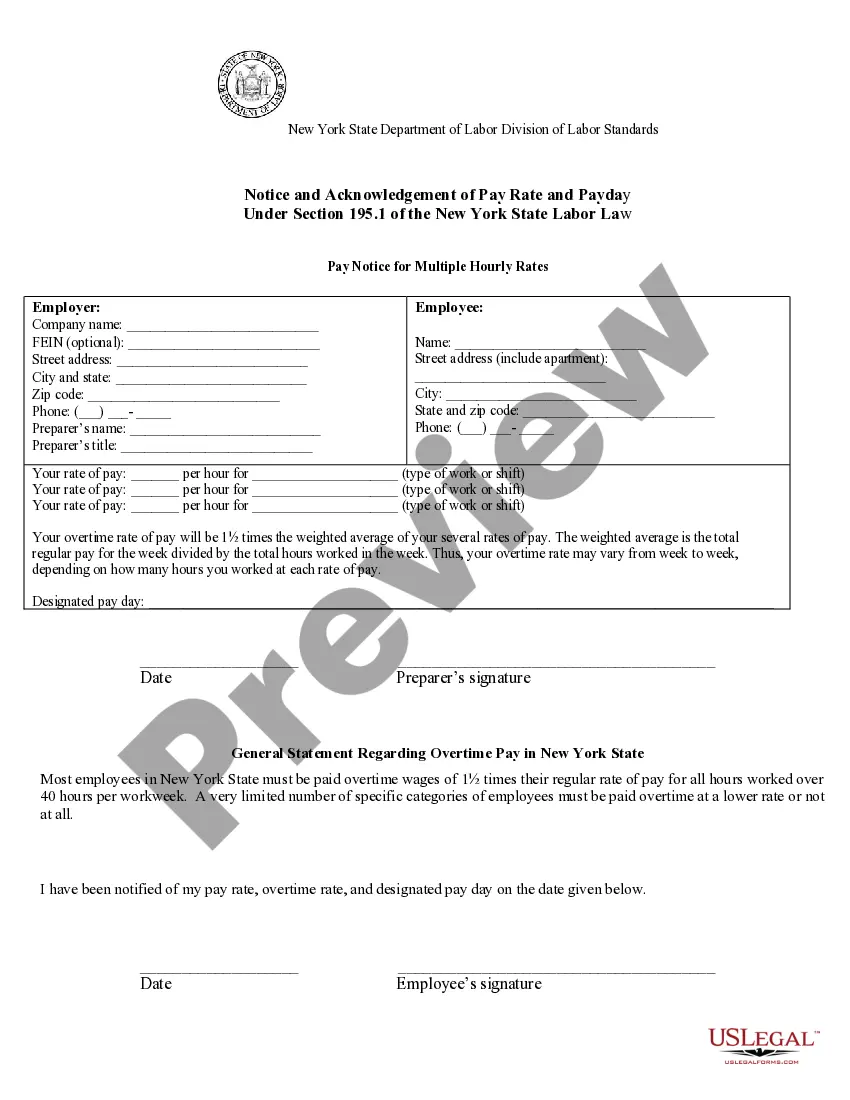

The Kings New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate, or Other Non-Hourly Pay is a crucial document that employers must provide to their employees to ensure transparency and compliance with labor laws. This notice serves as a formal acknowledgment of the employee's pay rate and payday, maintaining an open line of communication between the employer and employee. Different types of pay notices may exist for various compensation structures, including: 1. "Kings New York Pay Notice for Employees Paid a Salary for Varying Hours": This type of pay notice is applicable when employees are paid a salary but work varying hours. For example, employees might have flexible work schedules that are not tied to a specific number of hours per day or week. 2. "Kings New York Pay Notice for Employees Paid a Salary on a Day Rate": This type of pay notice is relevant when employees receive a fixed daily rate as their compensation. This may be common in industries such as construction or freelance work, where projects are completed on a per-day basis. 3. "Kings New York Pay Notice for Employees Paid a Salary on a Piece Rate": This type of pay notice is essential for employees who are paid based on the number of units or pieces they produce or complete. Piece-rate pay structures are typical in manufacturing, agriculture, or any industry where production output is measurable. 4. "Kings New York Pay Notice for Employees Paid a Salary on a Flat Rate": This type of pay notice is applicable when employees are compensated with a fixed amount for completing a specific task or job. This pay structure commonly applies to contractual work or one-time projects. 5. "Kings New York Pay Notice for Employees Paid a Salary on Other Non-Hourly Pay": This is a broad category that covers any other non-typical pay structures not mentioned above. It could encompass unique payment methods such as commission-based pay, profit-sharing, bonuses, or any other form of compensation that is not solely based on hourly wages. Regardless of the type of pay notice, it is crucial for employers to provide clear and concise details about the employee's pay rate and payday. This ensures that both parties have a mutual understanding of the compensation agreement, promoting fairness and compliance in the workplace.

Kings New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non-Hourly Pay - Notice And Acknowledgement Of Pay Rate And Payday?

If you are looking for a suitable form template, it’s hard to find a more user-friendly service than the US Legal Forms site – one of the most extensive online collections.

Here you can discover a vast array of templates for both business and personal use categorized by types and states, or through keywords.

With our premium search tool, obtaining the most current Kings New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday is as simple as 1-2-3.

Obtain the template. Specify the format and save it to your device.

Make modifications. Fill in, edit, print, and sign the acquired Kings New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday.

- If you are already familiar with our platform and possess a registered account, all you have to do to acquire the Kings New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the form you desire. Review its description and utilize the Preview feature (if accessible) to view its content. If it does not satisfy your needs, use the Search bar at the top of the page to find the appropriate document.

- Confirm your selection. Click on the Buy now option. Subsequently, select your preferred pricing plan and provide information to create an account.

- Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

Full-Time Employment ?Full-time? is defined by your employer, but must be at least six hours per day, for a five-day week.

Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

There are no limits on: The number of work hours per day (except for children under 18)

Work any number of hours in a day: New York employers are not restricted in the number of hours they require employees to work each day. This means that an employer may legally ask an individual to work shifts of 8, 10, 12 or more hours each day.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Under this law, there is no maximum number of hours that an employee can legally work in a single workday or workweek. However, for every hour above 40 in a workweek, their employer must pay them 1.5 times their regular rate of pay.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Interesting Questions

More info

See Paychecks, Section 3. • wages paid through a commission payment plan (such as a salary, commission, bonus, interest or other types of pay×. See Overtime Pay, Section 5. • wages paid through a bona fide payroll deduction plan (such as a retirement plan×. See Payroll Deductions, Section 2. • wages paid through an overtime pay arrangement. See Payroll Overtime, Section 2. • wages paid in an extra pay mode that is authorized by the Paycheck Code. See Extra Pay, Section 1. • wages paid in an irregular pay mode. See Unusual×Unusual Pay, Section 3. • wages paid with payment on demand. See Payment on Demand, Section 2. • wages paid in an automatic payroll deduction system (such as a payroll card×. See Automatic Payroll Deductions, Section 2. • wages paid in an overtime pay mode that is unauthorized by the Paycheck Code. See Overtime Pay, Section 1. • overtime pay provided by a private arrangement negotiated directly with an employee or the employer.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.