Queens, New York has specific guidelines in place regarding the written notice of rates of pay and regular payday for employees. It is important for employers to comply with these guidelines to ensure fair and lawful employment practices. The following description provides detailed information about the Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday, as well as different types if applicable. 1. Written Notice of Rates of Pay: Employers in Queens, New York are required to provide written notice to their employees regarding their rates of pay. This notice must be provided at the time of hire or within ten days of the start of employment. The notice should include all relevant details, such as the employee's hourly or salary rate, any overtime rates, and the basis of pay (usually weekly, biweekly, or monthly). Furthermore, the written notice should specify the regular payday for the employee. This ensures that workers are aware of when they can expect to receive their wages. 2. Regular Payday: The regular payday is the predetermined day on which employees should receive their wages. Queens New York Guidelines state that employers must establish a consistent payday schedule and inform their employees about it. This helps maintain transparency and prevents any ambiguity or confusion regarding payment dates. Employers are required to pay wages earned within seven days of the end of the designated pay period, as mandated by the New York State Labor Law. This timely payment is crucial to ensure employees receive their earnings promptly. 3. Types of Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday (if applicable): In Queens, New York, there are no specific types or variations of guidelines for written notice of rates of pay and regular payday. However, it is essential for employers to understand that these guidelines are applicable to all industries and sectors operating in the borough. Regardless of the job type or industry, employers must adhere to the Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday. These guidelines are in place to protect employees' rights and promote equitable compensation practices. In conclusion, employers in Queens, New York must provide written notice of rates of pay and establish a regular payday schedule for their employees. Adhering to these guidelines ensures proper communication of wages and timely payment, fostering a fair work environment. Compliance with these regulations is essential for employers in Queens, New York to uphold lawful employment practices.

Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday

Description

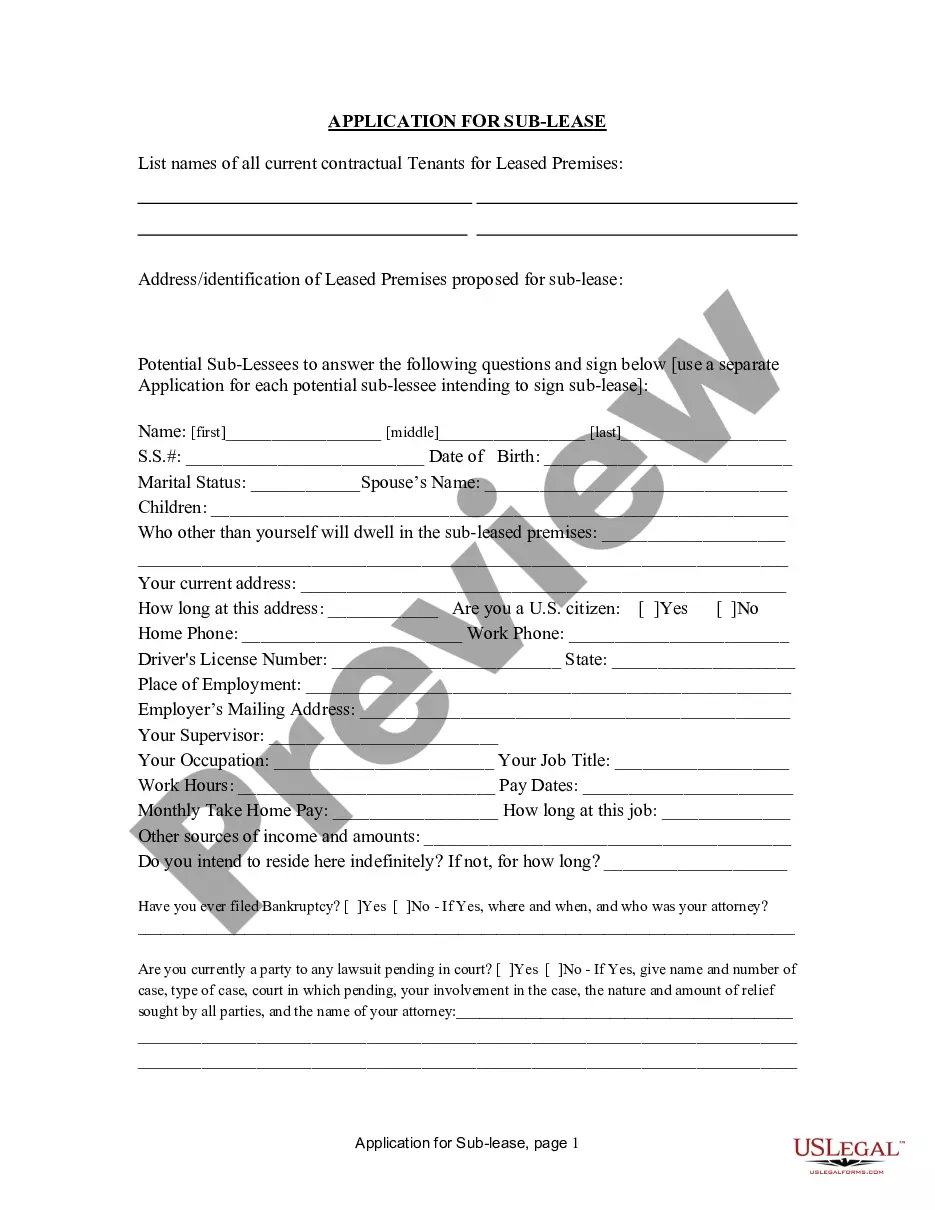

How to fill out Queens New York Guidelines For Written Notice Of Rates Of Pay And Regular Payday?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Queens New York Guidelines for Written Notice of Rates of Pay and Regular Payday. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!