Syracuse New York Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out New York Notice Of Assignment To Living Trust?

If you are looking for a legitimate form template, it’s challenging to locate a more user-friendly site than the US Legal Forms portal – one of the most substantial online collections.

With this collection, you can discover thousands of templates for both commercial and personal needs by categories and states, or search terms.

Utilizing the advanced search feature, finding the latest Syracuse New York Notice of Assignment to Living Trust is as straightforward as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the format and download it onto your device.

- Additionally, the validity of each document is ensured by a team of experienced lawyers who routinely assess the templates on our site and refresh them in line with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Syracuse New York Notice of Assignment to Living Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the form you desire. Review its details and use the Preview feature (if available) to examine its content. If it does not suit your requirements, utilize the Search functionality at the top of the page to find the appropriate document.

- Confirm your selection. Hit the Buy now button. Following that, choose your desired subscription plan and provide your details to create an account.

Form popularity

FAQ

To put everything in a living trust, first, you need to identify all assets you want to include. Then, you must transfer ownership of those assets into the trust, which often involves changing titles or updating account information. It’s advisable to seek guidance from a legal expert to ensure all steps are correctly followed. The Syracuse New York Notice of Assignment to Living Trust can help facilitate this process and offer peace of mind knowing your assets are properly organized.

To fill a living trust, start by collecting detailed information about your assets. You will need to list your properties, bank accounts, investments, and personal items. Next, you can draft the trust document, ensuring it adheres to your state's laws. Utilizing the Syracuse New York Notice of Assignment to Living Trust can make this process simpler, ensuring your trust is complete and legally sound.

Certain assets, like retirement accounts and life insurance policies, are generally not placed in a living trust. Keeping these assets outside the trust allows for direct beneficiary designations, avoiding probate. Moreover, personal belongings and certain types of property, such as cars, may be easier to manage outside of a living trust. Understanding the implications of the Syracuse New York Notice of Assignment to Living Trust will help you make informed decisions on transferring the right assets.

The downside of a living trust can include upfront costs and the need for ongoing maintenance. While a living trust helps avoid probate, it does not provide protection from creditors. Additionally, you must transfer assets to the trust to reap its benefits, which can be a time-consuming process. Consider using a Syracuse New York Notice of Assignment to Living Trust to streamline asset transfer and ensure your trust remains effective.

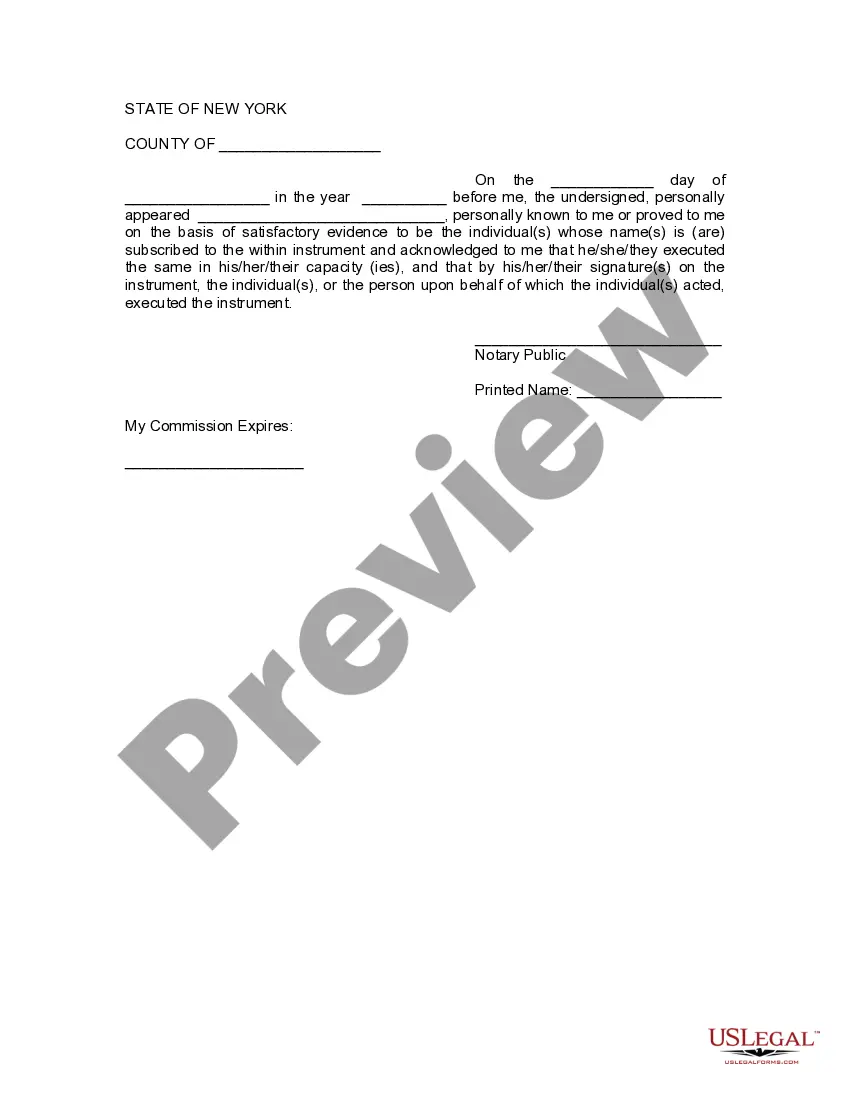

Transferring property to a trust in New York requires drafting a deed that indicates the trust as the new owner. After preparing the deed, you must sign it and have it notarized. Finally, file the deed with the appropriate local government office. Utilizing a Syracuse New York Notice of Assignment to Living Trust can help guide you through this process and provide legal assurance of your intent.

To transfer your property into a trust in New York, you will need to execute a deed that reflects the change in ownership from your name to the trust's name. This step typically requires filing the new deed with the county clerk's office. It's advisable to also complete a Syracuse New York Notice of Assignment to Living Trust to ensure compliance with state laws and to clarify your intent regarding the property.

Assets are moved into a trust through a process called funding. This involves titling assets in the name of the trust or transferring ownership to the trustee. You may need to complete specific legal documents, such as a Syracuse New York Notice of Assignment to Living Trust, to facilitate this transfer. This action ensures your assets are managed according to your wishes outlined in the trust.

The biggest mistake parents often make when setting up a trust fund is not clearly defining their intentions or the terms of the trust. This lack of clarity can lead to disputes among beneficiaries, which is something everyone wants to avoid. It is essential to outline how you want your assets distributed and ensure your wishes are documented clearly. Consider utilizing the Syracuse New York Notice of Assignment to Living Trust to simplify this process.

A trust fund can offer financial security, but it also carries certain risks. Mismanagement or lack of clear communication can lead to misunderstanding or even conflict among family members regarding the Syracuse New York Notice of Assignment to Living Trust. Furthermore, if a trust is not funded correctly, it may not meet the intended goals. Utilizing USLegalForms can help navigate these risks by providing clear documents and guidance throughout the process.

Creating a trust can offer significant advantages for asset management and transfer. By utilizing the Syracuse New York Notice of Assignment to Living Trust, your parents can ensure a smoother transition of their assets while minimizing potential tax implications. A trust allows them to specify how their assets are distributed after their passing, which can provide peace of mind. It is wise to consult with a legal expert to tailor a trust to their specific situation.