Nassau New York Assignment to Living Trust is a legal document that transfers the ownership of assets and properties in Nassau County, New York, into a trust for the benefit of beneficiaries. This assignment ensures that the assets held within the trust are properly managed and distributed according to the granter's wishes, while avoiding the probate process. A living trust, also known as an inter vivos trust, is a popular estate planning tool in Nassau County, New York, that allows individuals to retain control over their assets during their lifetime and efficiently distribute them upon their death. By creating a living trust, individuals can avoid the time-consuming and expensive probate process, which can be especially burdensome in Nassau County. There are different types of Nassau New York Assignment to Living Trust that individuals can consider based on their unique circumstances and estate planning goals. These include: 1. Revocable Living Trust: This is the most common type of living trust in Nassau County, New York. The granter retains the ability to modify or revoke the trust during their lifetime and can act as a trustee, managing the assets within the trust themselves. Upon the granter's death, a successor trustee takes over and distributes the assets to the designated beneficiaries. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be modified or revoked by the granter once it is created. This type of trust provides stronger asset protection and may offer certain tax benefits. However, it requires the granter to relinquish control over the assets and requires careful consideration before implementation. 3. Testamentary Trust: This type of trust is established through a will and does not become effective until the granter's death. Upon the granter's passing, their assets are transferred to the trust to be managed and distributed according to the terms of the will. A testamentary trust can be an effective tool for individuals who want to maintain control over their assets during their lifetime while ensuring a smooth and orderly transfer upon death. 4. Special Needs Trust: This type of living trust is specifically designed to provide for the needs of individuals with disabilities or special needs. A special needs trust allows for the management of assets while preserving eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). Creating a Nassau New York Assignment to Living Trust involves several important steps, including drafting the trust document, identifying the assets to be transferred into the trust, appointing a trustee, and designating beneficiaries. It is crucial to consult with an experienced estate planning attorney in Nassau County to ensure all legal requirements and considerations are met. In summary, a Nassau New York Assignment to Living Trust is a valuable estate planning tool that allows individuals to protect their assets, maintain control over their properties, and efficiently transfer them to designated beneficiaries without going through probate. By choosing the right type of living trust and seeking professional guidance, individuals can ensure their assets are properly managed and distributed in accordance with their wishes.

Nassau New York Assignment to Living Trust

Description

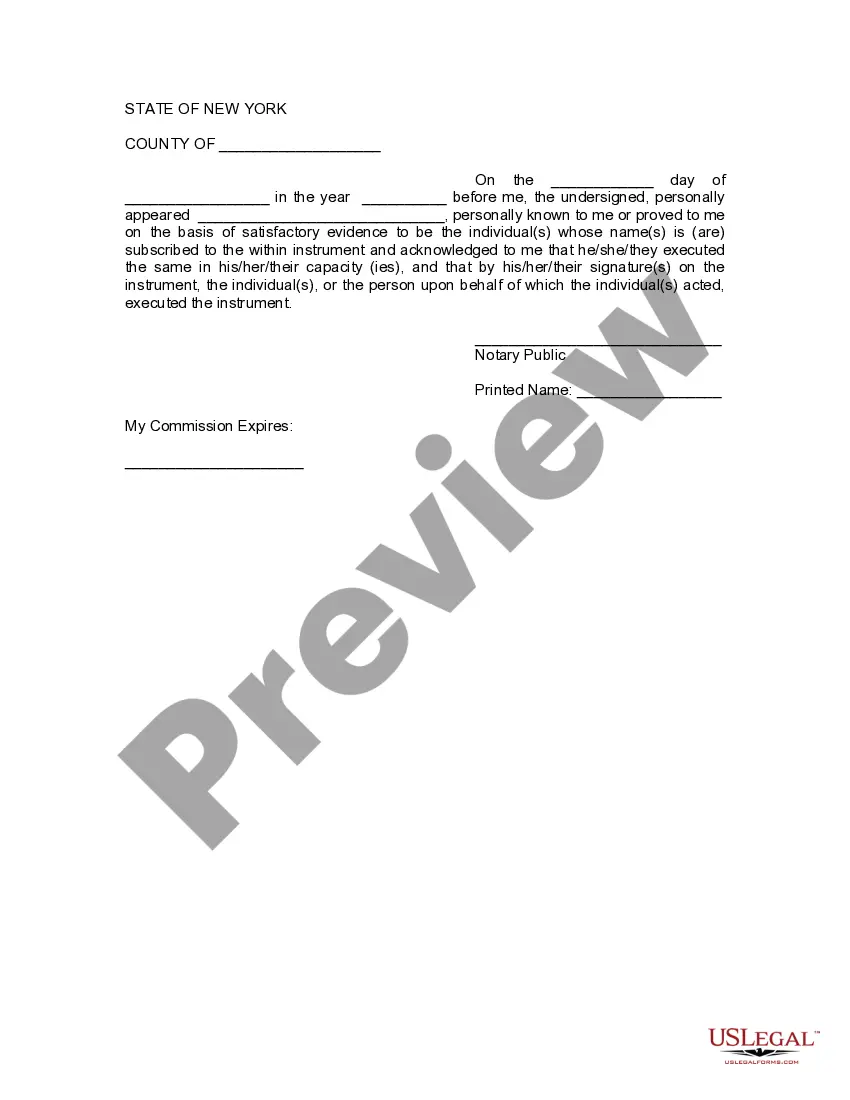

How to fill out Nassau New York Assignment To Living Trust?

Are you looking for a reliable and affordable legal forms provider to buy the Nassau New York Assignment to Living Trust? US Legal Forms is your go-to option.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of separate state and county.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Nassau New York Assignment to Living Trust conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the form is good for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Nassau New York Assignment to Living Trust in any provided format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online once and for all.