A living trust, also referred to as a revocable trust or a family trust, is a legal document that allows individuals to control and manage their assets during their lifetime and distribute them upon their death. In Rochester, New York, living trusts are particularly relevant for husbands and wives with minor and/or adult children, as they provide a comprehensive and efficient means of estate planning. Here, we will elaborate on the different types of living trusts that pertain to this situation. 1. Rochester New York Living Trust for Husband and Wife with Minor Children: When creating a living trust for a husband and wife with minor children, the primary objective is to ensure the well-being and financial security of the children in the event of both parents' incapacitation or death. This living trust typically involves naming a trustee, who will manage the assets held within the trust on behalf of the children until they reach a specified age or milestone, such as turning 18 or completing their education. It may also outline detailed instructions regarding the children's guardianship, healthcare decisions, and education. 2. Rochester New York Living Trust for Husband and Wife with Adult Children: For couples with adult children, the purpose of a living trust often shifts towards asset preservation and effective wealth transfer. This type of trust allows the parents to maintain control over their assets and decide the timing and conditions under which their adult children will inherit them. It may include provisions for handling potential incapacity, appointing successor trustees, and offering asset protection from creditors or divorce. 3. Joint Living Trust for Husband and Wife with Minor and Adult Children: In some cases, couples may choose to establish a joint living trust to encompass the needs of both minor and adult children. This type of trust provides a holistic estate planning solution that caters to the various circumstances and requirements of the entire family. It allows for the seamless management and distribution of assets while ensuring the protection and care of both minor and adult children. Regardless of the specific type, a Rochester New York Living Trust for Husband and Wife with Minor and/or Adult Children affords numerous benefits. These include avoiding probate, maintaining privacy, minimizing estate taxes, providing clear instructions for asset distribution, protecting assets from potential legal disputes, and enabling flexibility to amend or revoke the trust during the granters' lifetime. It is crucial to consult with an experienced estate planning attorney in Rochester, New York, to determine the most suitable type of living trust for a husband and wife with minor and/or adult children, as individual circumstances and preferences may greatly influence the specific provisions and structure of the trust.

Rochester New York Living Trust for Husband and Wife with Minor and or Adult Children

Description

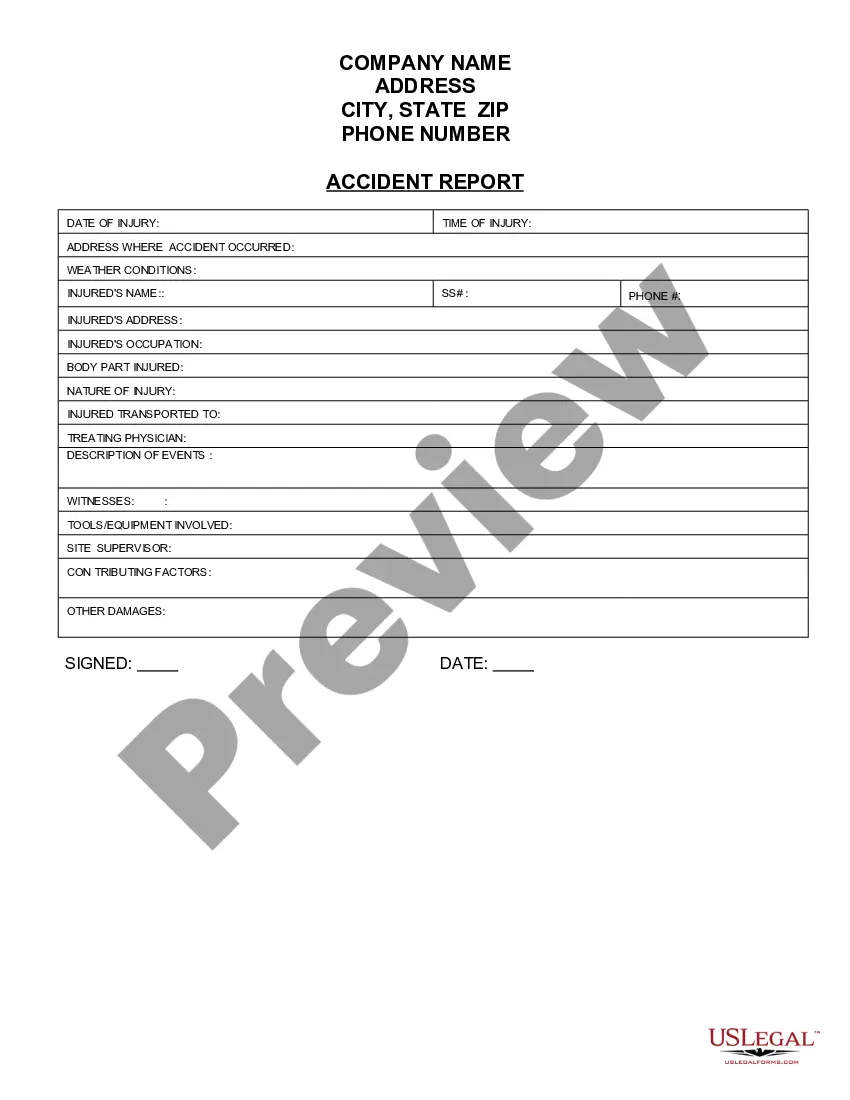

How to fill out Rochester New York Living Trust For Husband And Wife With Minor And Or Adult Children?

Benefit from the US Legal Forms and get immediate access to any form you require. Our beneficial platform with thousands of document templates makes it easy to find and obtain virtually any document sample you require. You can download, complete, and certify the Rochester New York Living Trust for Husband and Wife with Minor and or Adult Children in a couple of minutes instead of browsing the web for many hours looking for a proper template.

Using our collection is an excellent way to improve the safety of your document submissions. Our experienced attorneys on a regular basis check all the records to ensure that the forms are relevant for a particular state and compliant with new laws and regulations.

How can you get the Rochester New York Living Trust for Husband and Wife with Minor and or Adult Children? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. Moreover, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions listed below:

- Find the form you need. Make sure that it is the template you were looking for: examine its headline and description, and take take advantage of the Preview function if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the file. Choose the format to obtain the Rochester New York Living Trust for Husband and Wife with Minor and or Adult Children and edit and complete, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable template libraries on the internet. Our company is always ready to help you in any legal process, even if it is just downloading the Rochester New York Living Trust for Husband and Wife with Minor and or Adult Children.

Feel free to take full advantage of our service and make your document experience as efficient as possible!