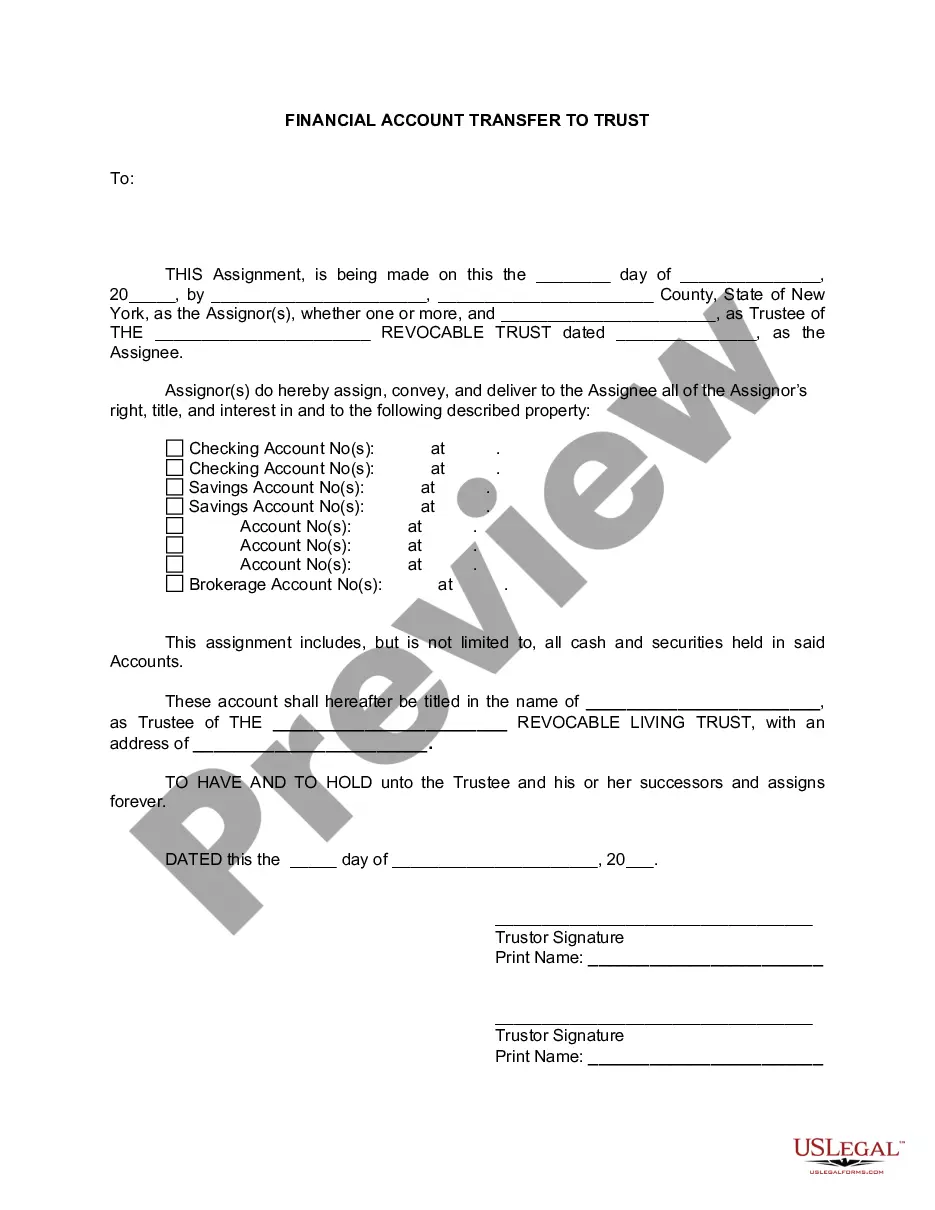

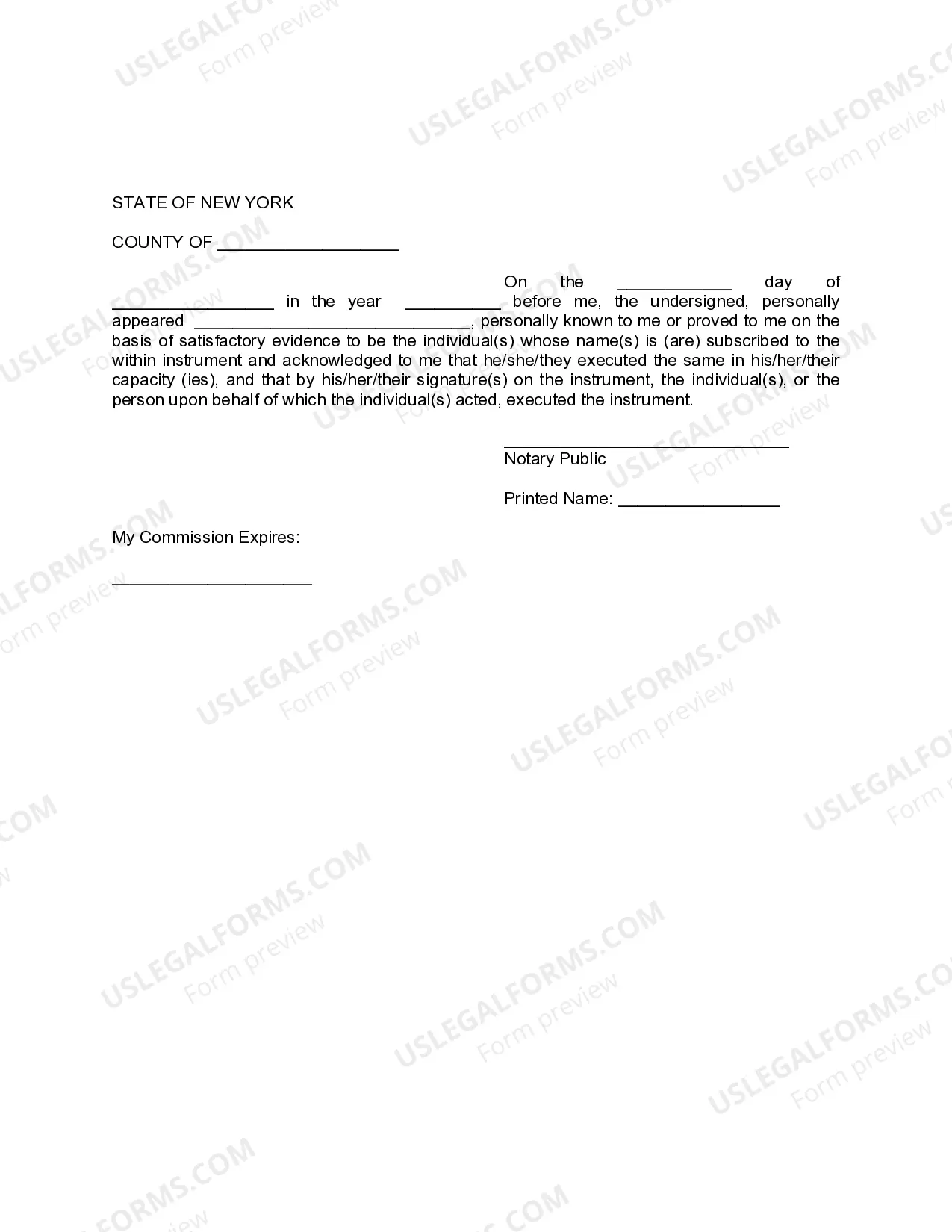

Yonkers New York Financial Account Transfer to Living Trust: A Comprehensive Guide When it comes to estate planning, transferring financial accounts to a living trust can be a crucial step. Yonkers, New York residents seeking to safeguard their assets and ensure a smooth transfer of wealth to their beneficiaries often opt for this arrangement. In this detailed description, we will outline the importance of financial account transfer to living trusts, explain the process, and highlight different types of transfers available. Why Transfer Financial Accounts to a Living Trust in Yonkers, New York? Transferring financial accounts to a living trust in Yonkers, New York offers numerous advantages. First and foremost, it allows individuals to retain control and ownership of their assets while enjoying the benefits of a trust. This ensures that all financial accounts, including checking and savings accounts, investments, retirement plans, and even real estate, are held and managed under the trust's umbrella. In the event of incapacity or death, this arrangement ensures a seamless transfer of assets to desired beneficiaries, bypassing probate. Process of Financial Account Transfer to Living Trust in Yonkers, New York Yonkers residents looking to transfer financial accounts to a living trust should follow these steps: 1. Establish a Living Trust: Consult with a qualified estate planning attorney to create a living trust document that suits your specific needs and wishes. 2. Identify Financial Accounts: Compile a list of financial accounts you wish to include in the living trust. This may include bank accounts, investment portfolios, retirement plans, and any other financial holdings. 3. Update Account Ownership: Contact each financial institution, provide them with the necessary trust documents, and request a change in ownership of the accounts to the living trust. This process typically involves completing specific forms provided by each institution. 4. Follow Legal Formalities: Some financial institutions may require additional steps or documentation, such as notarized signatures or witnessing by a trust officer. Ensure compliance with all legal requirements to finalize the transfer. 5. Monitor and Review: Regularly review your financial accounts and ensure that any new accounts are appropriately titled under the living trust. It is important to keep the trust documents up to date to accurately reflect your wishes. Different Types of Yonkers New York Financial Account Transfers to Living Trust While the core objective remains the same, Yonkers residents may encounter different types of financial account transfers to living trusts. These may include: 1. Checking and Savings Accounts: The most common type of financial accounts transferred to living trusts are everyday checking and savings accounts. By titling these accounts under the trust, they become subject to the trust's terms and provisions. 2. Investment Portfolios: Yonkers residents may also transfer investment portfolios, including stocks, bonds, mutual funds, and other securities, to their living trusts. This consolidates the management and distribution of these assets accordingly. 3. Retirement Plans: Individuals with retirement accounts, such as IRAs, 401(k)s, or pensions, can designate their living trust as the primary or contingent beneficiary. This ensures a smooth transition of these assets and potentially provides long-term financial benefits to beneficiaries. 4. Real Estate: Yonkers residents who own real estate can transfer their properties to a living trust, ensuring that these assets are efficiently managed and distributed according to their wishes. In conclusion, the process of transferring financial accounts to a living trust in Yonkers, New York is a vital component of comprehensive estate planning. By engaging in this process, individuals can secure their assets, simplify estate administration, and preserve their wealth for future generations. Whether it involves traditional bank accounts, investment portfolios, retirement plans, or real estate, Yonkers residents have various options when it comes to the types of financial account transfers to their living trusts.

Yonkers New York Financial Account Transfer to Living Trust

Description

How to fill out Yonkers New York Financial Account Transfer To Living Trust?

Make use of the US Legal Forms and obtain immediate access to any form sample you require. Our useful website with a huge number of document templates allows you to find and get almost any document sample you need. You are able to export, fill, and certify the Yonkers New York Financial Account Transfer to Living Trust in just a matter of minutes instead of browsing the web for many hours attempting to find a proper template.

Using our catalog is a wonderful strategy to improve the safety of your document filing. Our experienced legal professionals regularly check all the records to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How can you obtain the Yonkers New York Financial Account Transfer to Living Trust? If you have a profile, just log in to the account. The Download button will appear on all the documents you view. Moreover, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Open the page with the template you require. Ensure that it is the template you were seeking: check its title and description, and use the Preview option if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the saving process. Select Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the document. Choose the format to obtain the Yonkers New York Financial Account Transfer to Living Trust and edit and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy template libraries on the web. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Yonkers New York Financial Account Transfer to Living Trust.

Feel free to make the most of our platform and make your document experience as efficient as possible!