Queens New York Assignment to Living Trust is a legal process where an individual's assets and properties located in Queens, New York are transferred to a Living Trust. A Living Trust is a legal document that allows the granter (the person creating the trust) to put their assets in a trust during their lifetime and designate beneficiaries to receive those assets after their death. This assignment helps ensure the seamless transfer of assets while avoiding probate. There are different types of Queens New York Assignment to Living Trust, including: 1. Revocable Living Trust: This type of trust allows the granter to retain control of their assets during their lifetime, allowing them to make changes or revoke the trust if desired. It provides flexibility and is often the most common type of living trust. 2. Irrevocable Living Trust: Unlike the revocable trust, this assignment is permanent, and once assets are transferred, they no longer remain under the granter's control. Typically, an irrevocable trust is utilized in estate planning to protect assets from estate taxes, creditors, or to preserve eligibility for government benefits. 3. Testamentary Living Trust: This type of trust is created through a will and only goes into effect after the granter's death. The assets are transferred to the living trust upon the granter's demise, and the trust is administered according to the granter's specified wishes. 4. Special Needs Trust: This trust is designed to provide for individuals with disabilities or special needs. It allows assets to be held in trust for the benefit of the disabled person, ensuring that they receive the necessary care without disqualifying them from government benefits. 5. Charitable Living Trust: This type of trust allows the granter to contribute assets to charitable organizations in Queens, New York. It provides tax benefits to the granter while supporting causes they are passionate about. The Queens New York Assignment to Living Trust helps individuals effectively manage their assets during their lifetime, streamline the distribution process after their death, and potentially reduce estate taxes. Consulting an experienced attorney knowledgeable in estate planning is crucial to determine the type of trust that best fits an individual's specific needs and goals in Queens, New York.

Queens Trust

Category:

State:

New York

County:

Queens

Control #:

NY-E0178E

Format:

Word;

Rich Text

Instant download

Description

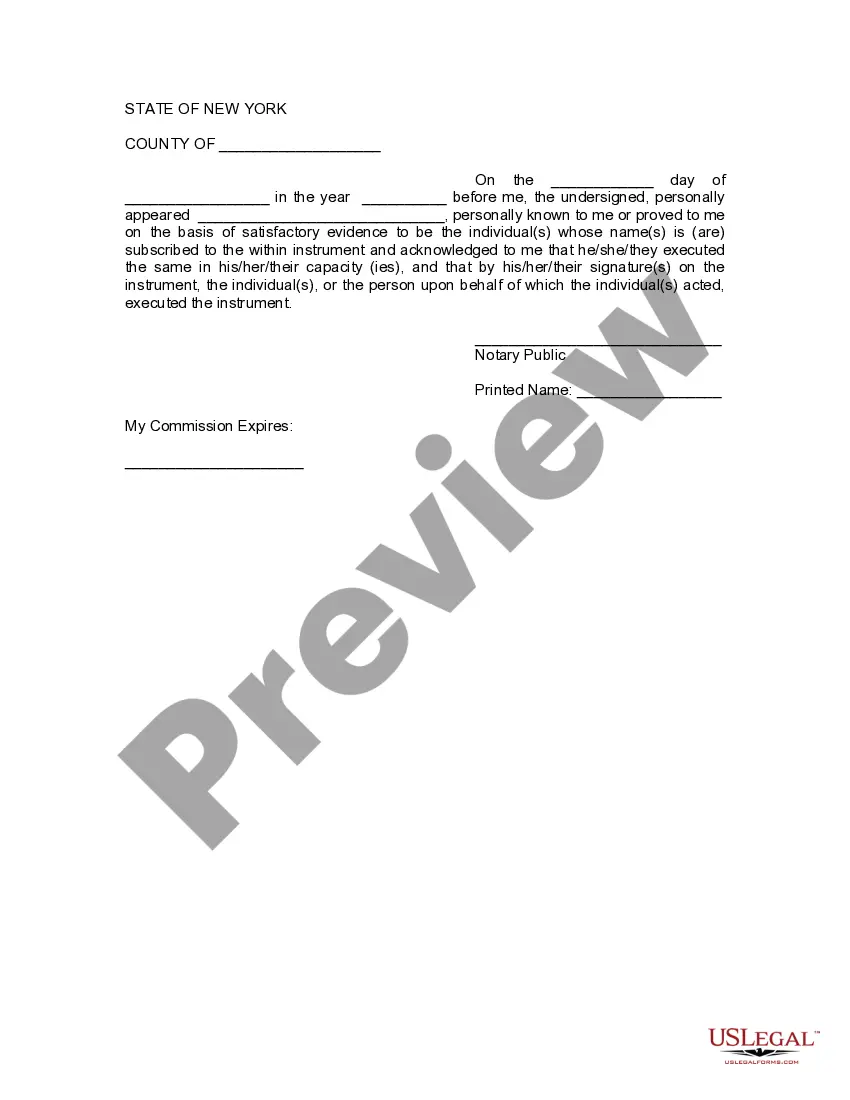

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Queens New York Assignment to Living Trust is a legal process where an individual's assets and properties located in Queens, New York are transferred to a Living Trust. A Living Trust is a legal document that allows the granter (the person creating the trust) to put their assets in a trust during their lifetime and designate beneficiaries to receive those assets after their death. This assignment helps ensure the seamless transfer of assets while avoiding probate. There are different types of Queens New York Assignment to Living Trust, including: 1. Revocable Living Trust: This type of trust allows the granter to retain control of their assets during their lifetime, allowing them to make changes or revoke the trust if desired. It provides flexibility and is often the most common type of living trust. 2. Irrevocable Living Trust: Unlike the revocable trust, this assignment is permanent, and once assets are transferred, they no longer remain under the granter's control. Typically, an irrevocable trust is utilized in estate planning to protect assets from estate taxes, creditors, or to preserve eligibility for government benefits. 3. Testamentary Living Trust: This type of trust is created through a will and only goes into effect after the granter's death. The assets are transferred to the living trust upon the granter's demise, and the trust is administered according to the granter's specified wishes. 4. Special Needs Trust: This trust is designed to provide for individuals with disabilities or special needs. It allows assets to be held in trust for the benefit of the disabled person, ensuring that they receive the necessary care without disqualifying them from government benefits. 5. Charitable Living Trust: This type of trust allows the granter to contribute assets to charitable organizations in Queens, New York. It provides tax benefits to the granter while supporting causes they are passionate about. The Queens New York Assignment to Living Trust helps individuals effectively manage their assets during their lifetime, streamline the distribution process after their death, and potentially reduce estate taxes. Consulting an experienced attorney knowledgeable in estate planning is crucial to determine the type of trust that best fits an individual's specific needs and goals in Queens, New York.

Free preview

How to fill out Queens New York Assignment To Living Trust?

If you’ve already used our service before, log in to your account and save the Queens New York Assignment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Queens New York Assignment to Living Trust. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!