The Kings New York Assignment to Living Trust is a legal process that involves transferring assets from an individual's ownership to a trust for the benefit of designated beneficiaries. This assignment is a popular method of estate planning in Kings County, New York, allowing individuals to ensure the smooth distribution of their assets upon death while potentially avoiding probate. In a Kings New York Assignment to Living Trust, the person creating the trust, also known as the granter, transfers ownership of assets such as real estate, investments, bank accounts, and personal belongings to a legal entity known as the living trust. The living trust is managed by a trustee, who can be the granter or any other trusted person or institution appointed for this role. The granter specifies the beneficiaries who will benefit from the trust and the terms and conditions under which the assets will be distributed. There are different types of Kings New York Assignment to Living Trust, each serving different purposes and accommodating specific circumstances. Some common variations of living trusts include: 1. Revocable Living Trust: This type of trust allows the granter to modify or revoke the trust at any time during their lifetime, offering flexibility and control over assets. Additionally, these trusts typically become irrevocable upon the granter's death, ensuring the smooth transition of assets to beneficiaries. 2. Irrevocable Living Trust: Unlike revocable trusts, irrevocable trusts cannot be altered or dissolved once established, providing enhanced asset protection and potential tax advantages. The granter permanently relinquishes control and ownership of the assets, allowing them to be excluded from their taxable estate. 3. Testamentary Trust: This type of living trust is established through a will and only takes effect after the granter's death. The assets are transferred to the trust, and the appointed trustee manages and distributes them according to the provisions stated in the will. 4. Special Needs Trust: These trusts are designed to provide financial support and care for individuals with special needs or disabilities. The trust ensures that these individuals receive the necessary resources while still qualifying for government benefits and assistance programs. By utilizing a Kings New York Assignment to Living Trust, individuals are able to achieve a wide range of goals, such as avoiding probate, maintaining privacy, minimizing estate taxes, protecting assets from creditors, preventing family disputes, and providing for loved ones efficiently and according to their wishes. When considering a Kings New York Assignment to Living Trust, it is crucial to seek professional advice from an attorney experienced in estate planning. They can guide individuals through the intricacies of trust creation, tailoring the trust to individual needs and objectives while ensuring compliance with relevant laws and regulations.

Kings New York Assignment to Living Trust

Description

How to fill out Kings New York Assignment To Living Trust?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no legal background to draft such paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive library with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Kings New York Assignment to Living Trust or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Kings New York Assignment to Living Trust quickly employing our reliable service. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps prior to obtaining the Kings New York Assignment to Living Trust:

- Be sure the template you have found is good for your area since the regulations of one state or area do not work for another state or area.

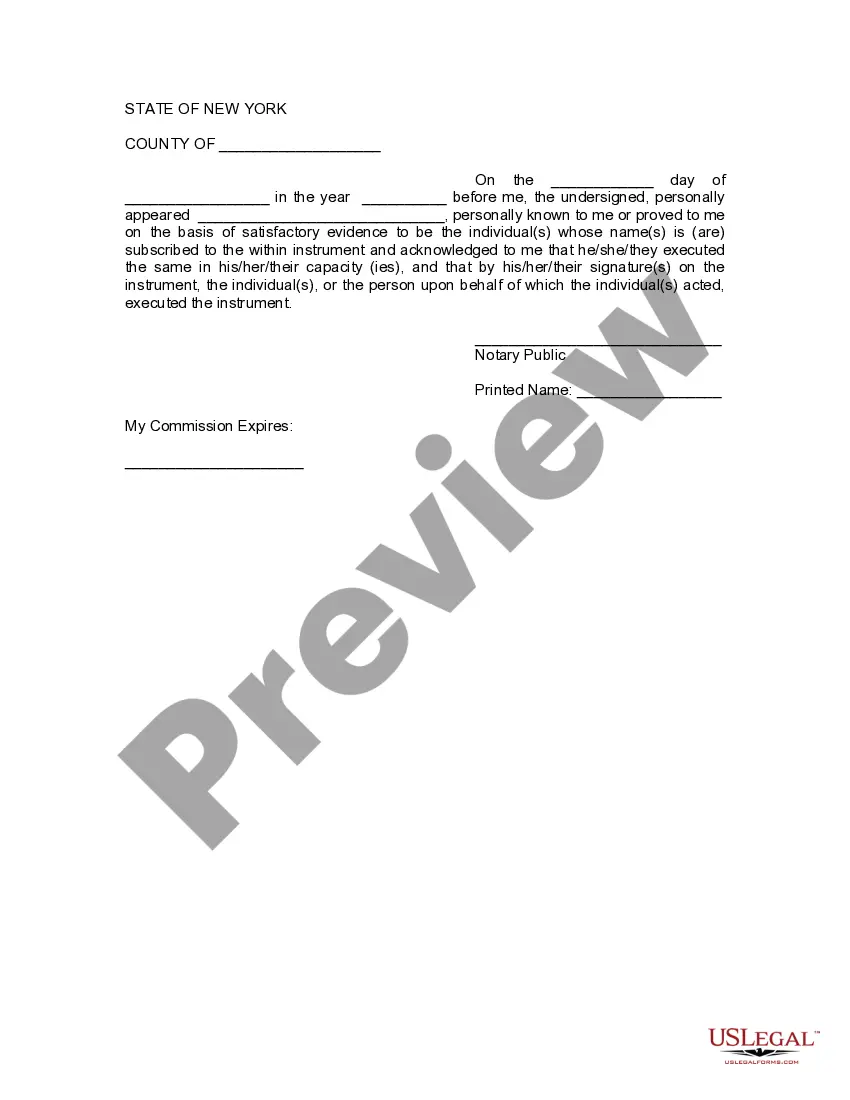

- Preview the form and read a brief description (if available) of scenarios the document can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start again and search for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Kings New York Assignment to Living Trust once the payment is through.

You’re all set! Now you can go ahead and print out the form or fill it out online. In case you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.