Title: Suffolk New York Pay Notice for Hourly Rate Employees — Notice and Acknowledgement of Pay Rate and Payday Keywords: Suffolk New York, pay notice, hourly rate employees, pay rate, payday, notice and acknowledgement 1. Introduction to the Suffolk New York Pay Notice for Hourly Rate Employees: — Understanding the importance of transparency and compliance in wage policies. — Overview of the Suffolk New York Pay Notice, specifically designed for employees paid on an hourly rate basis. — Exploring the significance of providing employees with a comprehensive notice and acknowledgement of their pay rate and payday. 2. Purpose and Legal Requirements of the Suffolk New York Pay Notice: — Complying with Suffolk County laws and regulations regarding employee compensation. — Ensuring fair treatment for hourly rate employees by providing clear information about their wages. — Meeting legal obligations by documenting employee agreement to the pay rate and payday. 3. Contents of the Suffolk New York Pay Notice for Hourly Rate Employees: — Detailed explanation of the employee's hourly pay rate, including any applicable minimum wage requirements. — Inclusion of the payday frequency, which could be weekly, bi-weekly, or monthly, depending on the employer's policies. — Mention of any additional terms or conditions related to pay, such as overtime rates or meal breaks. 4. Different Types of Suffolk New York Pay Notice for Hourly Rate Employees: — Standard Pay Notice: A comprehensive notice form tailored for employees paid on an hourly basis. — Overtime Pay Notice: A modified form that includes specific details about overtime rates and regulations. — Minimum Wage Adjustment Notice: A specialized variation for employees whose pay rate may vary due to changes in the minimum wage. 5. Importance of Acknowledgement: — Highlighting the significance of the employee's signature as proof of understanding and agreement with the provided pay rate and payday. — Ensuring clarity and preventing misunderstandings or disputes in the future. — Emphasizing that the notice and acknowledgement process is crucial for both employers and employees. Conclusion: — Emphasizing that the Suffolk New York Pay Notice for Hourly Rate Employees is a vital document for ensuring fair and transparent compensation practices. — Encouraging employers to understand and comply with Suffolk County laws when creating and implementing pay notices. — Stressing the importance of ongoing communication and documentation to maintain a harmonious employee-employer relationship in matters of pay.

Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Hourly Rate Employees - Notice And Acknowledgement Of Pay Rate And Payday?

Regardless of your social or occupational rank, finalizing legal documents is an unfortunate necessity in the current professional landscape.

Frequently, it’s nearly impossible for someone lacking legal training to generate such paperwork from the ground up, primarily due to the complicated terminology and legal nuances they involve.

This is where US Legal Forms can be a lifesaver.

Confirm that the form you have located is appropriate for your area since the laws of one state or county are not applicable to another.

Review the document and review a brief description (if available) of situations the paper can be utilized for.

- Our platform offers an extensive library with over 85,000 state-specific documents ready for use that cater to nearly any legal situation.

- US Legal Forms also proves to be an invaluable resource for associates or legal advisors looking to save time with our DIY papers.

- Whether you need the Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday or any other document that will be valid in your state or county, US Legal Forms has everything readily accessible.

- Here’s how to quickly acquire the Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday using our reliable platform.

- If you are already a subscriber, proceed to Log In to your account to download the necessary form.

- If you are unfamiliar with our platform, make sure you adhere to these steps before downloading the Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday.

Form popularity

FAQ

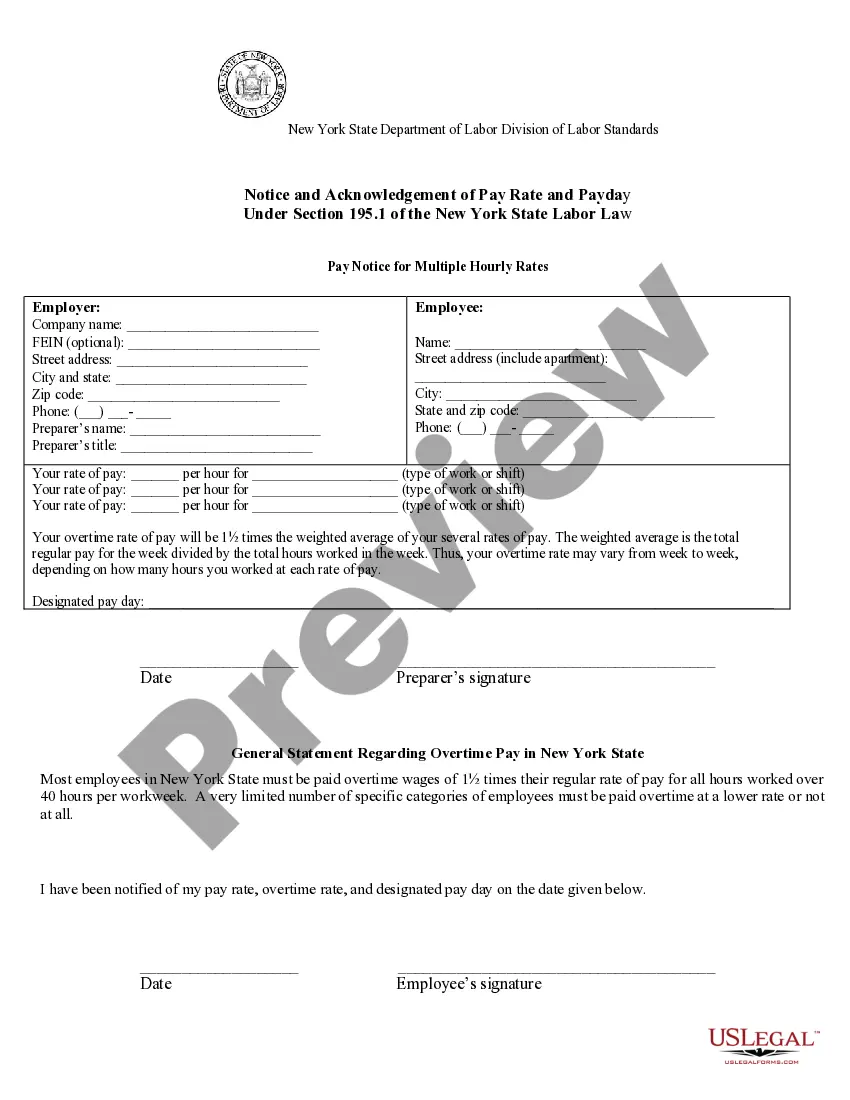

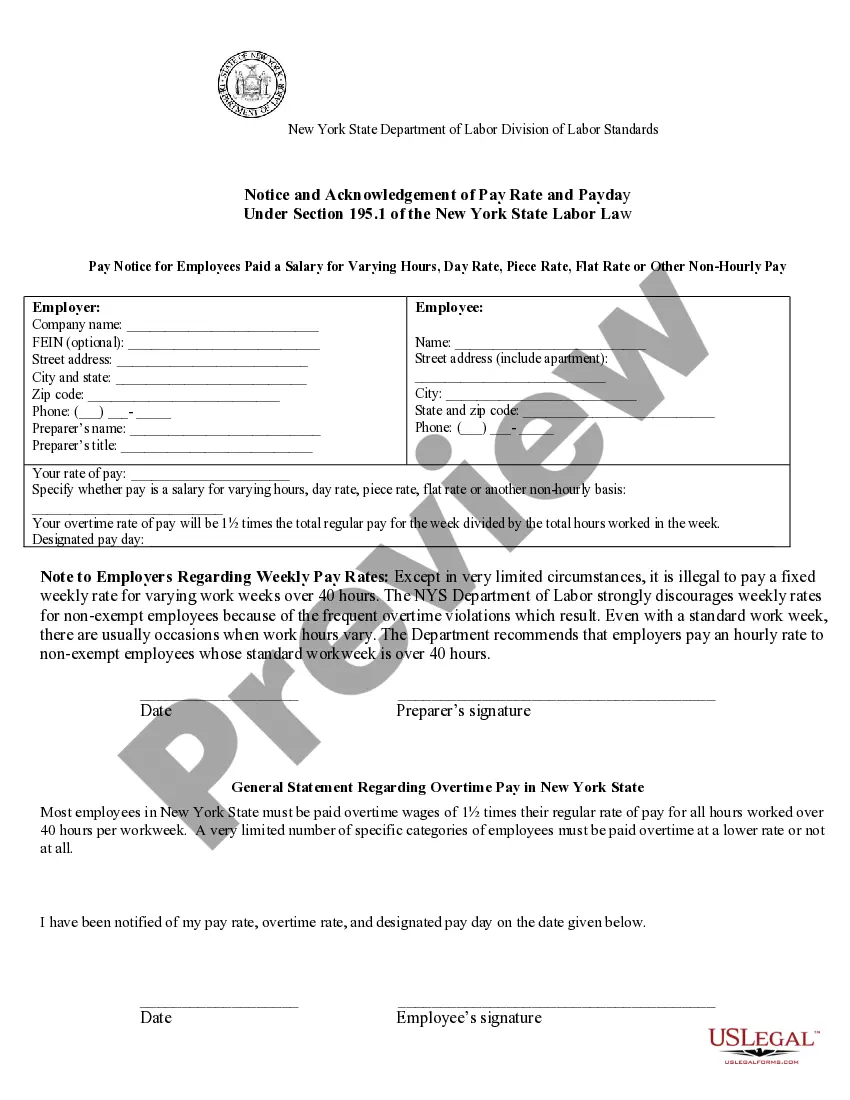

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law.

Section 193, subdivision 1(c), of the New York State Labor Law permits an employer to make deductions from an employee's wages for ?an overpayment of wages where such overpayment is due to a mathematical or other clerical error by the employer.? Such deductions are only permitted as follows: (a) Timing and duration.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

LS 54 Notice for Hourly Rate Employees This form is for hourly employees who are not exempt from coverage under the applicable State and Federal overtime provisions. For example, use for an employee whose regular rate of pay is $10 per hour and overtime rate is $15 per hour.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

More info

Complete and return signed Notice and acknowledgement of pay rate and payday to: (Name) Office of Labor Standards (Telephone Number) (Address) New York State Department of Labor (State Capitol New York, 99 Washington Pl. Albany, NY 12233) and fax your completed NYS Form 59 or your completed New York State Form 66 — Payment by Electronic Mail or Online — to (Address, or Mailing Address) on file. Employment rights by phone are available at. Employment rights by email are available at:, or, or. The State Department of Labor (State Capitol New York, 99 Washington Pl. Albany, NY 12233) has established a toll-free number. If you do not get an answer on your first try, do not be discouraged: You are still in good company, as about one in four callers gets an immediate answer. Employment rights by computer are available through New York State's Job Bank on the Internet at. Employment rights by phone are available by calling.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.