Queens New York Revocation of Living Trust

Description

How to fill out New York Revocation Of Living Trust?

If you have previously used our service, Log In to your account and download the Queens New York Revocation of Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial time using our service, follow these straightforward steps to access your file.

You have continuous access to all the documents you have purchased: you can find them in your profile under the My documents menu whenever you wish to use them again. Utilize the US Legal Forms service to easily find and store any template for your personal or professional requirements!

- Ensure you’ve discovered an appropriate document. Review the description and utilize the Preview feature, if available, to determine if it satisfies your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Acquire your Queens New York Revocation of Living Trust. Select the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

Revoking a trust can be a straightforward process, especially with the right guidance. In Queens, New York, revocation of a living trust typically involves preparing a formal document stating your intent to revoke the trust. It is essential to ensure that this document complies with state regulations to avoid future complications. For assistance, consider using US Legal Forms, where you can find templates and resources to simplify the Queens New York revocation of living trust process.

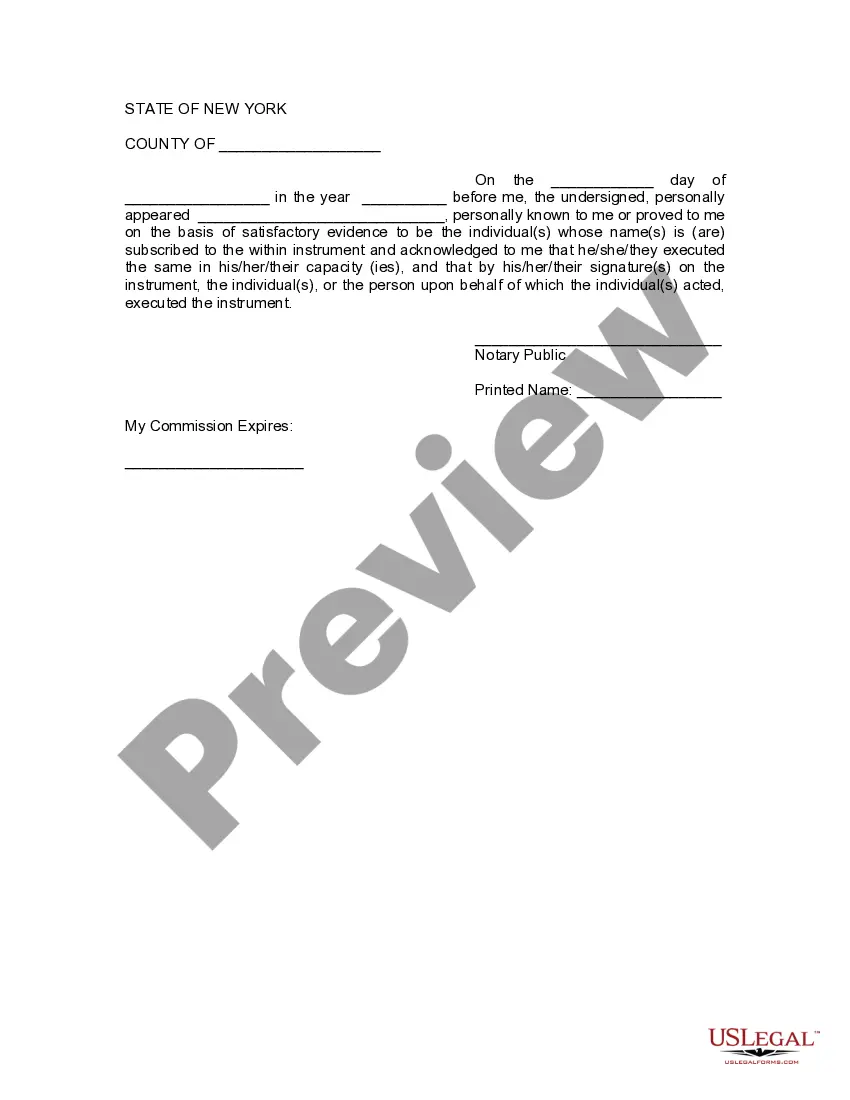

You can revoke a revocable trust by following specific legal steps to ensure its validity. Typically, you need to create a written document stating your intention to revoke the trust, and you may want to sign and date it in front of a notary. It is essential to follow the procedures outlined in the trust document and under New York law for the Queens New York Revocation of Living Trust. If you need assistance navigating this process, U.S. Legal Forms can provide the necessary resources and templates to help you efficiently revoke your living trust.

Revoking a trust in New York involves following the specific terms laid out in the trust agreement. You may need to draft a written revocation document that clearly states your intentions. To ensure that your revocation is effective and meets all legal standards, using resources like UsLegalForms can be beneficial during the Queens New York Revocation of Living Trust.

To revoke a revocable living trust, the grantor must follow the procedures outlined in the trust document. This typically involves creating a formal revocation document or simply destroying the original trust document. Doing this correctly ensures the revocation is valid and recognized, which is crucial during the Queens New York Revocation of Living Trust.

Generally, irrevocable trusts cannot be revoked easily, as they are designed to be permanent. However, you may be able to modify or terminate them under specific circumstances, such as changes in law or if all beneficiaries agree to the revocation. Consulting with a legal expert can clarify your options in relation to the Queens New York Revocation of Living Trust.

A trust can be terminated in three primary ways: by the terms of the trust document, by a court order, or by mutual agreement among the beneficiaries. It's important to refer to the specific provisions in the trust document when considering termination. Understanding these options can aid you during the Queens New York Revocation of Living Trust process.

While having an attorney is not legally required to dissolve a trust, enlisting professional help can simplify the process. An attorney can guide you through the complexities of trust laws in New York, ensuring that all legal requirements are met. This approach can be especially beneficial during the Queens New York Revocation of Living Trust, where proper handling is crucial.

To execute a trust in New York, you need a written document that details the terms of the trust. The trust must be signed by the person creating it, known as the grantor, in the presence of at least two witnesses. Additionally, you should consider having it notarized to ensure its validity during the Queens New York Revocation of Living Trust process.

An example of trust revocation could involve a person who initially established a living trust but later decides to redistribute their assets differently. They would create a revocation document that explicitly disbands the original trust, effectively moving assets out of the trust. Utilizing US Legal Forms can help you generate the documentation needed to smoothly handle your Queens New York Revocation of Living Trust.

A sample revocation of a living trust typically includes a straightforward statement declaring the trust revoked, along with essential details such as the trust's name, date, and the signatures of the creator and witnesses. By obtaining a sample from resources like US Legal Forms, you can tailor it to your situation, ensuring that your Queens New York Revocation of Living Trust is legally sound.