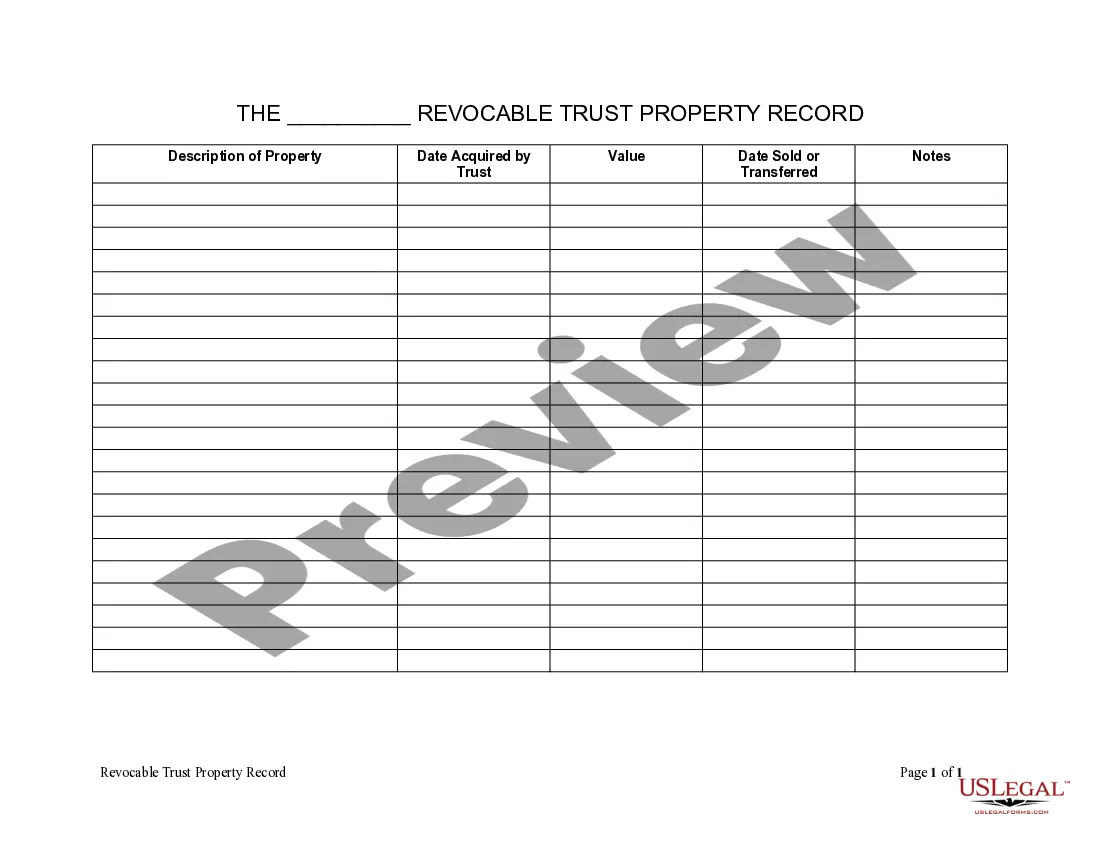

Syracuse New York Living Trust Property Record

Description

How to fill out New York Living Trust Property Record?

Regardless of one's social or professional standing, finalizing law-related documents is an unfortunate obligation in the modern world.

Frequently, it’s nearly unfeasible for an individual lacking any legal expertise to create such documents from scratch, primarily due to the complex terminology and legal subtleties they involve.

This is where US Legal Forms comes to the aid.

Confirm that the template you have selected is relevant to your area since the laws of one state or county do not apply to another.

Review the document and read a brief overview (if available) of the situations for which the document is applicable.

- Our service boasts an extensive library with over 85,000 ready-to-use documents tailored to specific states that are applicable for almost any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors seeking to save time with our DIY forms.

- Regardless of whether you need the Syracuse New York Living Trust Property Record or any other document applicable in your region, with US Legal Forms, everything is accessible.

- Here’s how you can quickly acquire the Syracuse New York Living Trust Property Record using our reliable service.

- If you are already a subscriber, you can proceed to Log In to your account to access the needed form.

- However, if you are new to our platform, make sure to follow these instructions before obtaining the Syracuse New York Living Trust Property Record.

Form popularity

FAQ

To put everything in a living trust, start by reviewing all your assets and determining which ones you want to include. Then, you will need to legally transfer titles and ownership, making sure your Syracuse New York Living Trust Property Record represents these changes accurately. This process can involve paperwork, and resources like US Legal Forms can simplify your tasks with easy-to-use templates.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund the trust adequately. Creating a trust is just the first step; you must also ensure that your Syracuse New York Living Trust Property Record is complete with all relevant assets. Neglecting this can lead to complications in the future. US Legal Forms can assist in providing the necessary documentation to avoid this issue.

Filling out a trust fund requires specific information about your assets, beneficiaries, and the terms of the trust. Start by detailing the assets you wish to include and designating beneficiaries. It is crucial that your Syracuse New York Living Trust Property Record aligns with the details in your trust documents. To streamline this task, US Legal Forms can offer templates that guide you through the requirements.

Filling a living trust involves creating the trust document and then transferring assets into it. Begin by drafting the trust, clearly outlining your wishes and beneficiaries. Next, you will file the necessary forms, ensuring your Syracuse New York Living Trust Property Record reflects these assets accurately. Tools like US Legal Forms make this process more straightforward.

While a living trust offers several benefits, it does have downsides. One significant disadvantage is that it may not provide tax benefits like other estate planning options. Additionally, you need to actively manage and update the trust as your assets change, ensuring proper Syracuse New York Living Trust Property Record documentation. Understanding these nuances can help you make an informed decision.

To list assets in a trust, start by identifying all the property you want to include. This can range from real estate, such as your home in Syracuse, to bank accounts and investments. Once you have your list, you will need to transfer ownership of these assets to the trust. For detailed assistance, consider visiting US Legal Forms for forms tailored to your needs.

Generally, a living trust does not need to be recorded like a will or deed; however, any property transferred into the trust should be recorded at the local level. This ensures that the property records reflect the trust as the new owner. Maintaining an accurate Syracuse New York Living Trust Property Record is essential for clear title and ownership. You can turn to US Legal Forms for advice and documentation support in this process.

To transfer your property into a trust in New York, you must execute a new deed that transfers the property from your name to the name of the trust. It is important to have this deed drafted properly to comply with legal requirements. Always record the deed with the local government to update your Syracuse New York Living Trust Property Record. US Legal Forms offers helpful resources to guide you through each step.

Transferring property to a trust in New York requires drafting a deed that names the trust as the new owner. This deed must then be signed, notarized, and filed with the county clerk where the property is located. This step is central to ensuring your Syracuse New York Living Trust Property Record accurately reflects ownership. Using US Legal Forms can provide you with the necessary templates to facilitate this transfer smoothly.

Filing a living trust in New York involves creating a trust document that outlines the terms and conditions of your trust. While there is no formal filing process, it's important to keep the trust document in a safe place and ensure your assets are properly funded into the trust. Additionally, documenting all transfers will help maintain your Syracuse New York Living Trust Property Record effectively. Consider using US Legal Forms for templates and guidance.