The guidelines for written notice of rates of pay and regular payday in Rochester, New York are essential for ensuring fair and transparent employment practices. Employers in Rochester must follow specific guidelines and regulations when it comes to notifying their employees about their wages and payday. These guidelines aim to protect both employers and employees by establishing clear communication and promoting accountability in the workplace. 1. Rochester New York Guidelines for Rates of Pay: — Employers in Rochester must provide written notice to each employee containing specific information about their rate of pay. — The notice should include the regular hourly rate, the overtime rate (if applicable), and any other compensation such as bonuses or commissions that the employee is entitled to receive. — This notice should be given at the time of hiring or within 10 business days after any changes in the rate of pay occur. — Employers should keep a copy of the notice for their records and ensure their employees receive a copy as well. 2. Rochester New York Guidelines for Regular Payday: — Employers in Rochester must establish a regular payday for their employees, which cannot be longer than 16 days apart. — The regular payday should be consistent and agreed upon by both the employer and employee. — Employees must be notified in writing of their regular payday at the time of hiring. — If there are any changes in the regular payday, employers must provide a written notice to employees at least seven calendar days in advance of the change. Employers in Rochester need to adhere to these guidelines to maintain compliance with local labor laws. Failing to provide the required written notice of rates of pay and regular payday can result in legal consequences. It is crucial for employers in Rochester to understand the importance of maintaining accurate and updated records of employee rates of pay and regular payday. These guidelines foster transparency in the workplace, ensuring that employees are aware of their compensation and payday schedule. By following these guidelines, employers can demonstrate responsible and fair employment practices while promoting a positive working environment. In conclusion, the Rochester New York guidelines for written notice of rates of pay and regular payday are crucial for maintaining fairness and transparency in the workplace. Employers must provide written notice of rates of pay to employees, including all compensation details, at the time of hiring or when changes occur. They must also establish a regular payday that is consistent and communicated to employees. Compliance with these guidelines ensures harmonious and equitable relationships between employers and employees in Rochester, New York.

Rochester New York Guidelines for Written Notice of Rates of Pay and Regular Payday

Description

How to fill out Rochester New York Guidelines For Written Notice Of Rates Of Pay And Regular Payday?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

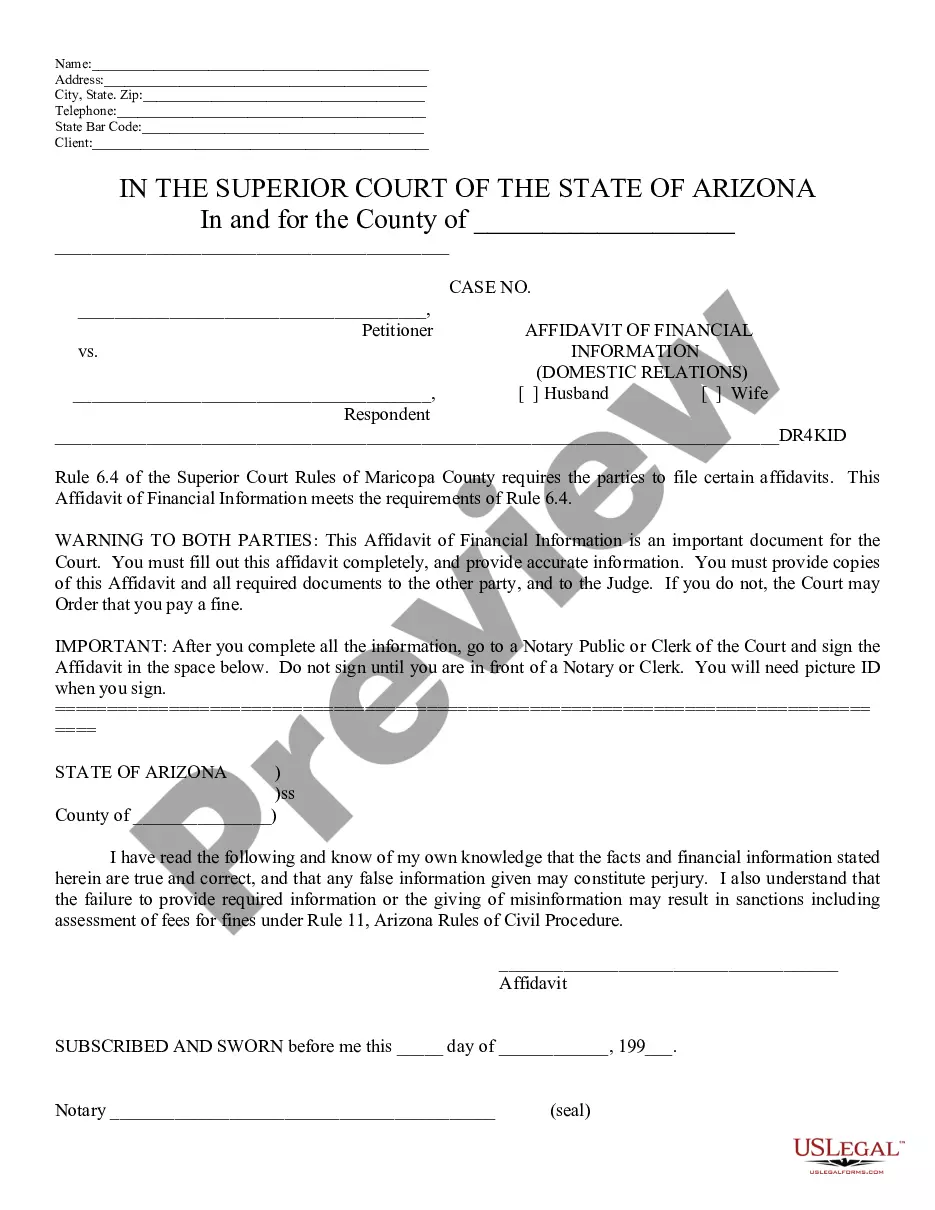

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Rochester New York Guidelines for Written Notice of Rates of Pay and Regular Payday or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Rochester New York Guidelines for Written Notice of Rates of Pay and Regular Payday adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Rochester New York Guidelines for Written Notice of Rates of Pay and Regular Payday is proper for you, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!