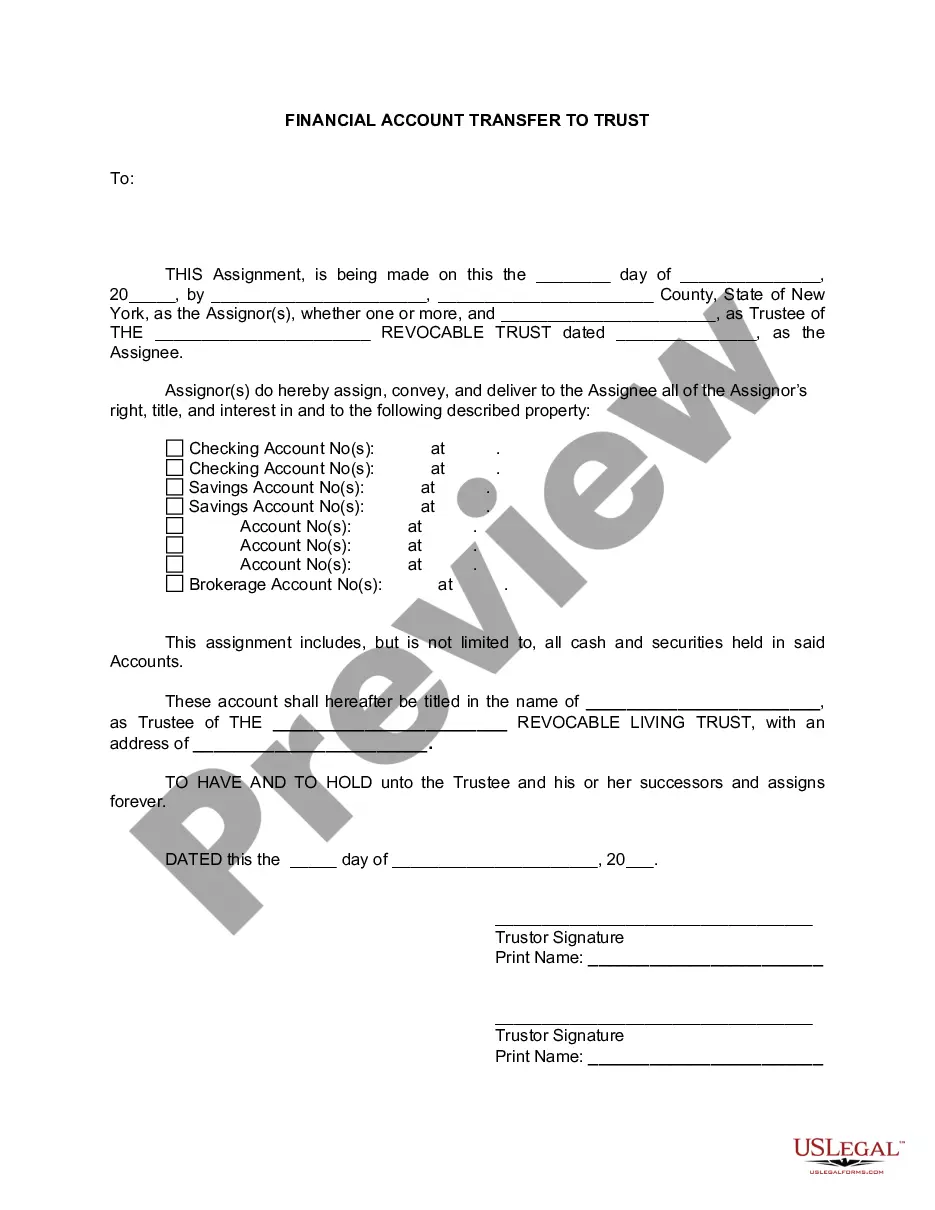

Rochester New York Financial Account Transfer to Living Trust: A Comprehensive Guide In the realm of estate planning and wealth management, a Financial Account Transfer to Living Trust plays a vital role for individuals and families in Rochester, New York. This process ensures a smooth and efficient transfer of financial accounts to a living trust, providing numerous benefits such as enhanced asset protection, privacy, and efficient distribution of assets upon the granter's death. In this article, we will delve into the details of the Rochester New York Financial Account Transfer to Living Trust, uncovering different types and key considerations associated with this important financial planning tool. Types of Rochester New York Financial Account Transfer to Living Trust: 1. Bank Accounts: This type of transfer involves the re-titling of various bank accounts, including checking, savings, money market, and certificate of deposit (CD) accounts, into the name of the living trust. By doing so, the financial assets held in these accounts are protected within the trust's framework, allowing for seamless management and potential avoidance of probate. 2. Investment Accounts: Individuals in Rochester, New York may have a diverse range of investment accounts, such as brokerage accounts, individual retirement accounts (IRAs), 401(k)s, and other retirement vehicles. Transferring these accounts to a living trust can provide increased control over the investment strategy and facilitate the efficient transfer of these assets to beneficiaries upon the granter's passing. 3. Real Estate: While not specifically a financial account, including real estate properties within a living trust is essential for a comprehensive estate plan. Rochester's residents can transfer ownership of residential and commercial properties, such as houses, condos, and rental properties, into the trust, ensuring smoother management, protection, and disposition of these assets. Key Considerations and Benefits: a. Avoidance of Probate: By transferring financial accounts to a living trust, individuals in Rochester can potentially bypass probate proceedings, which can be costly, time-consuming, and subject to public scrutiny. This allows for a more efficient distribution of assets to beneficiaries, maintaining privacy and reducing administrative burdens. b. Asset Protection: Placing financial accounts into a living trust can shield these assets from potential legal claims and creditors, protecting them for the benefit of the named beneficiaries. This is particularly vital in Rochester, where the unpredictable nature of the economic environment necessitates robust asset protection strategies. c. Incapacity Planning: Utilizing a living trust for financial account transfers also provides a mechanism for incapacity planning. In the event that the granter becomes unable to manage their financial affairs due to illness or disability, the designated successor trustee can seamlessly take over the management of trust assets, ensuring uninterrupted financial stability. d. Tax Optimization: Transferring financial accounts to a living trust may have advantageous tax implications, such as potential reductions in estate taxes or capital gains taxes. It is crucial for Rochester residents to consult with experienced estate planning professionals to navigate these complex tax issues. In conclusion, the Rochester New York Financial Account Transfer to Living Trust is a valuable tool that empowers individuals to efficiently manage their financial affairs, protect assets, and ensure a seamless transfer of wealth to future generations. Whether it involves bank accounts, investment accounts, or real estate properties, this process offers numerous benefits, including probate avoidance, asset protection, incapacity planning, and tax optimization. Seeking guidance from knowledgeable professionals in estate planning is essential to effectively implement this strategy and achieve one's long-term financial goals.

Rochester New York Financial Account Transfer to Living Trust

Description

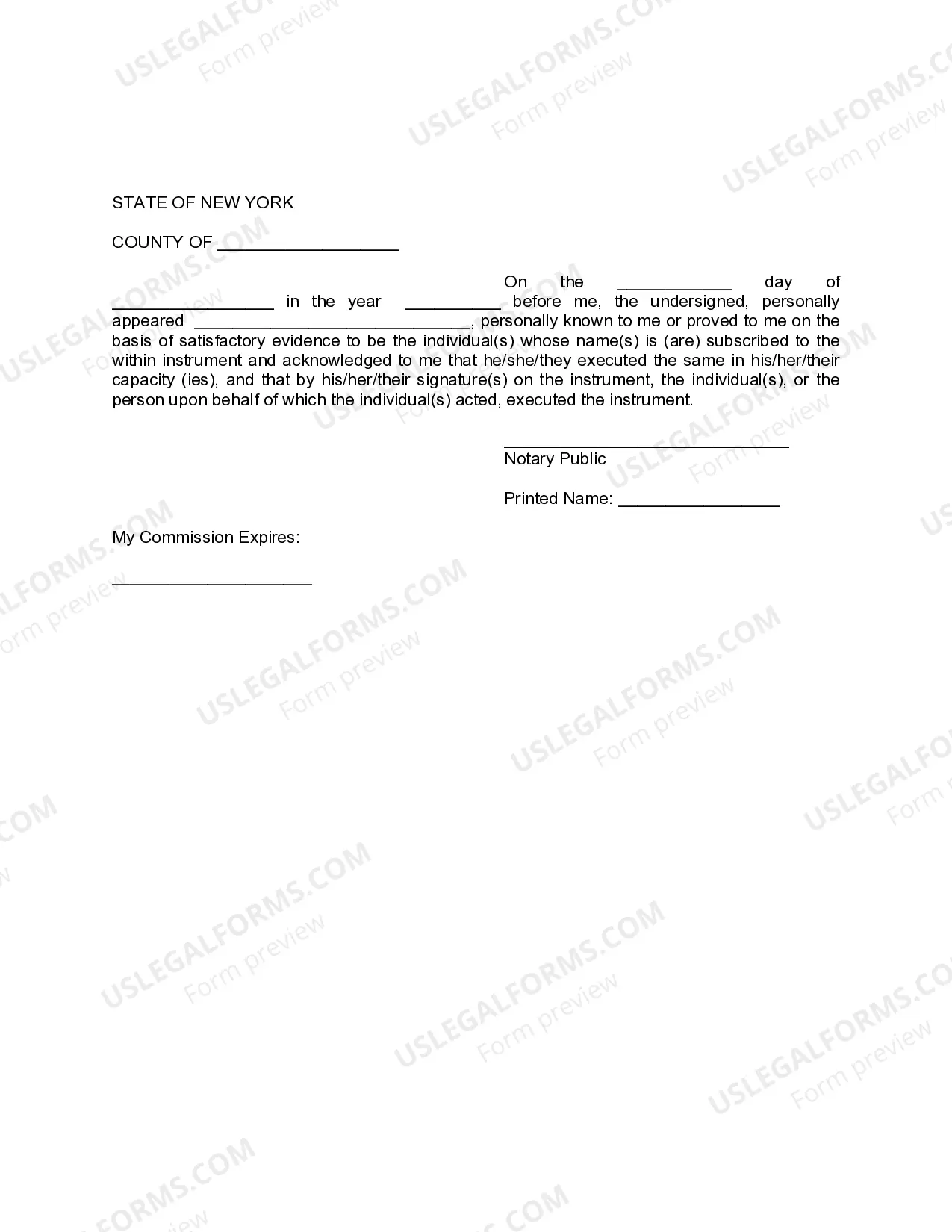

How to fill out Rochester New York Financial Account Transfer To Living Trust?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person with no law background to create such paperwork from scratch, mainly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service provides a huge collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Rochester New York Financial Account Transfer to Living Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Rochester New York Financial Account Transfer to Living Trust in minutes employing our trusted service. In case you are presently a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, in case you are unfamiliar with our library, make sure to follow these steps before obtaining the Rochester New York Financial Account Transfer to Living Trust:

- Ensure the template you have chosen is good for your location since the rules of one state or area do not work for another state or area.

- Preview the document and read a brief outline (if provided) of cases the document can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and search for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Rochester New York Financial Account Transfer to Living Trust as soon as the payment is through.

You’re good to go! Now you can go ahead and print the document or complete it online. Should you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.