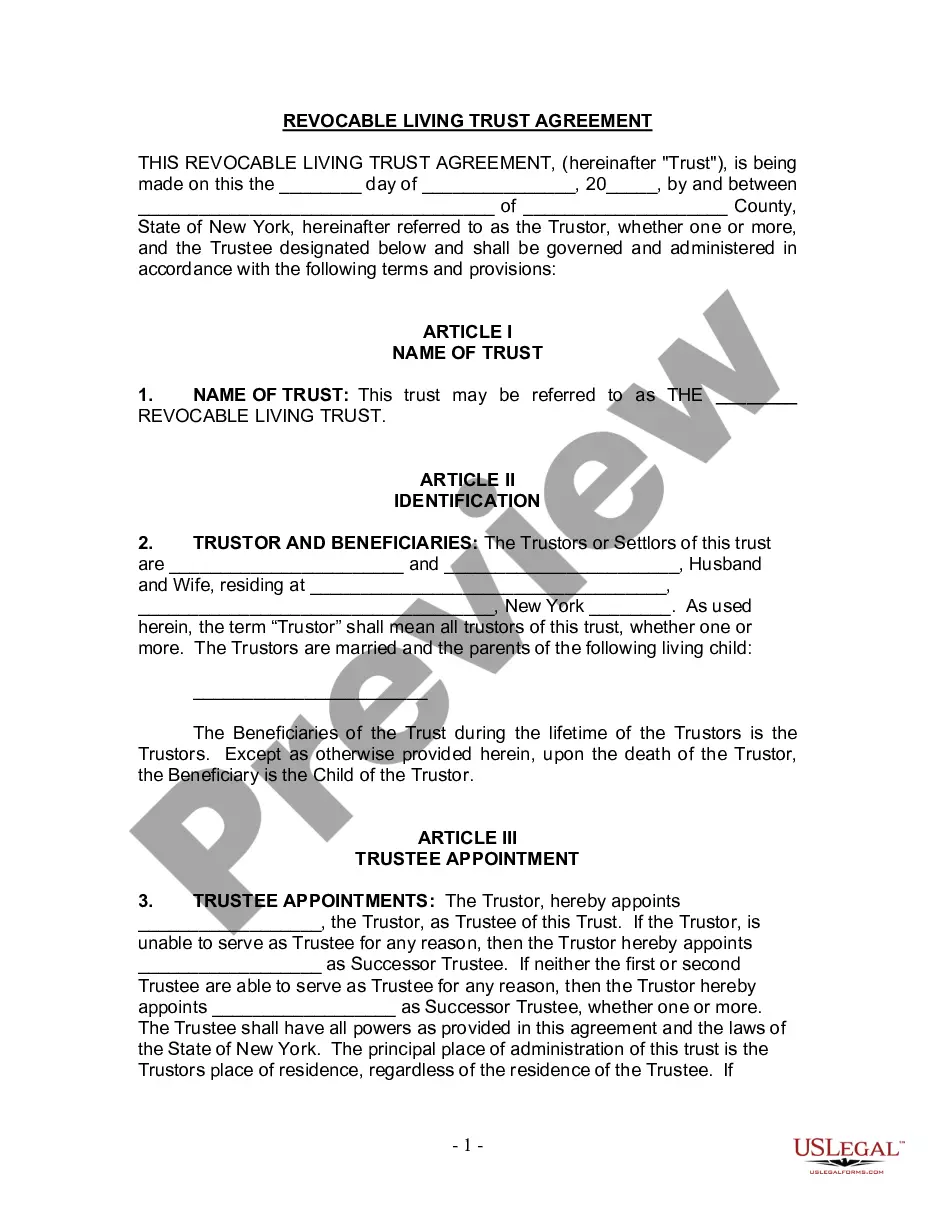

Keywords: Kings New York Living Trust, Husband and Wife, One Child, Types of Trusts Description: The Kings New York Living Trust for Husband and Wife with One Child is a legal document that offers numerous benefits and helps protect your assets and loved ones. This type of trust provides added security and control over your estates during your lifetime, as well as after your passing. The primary purpose of this trust is to ensure that your assets are distributed according to your wishes and to minimize potential conflicts among beneficiaries. There are several types of Kings New York Living Trust for Husband and Wife with One Child, each serving specific purposes based on individual needs and preferences. Some notable types include: 1. Revocable Living Trust: — Enables you to maintain control over your assets during your lifetime — Allows easy modifications or revocations of the trust terms — Avoids probate, saving time and expenses for your beneficiaries — Provides privacy as it doesn't become a public record 2. Irrevocable Living Trust: — Offers heightened asset protection by transferring ownership of assets to the trust — Minimizes estate taxes and potential creditors' claims — Ensures that the assets are distributed as intended, even in case of remarriage or incapacity — Provides long-term financial security for your child's future 3. Testamentary Trust: — Created within a last will and testament, only becoming effective after the testator's death — Allows control over the distribution of assets to your child while ensuring their proper management until they reach a certain age or achieve milestones — Provides financial stability and flexibility Regardless of the type, establishing a Kings New York Living Trust for Husband and Wife with One Child requires careful consideration of your specific financial goals and circumstances. It's advisable to consult with an experienced estate planning attorney to create a custom-tailored trust that suits your needs and ensures your wishes are carried out effectively.

Kings New York Living Trust for Husband and Wife with One Child

Description

How to fill out Kings New York Living Trust For Husband And Wife With One Child?

Do you need a trustworthy and affordable legal forms supplier to get the Kings New York Living Trust for Husband and Wife with One Child? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Kings New York Living Trust for Husband and Wife with One Child conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Kings New York Living Trust for Husband and Wife with One Child in any provided format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal paperwork online for good.