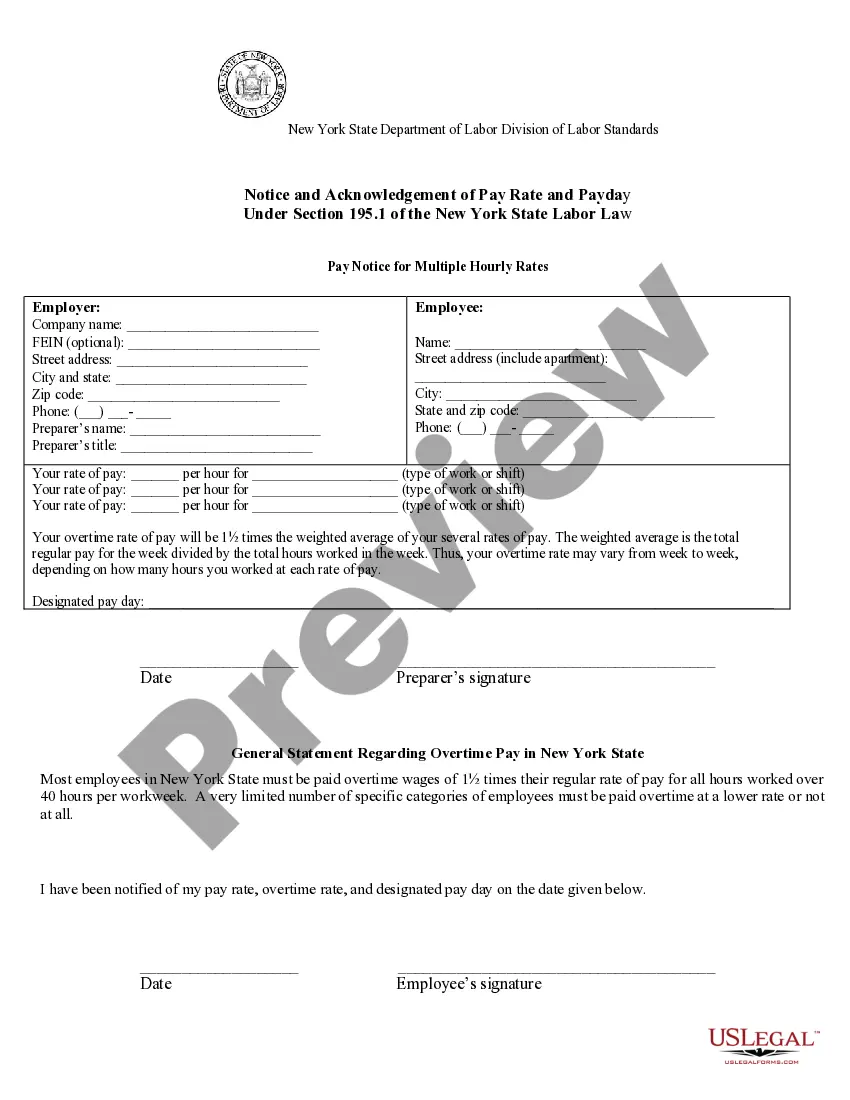

Syracuse New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non-Hourly Pay - Notice And Acknowledgement Of Pay Rate And Payday?

Are you searching for a reliable and cost-effective source of legal forms to obtain the Syracuse New York Pay Notice for Employees Compensated with a Salary for Varied Hours, Daily Rate, Piece Rate, Flat Rate, or Alternative Non-Hourly Compensation - Notification and Acknowledgment of Pay Rate and Pay Day.

US Legal Forms is your preferred option.

Whether you require a straightforward agreement to establish rules for living together with your partner or a set of documents to facilitate your separation or divorce through the court system, we have you covered.

Our platform provides over 85,000 current legal document templates for personal and business use. All the templates we offer are not generic and are tailored based on the needs of particular states and regions.

Review the form’s details (if available) to understand who and what the form is suitable for.

If the form does not fit your specific needs, restart your search.

- To acquire the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it.

- Please note that you can download your previously purchased document templates at any time from the My documents section.

- Are you unfamiliar with our platform? No problem.

- You can set up an account in a few minutes, but before doing so, ensure to complete the following.

- Determine whether the Syracuse New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate, or Other Non-Hourly Compensation - Notification and Acknowledgment of Pay Rate and Pay Day adheres to the regulations of your state and locality.

Form popularity

FAQ

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

For adult employees, there is no legal limit to the number of hours that one can work per week, but the Fair Labor Standards Act dictates standards for overtime pay in both the private and public sector.

Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

Is There a Limit on Working Hours in New York? The New York State Department of Labor does not limit the number of hours employees can work per day. This means employers may legally ask their employees to work shifts of eight, ten, twelve, or more hours each day.

There are no limits on: The number of work hours per day (except for children under 18)

Section 161. One day rest in seven.

Under this law, there is no maximum number of hours that an employee can legally work in a single workday or workweek. However, for every hour above 40 in a workweek, their employer must pay them 1.5 times their regular rate of pay.

Work any number of hours in a day: New York employers are not restricted in the number of hours they require employees to work each day. This means that an employer may legally ask an individual to work shifts of 8, 10, 12 or more hours each day.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)