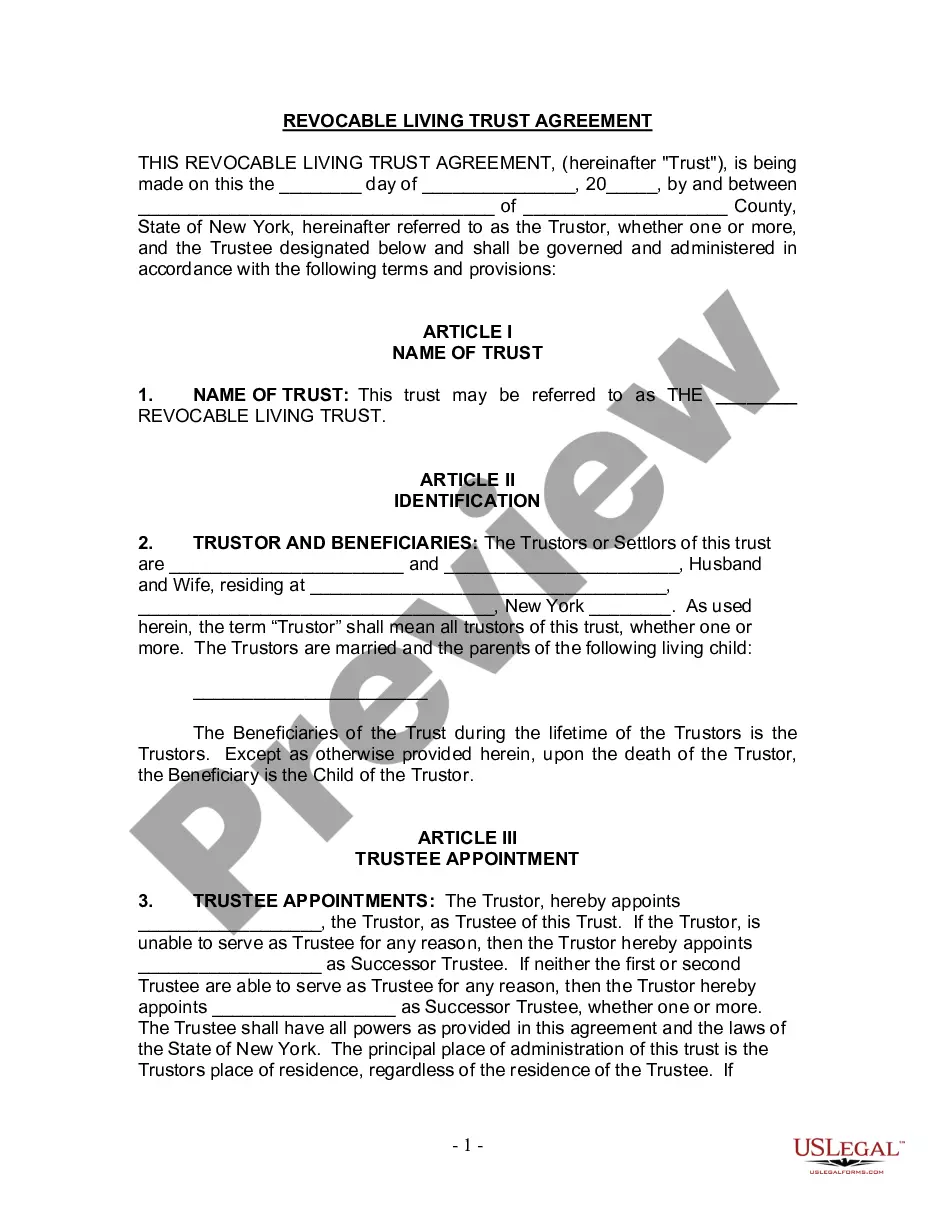

A Queens New York Living Trust for Husband and Wife with One Child is a legal document that allows a couple to establish a trust to manage their assets during their lifetime, provide for their surviving spouse, and ensure the smooth transfer of assets to their child upon their death. This type of living trust is designed specifically for couples who are married and have one child. It offers a practical and flexible way to protect and distribute their assets, avoid probate, minimize estate taxes, and provide for the financial security of their family. There are several types of Queens New York Living Trusts for Husband and Wife with One Child that can be customized to meet individual needs and preferences: 1. Revocable Living Trust: This is the most common type of living trust, allowing the couple to have complete control over their assets during their lifetime. They can modify or revoke the trust at any time and name themselves as trustees. In the event of their death, the trust assets are transferred to their child without going through probate. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be modified or revoked without the consent of the beneficiaries. This type of trust is often used to minimize estate taxes, protect assets from creditors, or provide for Medicaid planning. 3. Testamentary Trust: This type of trust is created within a will and comes into effect after the death of the couple. It allows the couple to name a trustee to manage and distribute their assets for the benefit of their child. Testamentary trusts are subject to probate and may not offer the same level of privacy and asset protection as living trusts. 4. Special Needs Trust: If the couple's child has special needs, a special needs trust can be established within the living trust. This type of trust ensures that the child's inheritance does not affect eligibility for government benefits by providing for supplemental care. 5. Marital and Bypass Trust: A Marital or "A" Trust and a Bypass or "B" Trust are often created within a living trust to make use of the couple's estate tax exemption. The Marital Trust provides income for the surviving spouse, while the Bypass Trust minimizes estate taxes by preserving the deceased spouse's exemption. Overall, a Queens New York Living Trust for Husband and Wife with One Child provides a comprehensive solution for estate planning, asset management, and wealth transfer. By consulting with an experienced attorney specializing in estate planning, couples can choose the most suitable type of living trust and tailor it to their specific needs and goals.

Queens New York Living Trust for Husband and Wife with One Child

Description

How to fill out Queens New York Living Trust For Husband And Wife With One Child?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone without any law education to create such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform offers a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Queens New York Living Trust for Husband and Wife with One Child or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Queens New York Living Trust for Husband and Wife with One Child quickly using our trustworthy platform. In case you are already a subscriber, you can proceed to log in to your account to download the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps before downloading the Queens New York Living Trust for Husband and Wife with One Child:

- Be sure the template you have found is suitable for your location considering that the rules of one state or area do not work for another state or area.

- Review the document and read a short outline (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start over and look for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the Queens New York Living Trust for Husband and Wife with One Child once the payment is completed.

You’re all set! Now you can proceed to print the document or complete it online. In case you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.