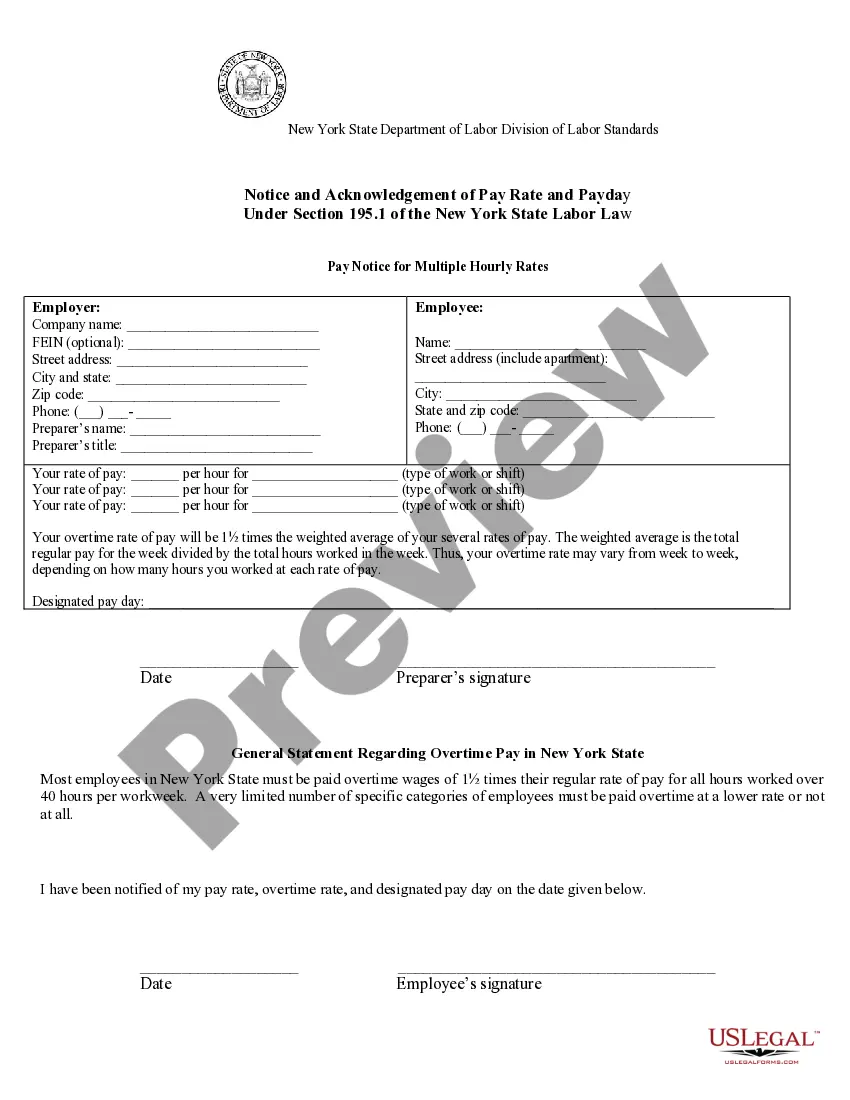

The Bronx New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay is a document that provides employees with important information regarding their pay rate and payday. This notice is crucial for ensuring transparency and adherence to labor laws in the Bronx, New York. The purpose of the Pay Notice is to inform employees about their compensation structure and ensure they are aware of their rights. It helps avoid any confusion or disputes related to their pay and provides clarity on the calculation methods used for varying hours, day rate, piece rate, flat rate, or other non-hourly pay. The Pay Notice and Acknowledgement of Pay Rate and Payday should include the following essential details to comply with Bronx employment regulations: 1. Employee Information: The document should contain the employee's full name, address, job title, and any other relevant identification information. 2. Employer Information: Include the employer's name, address, and contact details. This ensures that the notice is specific to the employee and the employing entity. 3. Pay Rate: The notice must specify the employee's pay rate, whether it's an hourly rate, a day rate, a piece rate, a flat rate, or any other non-hourly basis. This information provides employees with clarity on how their compensation is determined. 4. Payday: The Pay Notice should clearly state the payday frequency and dates on which the employee will receive their compensation. This allows employees to know when they can expect to receive their wages. 5. Calculation Method: If the pay rate fluctuates based on varying hours, piece rates, or other non-hourly methods, the notice should clearly outline the formula or calculation method used to determine the employee's total pay. This ensures transparency and prevents any confusion or misunderstandings. 6. Acknowledgement: The Pay Notice should contain a section for the employee to acknowledge that they have received, reviewed, and understood the information provided in the notice. This acknowledgement serves as evidence that the employee has been informed of their pay rate and payday. Different types of Pay Notices may exist based on the specific compensation structure. For example, there may be separate notices for employees paid a salary with varying hours, employees paid a day rate, employees paid on a piece rate basis, employees on a flat rate, or employees paid using other non-hourly methods. Overall, the Bronx New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate, or Other Non-Hourly Pay is an essential document that ensures compliance with labor laws and promotes transparency in employee compensation.

Bronx New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non-Hourly Pay - Notice And Acknowledgement Of Pay Rate And Payday?

We consistently strive to reduce or avert legal repercussions when managing intricate legal or financial matters.

To achieve this, we enlist legal services that are typically quite costly.

However, not all legal challenges are equally complicated. Many can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you've lost the form, you can always re-download it from the My documents tab. The process is equally simple if you're not acquainted with the platform! You can set up your account in a matter of minutes.

- Our library empowers you to handle your matters autonomously without relying on legal advisors.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, simplifying the search process significantly.

- Leverage US Legal Forms whenever you need to acquire and download the Bronx New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday or other documents swiftly and securely.

Form popularity

FAQ

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Timely Payment The hiring party must pay you for all completed work. You must receive payment on or before the date that is in the contract. If the contract does not include a payment date, the hiring party must pay you within 30 days after you complete the work.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

Work any number of hours in a day: New York employers are not restricted in the number of hours they require employees to work each day. This means that an employer may legally ask an individual to work shifts of 8, 10, 12 or more hours each day.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

An overtime-eligible employee (paid a salary) who regularly works more than 40 hours per week, they are still entitled to overtime pay for hours worked over 40 hours. The number of hours included in the employee's regular workweek only affects the rate of overtime pay.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Interesting Questions

More info

Share your customized files freely with friends and family, send them to work with the pay notice on personal devices. Send your files for editing using the web browser. Upload them directly to Dropbox or FTP, sync them by e-mail, send them to a coworker. Download the pay note for your printer or your mobile, so you can review the document when your printer is not connected to your network. The pay note for your printer is for your use, while the pay note for your mobile is for the use of your coworkers. What is the pay notice for part-time employees? Pay notice for part-time employees The pay notice for part-time employees specifies the work schedule and rates. It is provided upon request from the employer. How can I customize the pay note for my employees? A pay note can be designed to fit the specifications of the company and the employee's needs. For more information, ask your HR representative what kind of note you can upload. How do I change the pay period I am paid on?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.