Title: Understanding Suffolk New York Financial Account Transfer to Living Trust Introduction: A financial account transfer to a living trust is a comprehensive estate planning strategy that individuals in Suffolk, New York, commonly utilize to protect their assets and ensure a smooth transition of wealth to their beneficiaries. In this article, we will delve into the details of a Suffolk New York financial account transfer to a living trust, its benefits, and the different types of transfers available. 1. What is a Living Trust? A living trust, also known as a revocable trust, is a legal entity that holds an individual's assets during their lifetime and manages the distribution of those assets after their passing. By creating a living trust, individuals maintain control over their finances and can avoid probate, reduce estate taxes, and protect their interests. 2. Financial Account Transfer to Living Trust: Transferring financial accounts into a living trust involves re-titling ownership from an individual to the trust itself. This process typically includes bank accounts, investment accounts, retirement accounts, and other assets with a monetary value. 3. Benefits of a Suffolk New York Financial Account Transfer to Living Trust: a) Probate Avoidance: Unlike assets that pass through a will, assets held in a living trust bypass the probate process, providing privacy, cost savings, and quicker distribution to beneficiaries. b) Asset Protection: A trust can provide protection for assets from potential creditors, lawsuits, and other claims. c) Incapacity Planning: Living trusts also establish provisions for managing the trust maker's assets if they become incapacitated, ensuring seamless financial management. d) Continuous Control: The individual maintains full control of their assets during their lifetime and can change the trust's provisions or revoke it if necessary. 4. Types of Suffolk New York Financial Account Transfers to Living Trust: a) Revocable Living Trust: The most common type, allowing the person creating the trust (granter) to modify, amend, or revoke the trust during their lifetime. b) Irrevocable Living Trust: Once established, this type of trust cannot be easily changed or revoked; it offers additional asset protection and potential tax benefits. c) Testamentary Trust: Established through a will, this trust only becomes active upon the individual's death, transferring financial accounts to the designated trust beneficiaries. Conclusion: A Suffolk New York financial account transfer to a living trust is a practical option for individuals looking to protect their assets, avoid probate, and ensure a seamless transfer of wealth to their loved ones. Consulting with an experienced estate planning attorney is crucial to understand the legalities and determine the best trust plan according to specific circumstances and goals.

Suffolk New York Financial Account Transfer to Living Trust

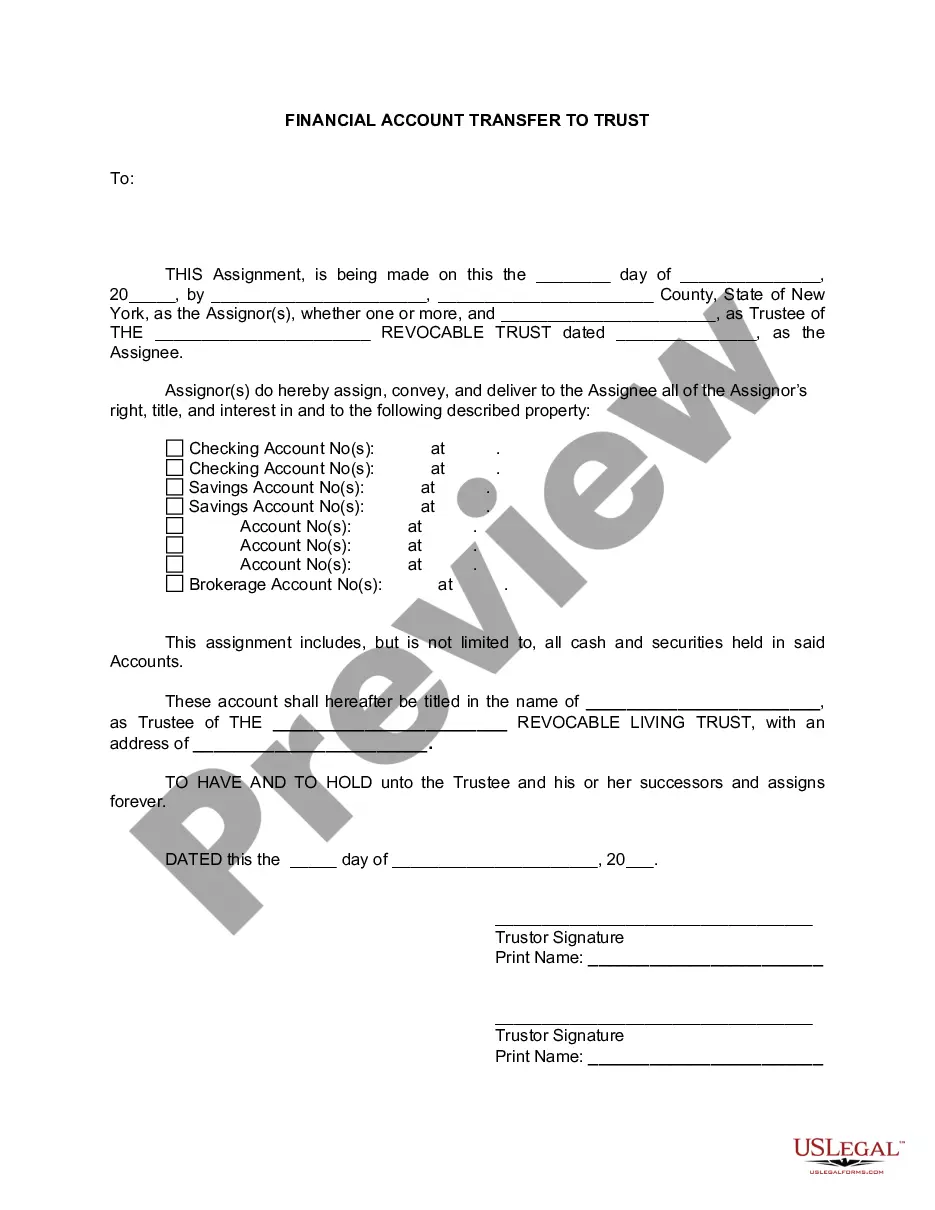

Description

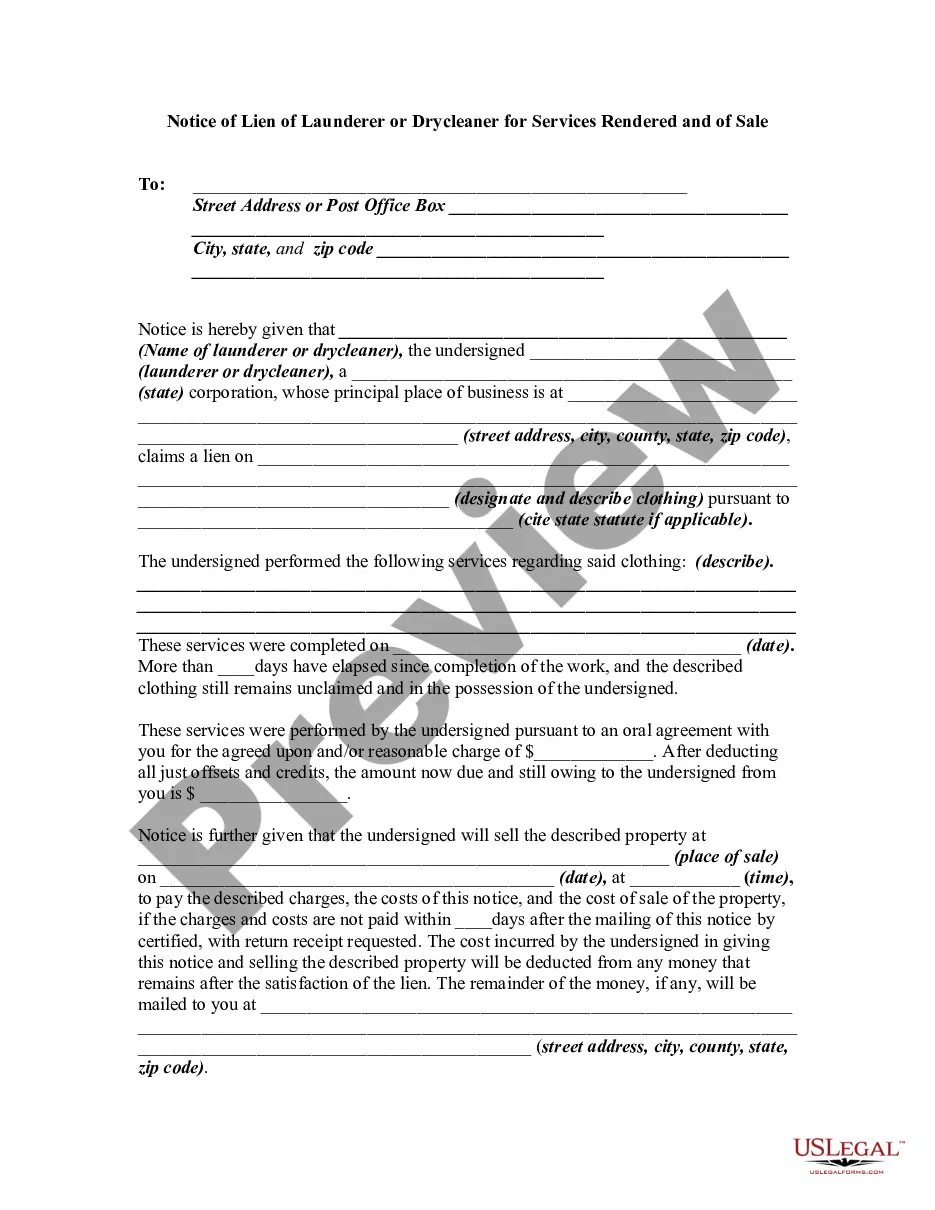

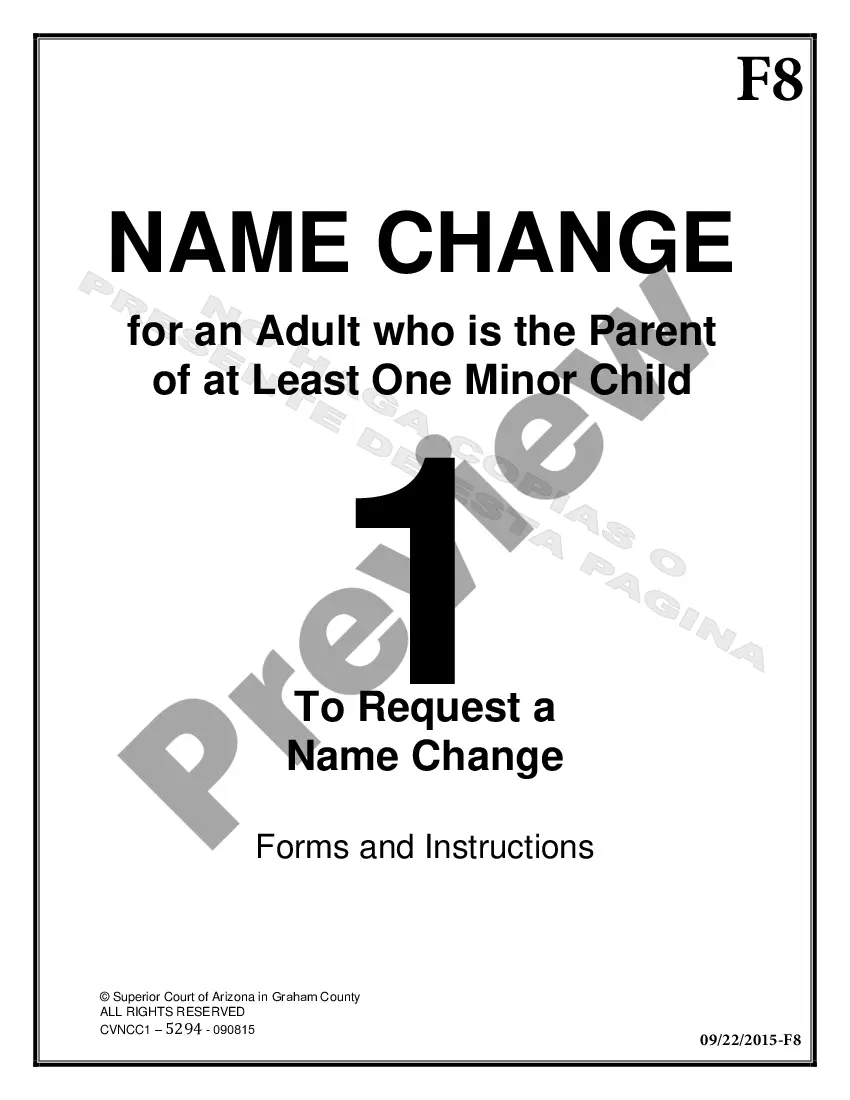

How to fill out New York Financial Account Transfer To Living Trust?

Utilize the US Legal Forms to gain immediate access to any template sample you need.

Our advantageous platform, featuring a vast array of documents, streamlines the process of locating and obtaining nearly any document sample you require.

You can save, complete, and sign the Suffolk New York Financial Account Transfer to Living Trust within minutes rather than spending hours online searching for an appropriate template.

Leveraging our catalog is a superb method to enhance the security of your form submission.

If you don’t have an account yet, follow the steps outlined below.

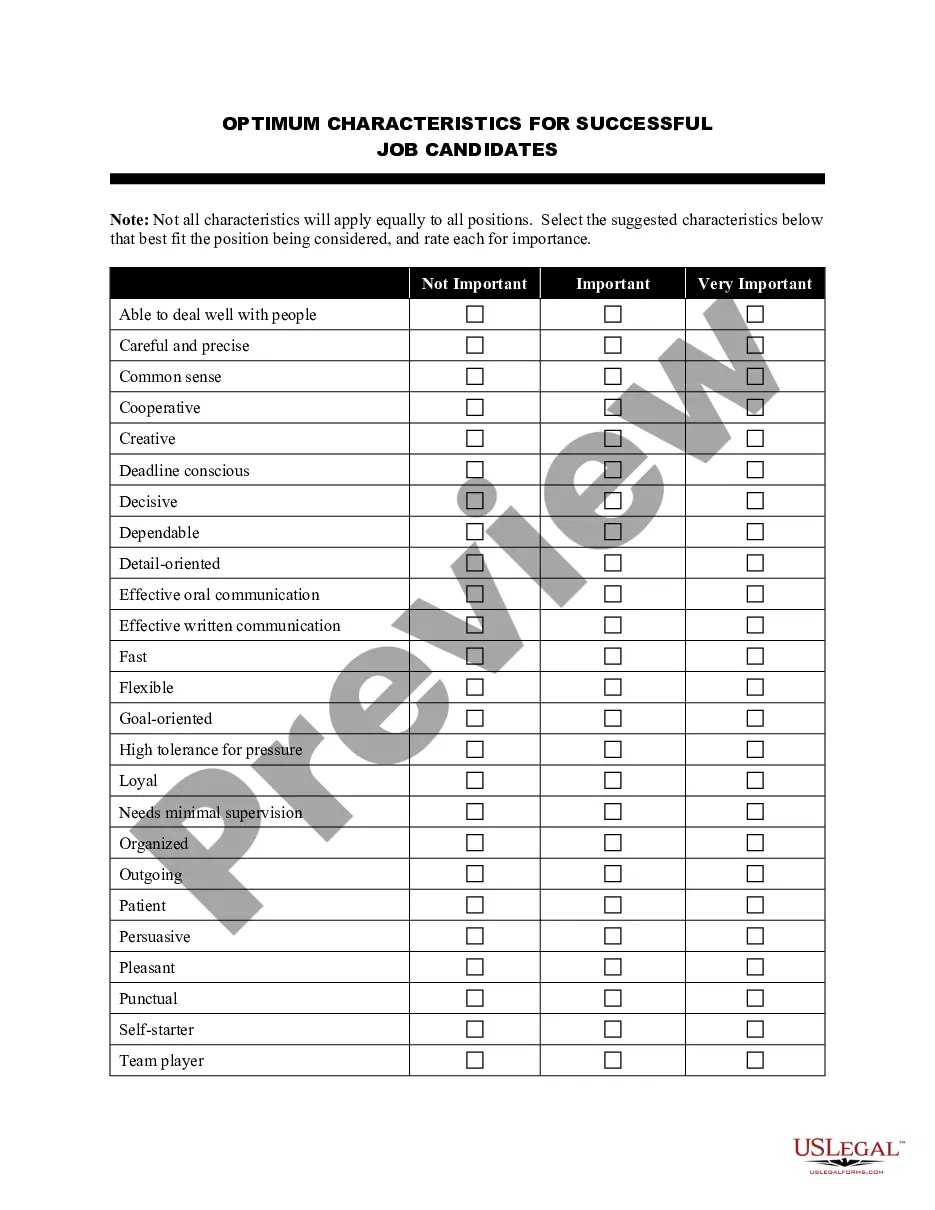

Locate the form you require. Ensure it is the template you are seeking: confirm its name and description, and take advantage of the Preview feature when available. Alternatively, use the Search bar to find the necessary one.

- Our expert legal professionals consistently examine all documents to ensure that the forms are suitable for a specific state and adhere to current laws and regulations.

- How can you obtain the Suffolk New York Financial Account Transfer to Living Trust.

- If you already possess an account, simply Log In to your account. The Download option will be visible on all documents you access.

- Moreover, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

When titling a bank account for a trust, use the trust's name as the account holder on the bank account, along with the trustee's name and title. Ensure that all related documents are complete and accurately reflect this title. Proper titling is essential for the Suffolk New York financial account transfer to living trust, as it confirms the account’s association with the trust.

To transfer a bank account to your living trust, visit your bank’s branch or website to start the process. You will need to provide your trust documentation and identification, as well as fill out the required forms for the transfer. This action allows for a smooth Suffolk New York financial account transfer to living trust, making it easier for your beneficiaries.

Placing bank accounts in a trust can be beneficial for managing your assets and avoiding probate after your passing. It provides a clear, organized way to specify how funds should be handled. This strategy is particularly useful in Suffolk, New York, for efficient financial account transfer to living trust and ensuring your wishes are followed.

Transferring assets into a trust involves identifying the assets, like property and bank accounts, and completing the necessary documentation to change ownership. Each asset might require different steps; however, the goal is to make sure they are retitled in the trust's name. Utilizing a platform like uslegalforms can simplify the Suffolk New York financial account transfer to living trust process.

To transfer a bank account into your living trust, contact your bank and request to change the account ownership to the trust. Typically, you will need to provide a copy of the trust document and fill out specific forms. This straightforward process allows for a Suffolk New York financial account transfer to living trust, simplifying asset management.

In New York, transferring property into a trust requires drafting a deed that conveys ownership from you to the trust. You must then file the new deed with your local county clerk for it to be legally recognized. This method ensures that your property is included in your Suffolk New York financial account transfer to living trust.

To transfer assets into a trust, you begin by establishing the trust and then formally transferring ownership of your assets to it. This process includes changing the title of property and updating account information for financial accounts. In Suffolk, New York, accurate documentation is essential for a successful financial account transfer to living trust.

Determining whether your parents should place their assets in a trust is a significant decision. A Suffolk New York Financial Account Transfer to Living Trust can offer benefits such as avoiding probate and ensuring more privacy for asset distribution. It's essential for your parents to consider their financial goals and estate planning needs. Consulting a legal expert can guide them in making the best choice.

Some people view trusts negatively due to misconceptions about their complexity and potential costs. However, when set up correctly, a Suffolk New York Financial Account Transfer to Living Trust can effectively protect assets and streamline the transfer process. The initial complexity shouldn't deter you from exploring the advantages a trust can offer. Choosing the right legal support can help alleviate fears surrounding trusts.

One disadvantage of a family trust is the complexity it introduces into estate planning. While a family trust can provide benefits like avoiding probate, it also requires proper documentation and maintenance, particularly for the Suffolk New York Financial Account Transfer to Living Trust. Mismanagement or failure to update the trust could lead to disputes among family members. It’s crucial to consult experts to navigate these challenges.