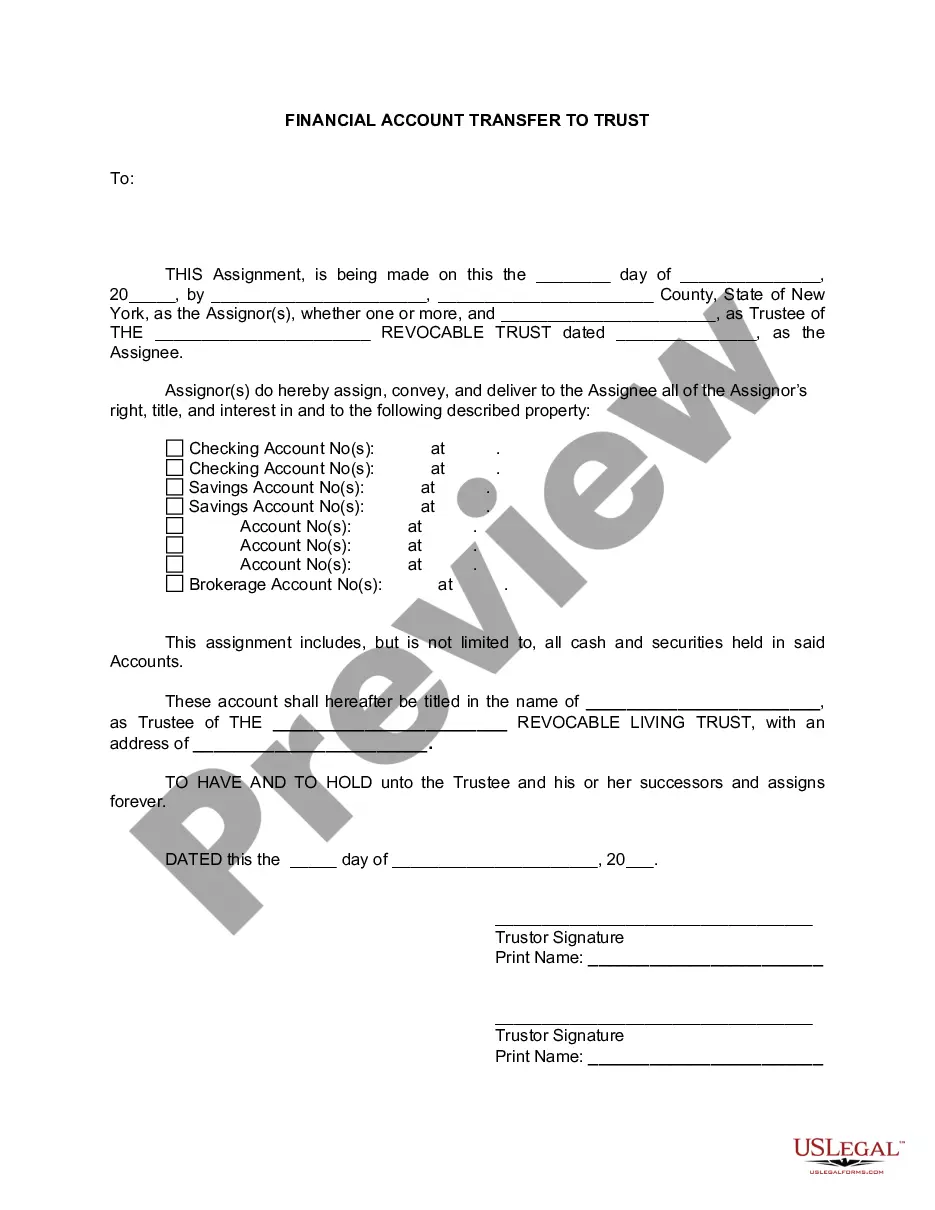

Bronx New York Financial Account Transfer to Living Trust is a process that allows individuals in the Bronx, New York region to transfer their financial accounts into a living trust. A living trust is a legal arrangement in which assets, including financial accounts, are placed in a trust during a person's lifetime and are managed for their benefit. This process is a crucial step in estate planning, as it ensures that the individual's financial accounts are properly managed and distributed as per their wishes after their passing. There are various types of financial accounts that can be transferred to a living trust in the Bronx, New York. These include: 1. Checking and Savings Accounts: Individuals can transfer their bank accounts, including checking and savings accounts, into a living trust. This ensures that funds are managed efficiently and distributed to beneficiaries according to the trust's terms. 2. Investment Accounts: Individuals can also transfer investment accounts, such as brokerage accounts, stocks, bonds, and mutual funds, into a living trust. This allows for seamless management and distribution of investments to beneficiaries in the event of the trust creator's incapacity or death. 3. Retirement Accounts: Certain retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, can also be transferred into a living trust. However, it is crucial to consult with a financial advisor or estate planning attorney as there are specific rules and tax implications associated with such transfers. 4. Real Estate and Property: Apart from financial accounts, individuals can transfer real estate and property, including residential homes, rental properties, and commercial buildings, into a living trust. This ensures efficient management and distribution of such assets upon the trust creator's death, while avoiding probate. Transferring financial accounts to a living trust in the Bronx, New York provides numerous benefits. First and foremost, it helps to avoid the lengthy and costly probate process, ensuring a smooth and efficient transfer of assets to beneficiaries. Additionally, it offers privacy as the trust details remain confidential, unlike probate proceedings. Furthermore, a living trust enables the trust creator to maintain control over their financial accounts during their lifetime and ensures the seamless management and distribution of assets in case of incapacity or death. To initiate a Bronx New York Financial Account Transfer to Living Trust, individuals should consult with an experienced estate planning attorney who can guide them through the process. The attorney will help draft the necessary legal documents, such as a trust agreement, and assist in transferring the financial accounts into the trust. Additionally, the attorney will ensure that all legal requirements and tax implications associated with such transfers are properly addressed, offering individuals peace of mind and protection for their financial accounts.

Bronx New York Financial Account Transfer to Living Trust

Description

How to fill out Bronx New York Financial Account Transfer To Living Trust?

Benefit from the US Legal Forms and get immediate access to any form template you need. Our helpful website with a large number of document templates makes it simple to find and get almost any document sample you require. You can export, fill, and sign the Bronx New York Financial Account Transfer to Living Trust in just a couple of minutes instead of browsing the web for several hours trying to find an appropriate template.

Utilizing our library is a great way to increase the safety of your document submissions. Our experienced legal professionals on a regular basis check all the records to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you get the Bronx New York Financial Account Transfer to Living Trust? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Additionally, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction below:

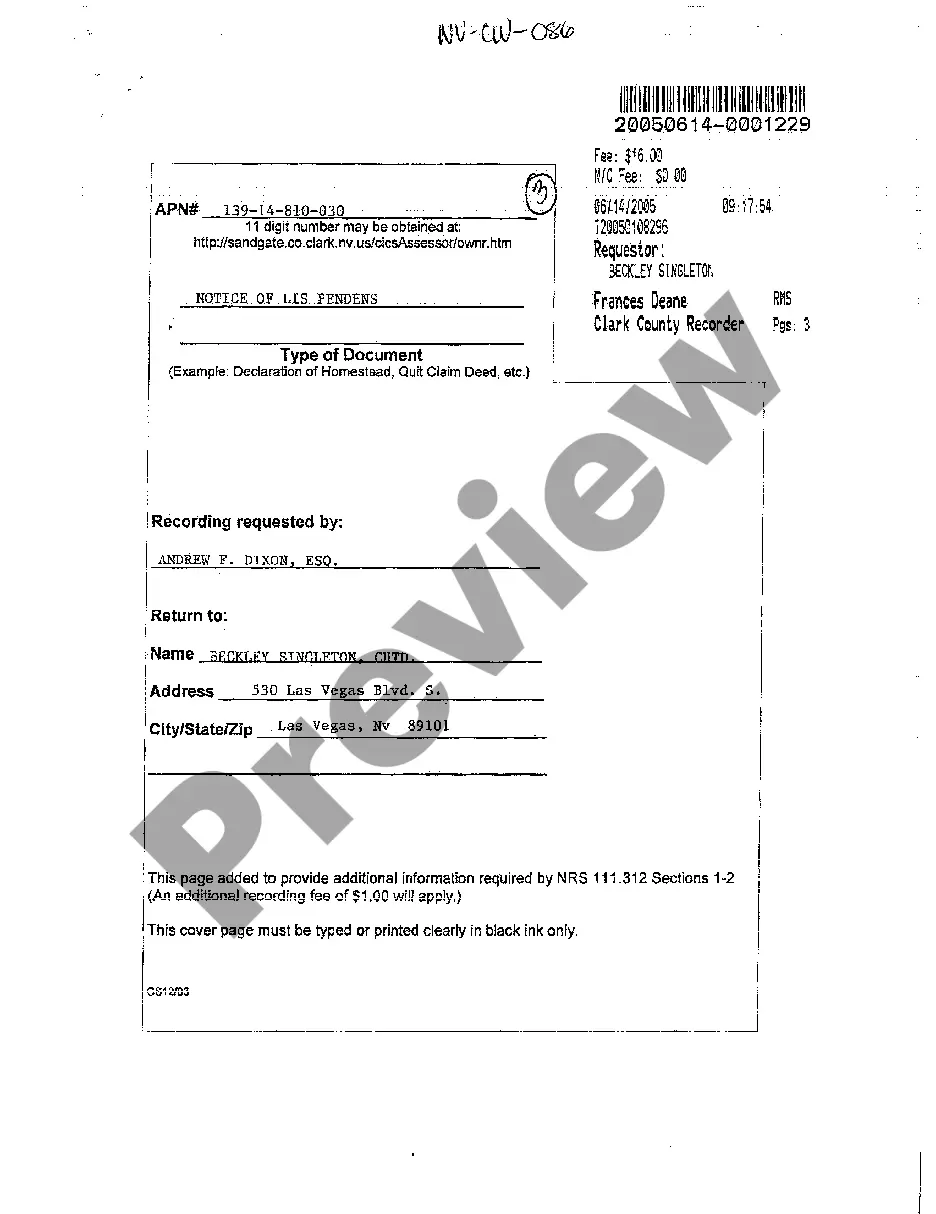

- Open the page with the form you need. Ensure that it is the form you were looking for: verify its name and description, and make use of the Preview option when it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Save the file. Choose the format to get the Bronx New York Financial Account Transfer to Living Trust and edit and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable document libraries on the internet. We are always ready to help you in any legal process, even if it is just downloading the Bronx New York Financial Account Transfer to Living Trust.

Feel free to benefit from our platform and make your document experience as efficient as possible!