Nassau New York Living Trust for Husband and Wife with One Child

Description

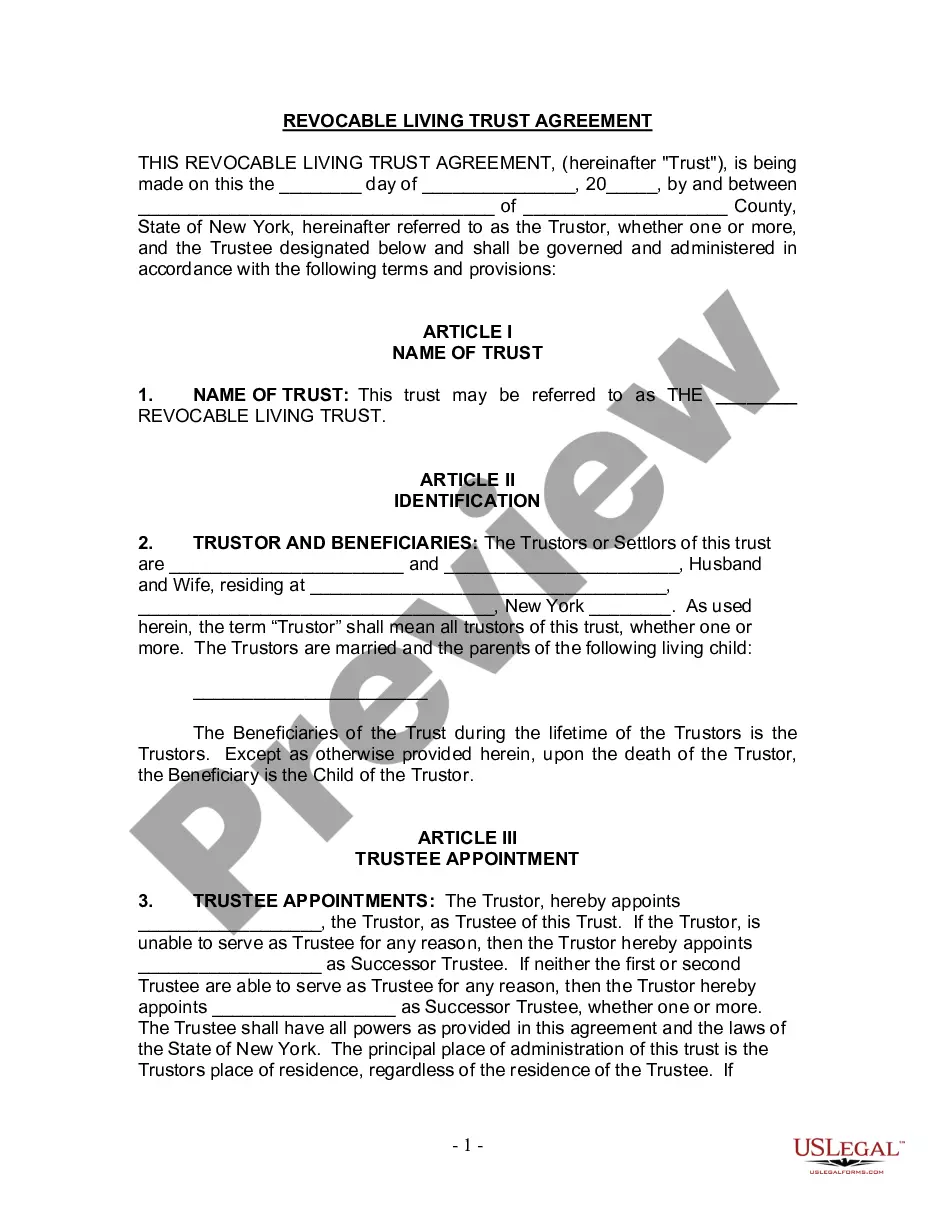

How to fill out New York Living Trust For Husband And Wife With One Child?

Regardless of your social or professional standing, finishing law-related paperwork is a regrettable requirement in the contemporary world. Far too frequently, it’s nearly unfeasible for someone without legal training to create such documents from scratch, primarily due to the intricate terminology and legal nuances they entail. This is where US Legal Forms comes to the aid.

Our service offers an extensive collection of over 85,000 ready-to-use, state-specific documents applicable to nearly any legal circumstance. US Legal Forms is also a fantastic resource for associates or legal advisors seeking to conserve time by using our DIY templates.

Regardless of whether you need the Nassau New York Living Trust for Husband and Wife with One Child or any other document suitable for your state or locality, with US Legal Forms, everything is within your reach. Here’s how you can swiftly obtain the Nassau New York Living Trust for Husband and Wife with One Child using our dependable service.

Use your credentials or create a new account from scratch. Choose the payment method and proceed to download the Nassau New York Living Trust for Husband and Wife with One Child once the payment is finalized.

You’re all set! Now you can either print the document or fill it out online. If you encounter any issues accessing your purchased documents, you can conveniently find them in the My documents section. Whatever circumstances you’re aiming to resolve, US Legal Forms has you covered. Give it a try today and experience it for yourself.

- If you are already a subscriber, you can proceed to Log In to your account to download the necessary form.

- However, if you are new to our library, ensure to follow these steps before acquiring the Nassau New York Living Trust for Husband and Wife with One Child.

- Verify that the template you selected is tailored to your region, as the laws of one state or region do not apply to another.

- Preview the document and read a brief overview (if available) of cases for which the paper can be utilized.

- If the chosen form does not fulfill your needs, you can initiate a new search for the appropriate document.

- Click Buy now and select the subscription plan that suits you best.

Form popularity

FAQ

While a living trust offers numerous benefits, there are downsides to consider. These may include initial setup costs and the need for continual management to ensure property titles align with the trust. In a Nassau New York Living Trust for Husband and Wife with One Child context, failing to fund the trust correctly can result in probate issues later. That's why using a comprehensive service like uslegalforms can help streamline the process and address potential challenges before they arise.

Placing your house in a trust can lead to complexities, especially when it comes to financing or refinancing the property. In the context of a Nassau New York Living Trust for Husband and Wife with One Child, it's essential to understand that transferring property into a trust may trigger reassessment for property taxes. Additionally, maintaining the trust requires ongoing management and documentation, which might be burdensome for some homeowners. Always consult with legal professionals to weigh your options.

In many cases, a husband and wife may benefit from a joint living trust, particularly in Nassau New York Living Trust for Husband and Wife with One Child situations. A joint trust simplifies the management of assets and offers a straightforward plan for estate distribution. However, separate trusts can provide unique advantages, such as individual control and tailored provisions for specific needs. Ultimately, the decision should reflect your family's financial goals and circumstances.

Suze Orman emphasizes the importance of trusts as a protective measure for individuals and families. She often highlights that establishing a Nassau New York Living Trust for Husband and Wife with One Child not only secures your assets but also provides peace of mind regarding your family’s future. According to Orman, trusts help steer clear of probate, manage taxes, and ensure that the individuals you love receive what you intend for them.

The ideal trust for a married couple often depends on their specific financial goals and family dynamics. Generally, a Nassau New York Living Trust for Husband and Wife with One Child serves as an excellent option, providing flexibility in asset management and distribution for both spouses and their child. This type of trust simplifies the transfer of assets upon one spouse's death, ensuring clarity and preventing disputes.

Husbands and wives may choose to establish separate trusts for various reasons, such as protecting individual assets from creditors or ensuring specific distributions for children from previous relationships. A Nassau New York Living Trust for Husband and Wife with One Child allows each spouse to retain control over their assets while managing shared responsibilities. Additionally, it can help in minimizing potential estate taxes and streamline the process during the distribution of assets.

One major mistake parents make when setting up a trust fund, including a Nassau New York Living Trust for Husband and Wife with One Child, is failing to clearly communicate their intentions. Not involving children in discussions about the trust can lead to misunderstandings and disputes down the road. Additionally, neglecting to update the trust as circumstances change can create unintended consequences. Regularly reviewing your trust with legal assistance can help prevent these issues and ensure your family's needs are met.

An irrevocable trust can indeed be subject to the 5-year rule, depending on how and when you transfer assets. When creating a Nassau New York Living Trust for Husband and Wife with One Child, you must understand that transferring assets quickly may trigger estate taxes if they are not held for the required period. Therefore, carefully planning asset transfers is crucial to ensuring your trust remains beneficial for your family. Always engage a qualified advisor to navigate these rules.

To avoid inheritance tax with a trust, particularly a Nassau New York Living Trust for Husband and Wife with One Child, consider setting up an irrevocable trust. Once assets are placed in this type of trust, they typically do not count as part of your estate for tax purposes. This means that upon your passing, your beneficiaries may not face the inheritance tax burden. It's wise to assess your financial circumstances with a professional to maximize your tax efficiency.

The 5 year rule for trusts involves a period during which certain transfers to a trust may be subject to estate taxes. If you establish a Nassau New York Living Trust for Husband and Wife with One Child and make significant contributions, those transfers could affect your estate tax liability if not held for five years or longer. It's essential to understand how this rule applies to your specific situation to strategize effectively. Consulting with a legal expert can help clarify how this rule might impact your trust's effectiveness.