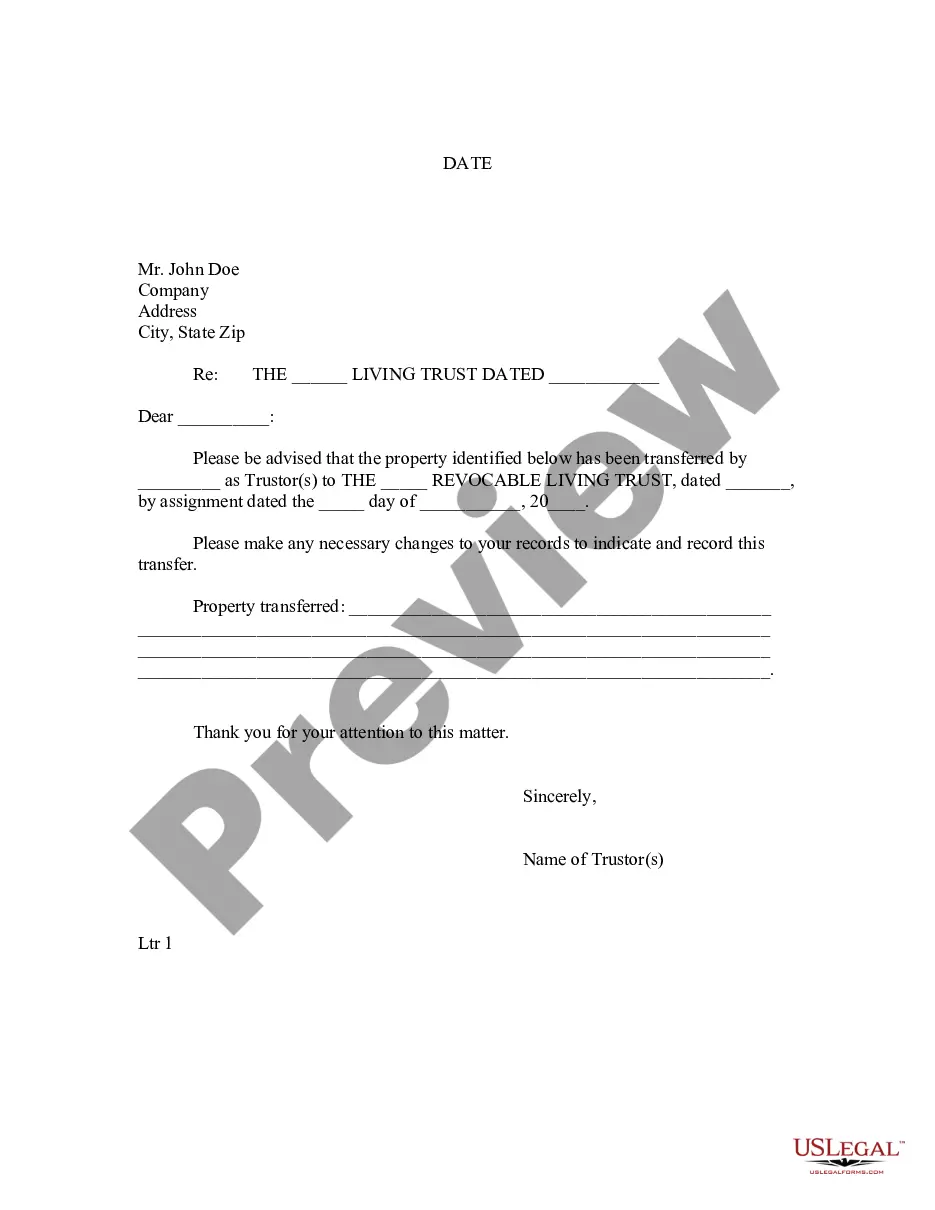

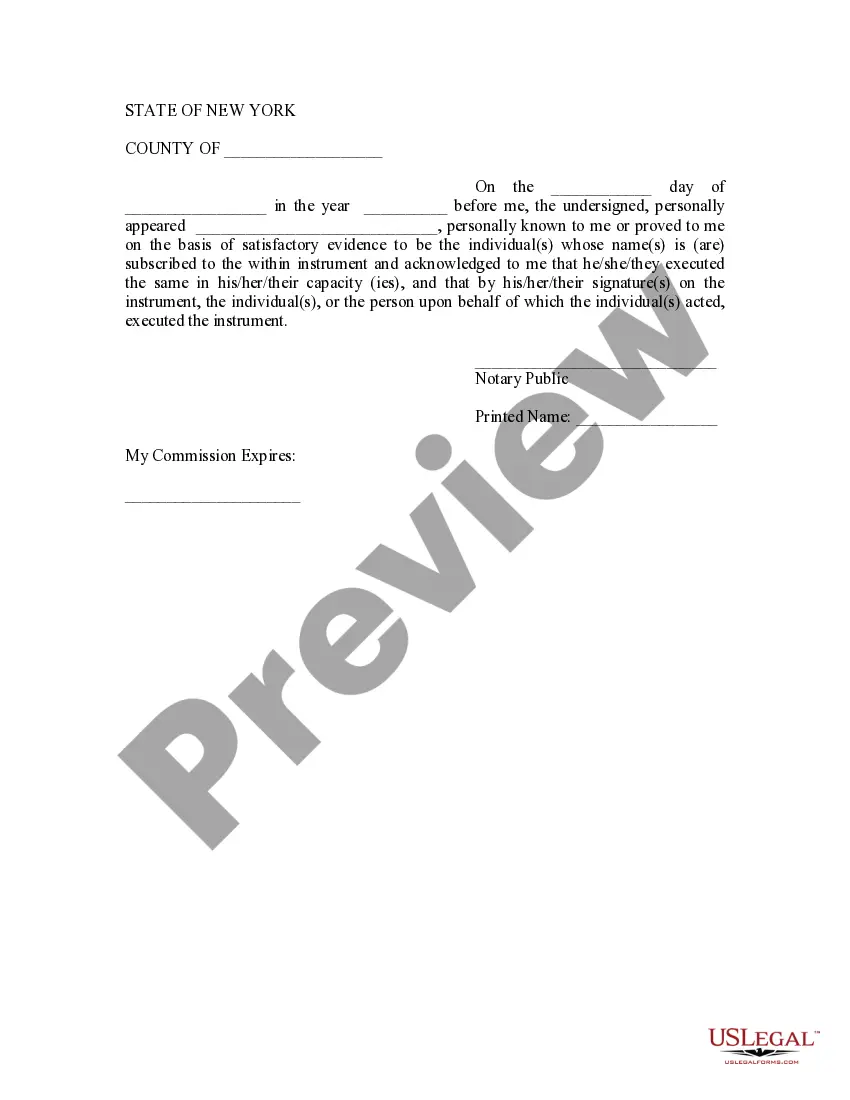

Title: Syracuse New York Letter to Lien holder to Notify of Trust — A Comprehensive Guide Keywords: Syracuse New York, letter to lien holder, notify of trust, trust notification, lien holder notification Introduction: In Syracuse, New York, when establishing a trust, it is essential to notify the lien holder of the trust's existence. This article will provide you with a detailed description and information on how to draft and send a Syracuse New York Letter to Lien holder to Notify of Trust. 1. Understanding the Purpose of the Letter to Lien holder: The Syracuse New York Letter to Lien holder to Notify of Trust serves as a formal notice for lien holders, such as mortgage lenders or other creditors, informing them about the creation of a trust. This letter aims to establish the trust's credibility and ensure the lien holder takes appropriate actions regarding future communication and transactions. 2. Key Components of the Syracuse New York Letter to Lien holder: a) Sender Information: Provide complete details about the person or entity establishing the trust, including their full name, contact information, and any identification numbers related to the trust. b) Lien holder Information: Include the name, contact details, and address of the lien holder such as the mortgage lender or creditor. c) Trust Information: Clearly state the name of the trust, the date of its establishment, the purpose of the trust, and any other relevant details. d) Trustee Information: Mention the trustee's name, contact details, and position in the trust. e) Lien holder's Duties: Emphasize the lien holder's responsibilities and duties concerning future communications, statements, payments, and any other transactions related to the trust. f) Request for Confirmation: Ask the lien holder to acknowledge and confirm that they have received the notice and understand their obligations towards the trust. g) Contact Information: Provide contact details for any further inquiries or additional information. 3. Types of Syracuse New York Letters to Lien holder to Notify of Trust: a) Property Trust Notification: When a real estate property is placed into a trust, this letter is sent to the mortgage lender or any other party holding a lien on the property. b) Financial Trust Notification: In cases where a financial asset, such as a bank account or investment fund, is transferred to a trust, this letter notifies the financial institution involved. c) Vehicle Trust Notification: If a vehicle is transferred into a trust, this letter is sent to the auto lien holder to notify them of the change in ownership. Conclusion: When establishing a trust in Syracuse, New York, it is crucial to send a formal letter to the relevant lien holder to notify them of the trust's existence. By including all necessary details and outlining the lien holder's obligations, you can ensure a smooth transition and the proper handling of all future transactions related to the trust. Remember to customize the letter according to the specific type of trust to be effective.

Syracuse New York Letter to Lienholder to Notify of Trust

Description

How to fill out Syracuse New York Letter To Lienholder To Notify Of Trust?

If you are looking for a relevant form template, it’s extremely hard to choose a more convenient platform than the US Legal Forms site – probably the most comprehensive online libraries. With this library, you can find a large number of form samples for business and personal purposes by types and regions, or key phrases. With the advanced search option, discovering the most recent Syracuse New York Letter to Lienholder to Notify of Trust is as elementary as 1-2-3. Additionally, the relevance of each record is proved by a group of professional attorneys that regularly check the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our platform and have a registered account, all you should do to get the Syracuse New York Letter to Lienholder to Notify of Trust is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have found the form you need. Read its information and make use of the Preview function to see its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to get the proper document.

- Affirm your decision. Select the Buy now button. Next, choose your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Syracuse New York Letter to Lienholder to Notify of Trust.

Each and every template you add to your user profile has no expiration date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, you can return and download it once again anytime.

Make use of the US Legal Forms extensive catalogue to gain access to the Syracuse New York Letter to Lienholder to Notify of Trust you were seeking and a large number of other professional and state-specific samples on one platform!