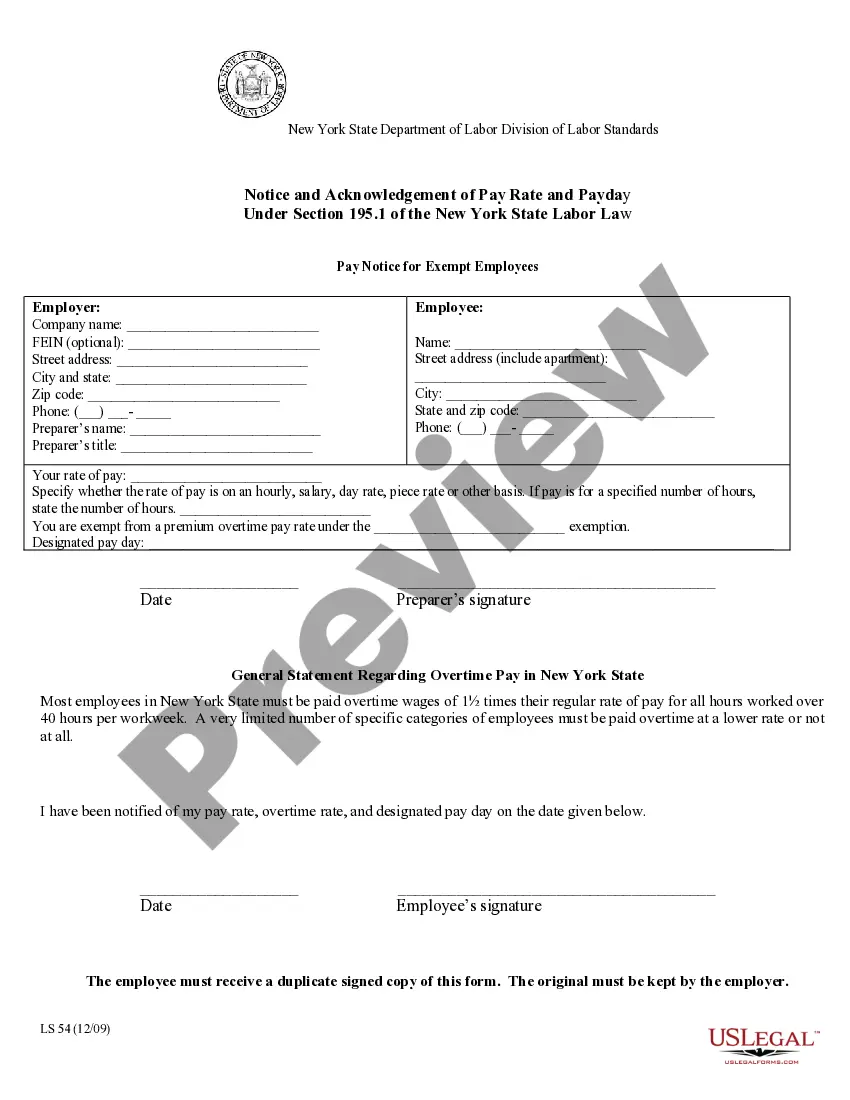

Kings New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Exempt Employees - Notice And Acknowledgement Of Pay Rate And Payday?

Regardless of social or professional rank, filling out law-related documents is a regrettable requirement in contemporary society.

Often, it’s nearly impossible for anyone lacking legal training to create these kinds of documents from the beginning, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms proves useful.

Make certain that the template you have selected is valid for your locality, as the laws of one state or county do not apply to another.

Review the document and read a brief overview (if available) of the situations for which the paper can be applied.

- Our platform offers an extensive catalog of more than 85,000 state-specific forms suitable for virtually any legal matter.

- US Legal Forms is also a fantastic asset for associates or legal advisors who aim to conserve time by using our DIY papers.

- Regardless of whether you need the Kings New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday or any other document pertinent to your state or county, US Legal Forms has everything readily available.

- Here’s how to obtain the Kings New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday in a matter of minutes using our dependable platform.

- If you are currently a member, you may proceed to Log In to your account to access the suitable form.

- However, if you are new to our platform, please ensure you follow these steps before retrieving the Kings New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday.

Form popularity

FAQ

To file a claim, you will need to complete a form to claim unpaid wages, wage supplements, minimum wage/overtime and various non-wage items, if your situation meets the criteria below. Unpaid Wages: Your employer did not pay you for all hours worked (including on-the-job training).

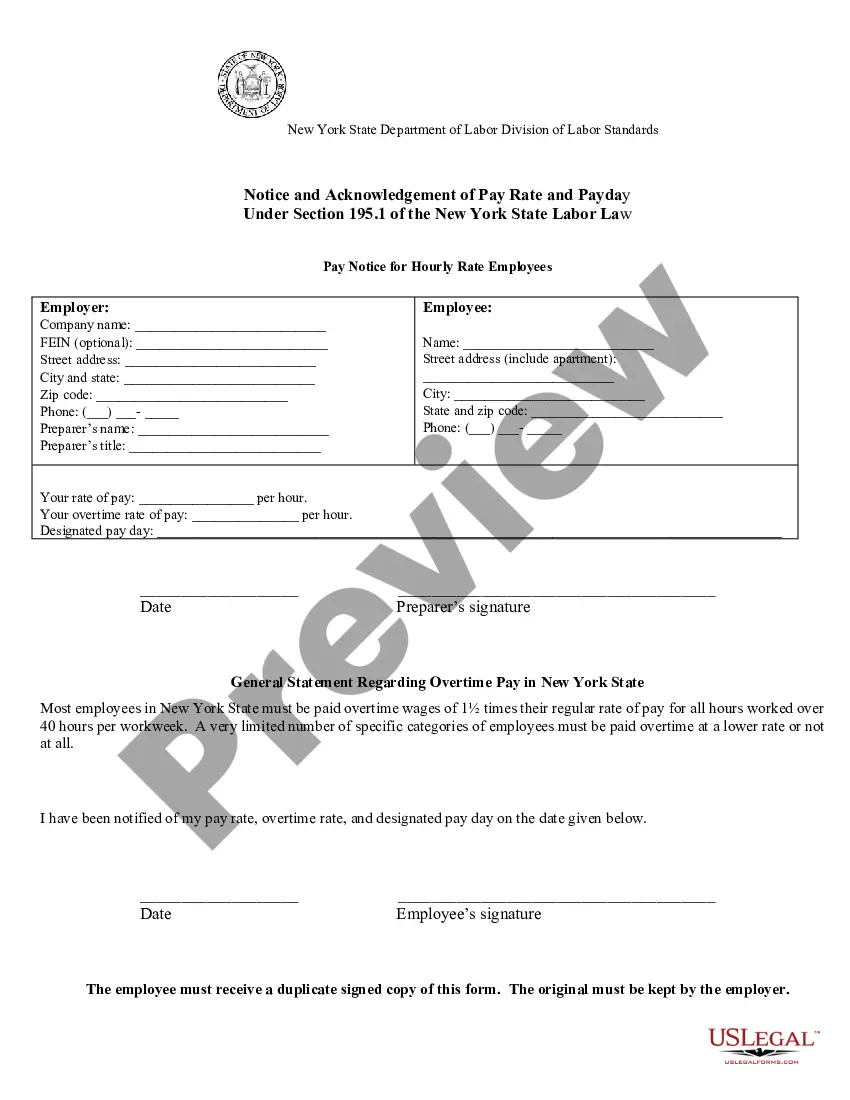

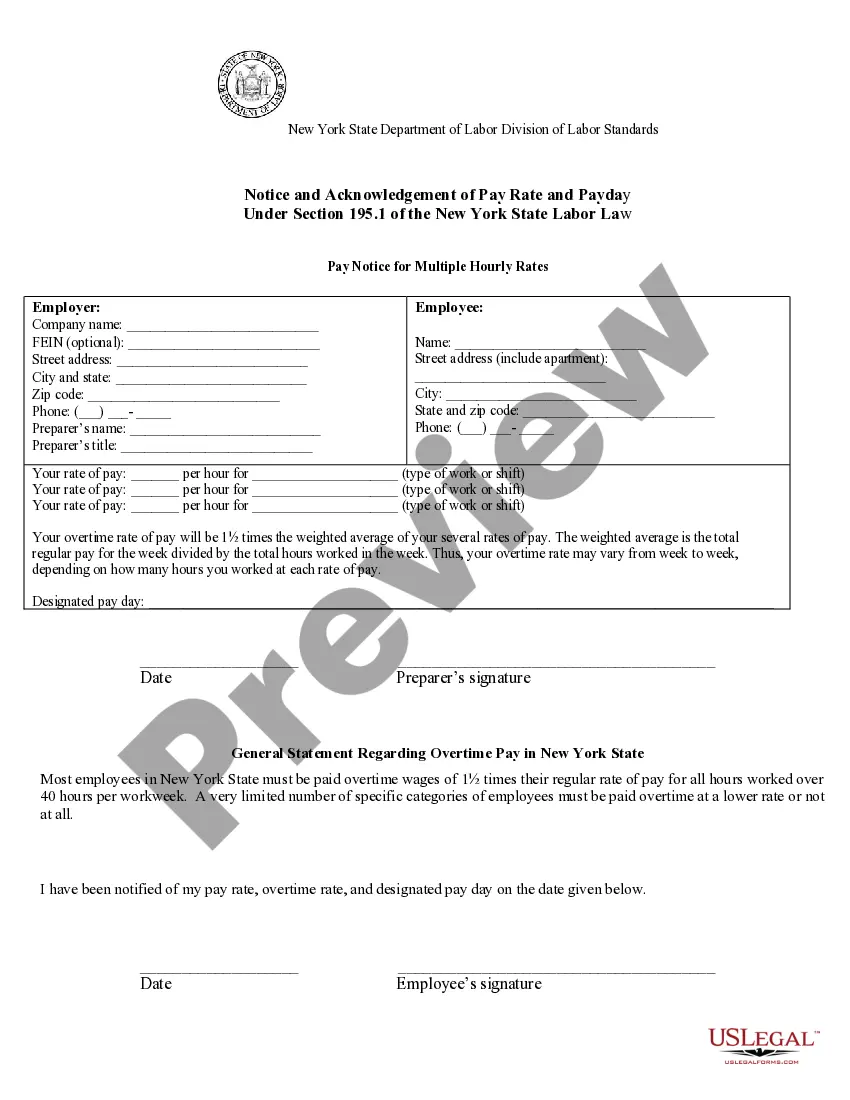

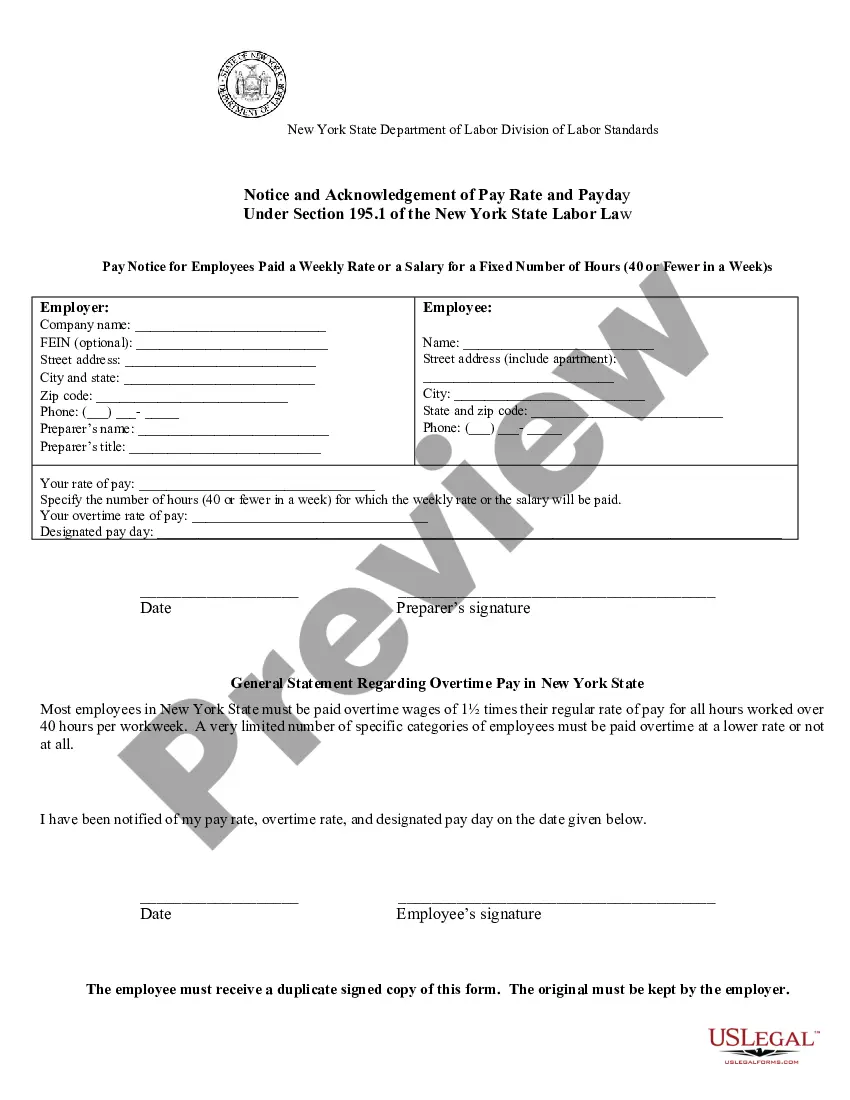

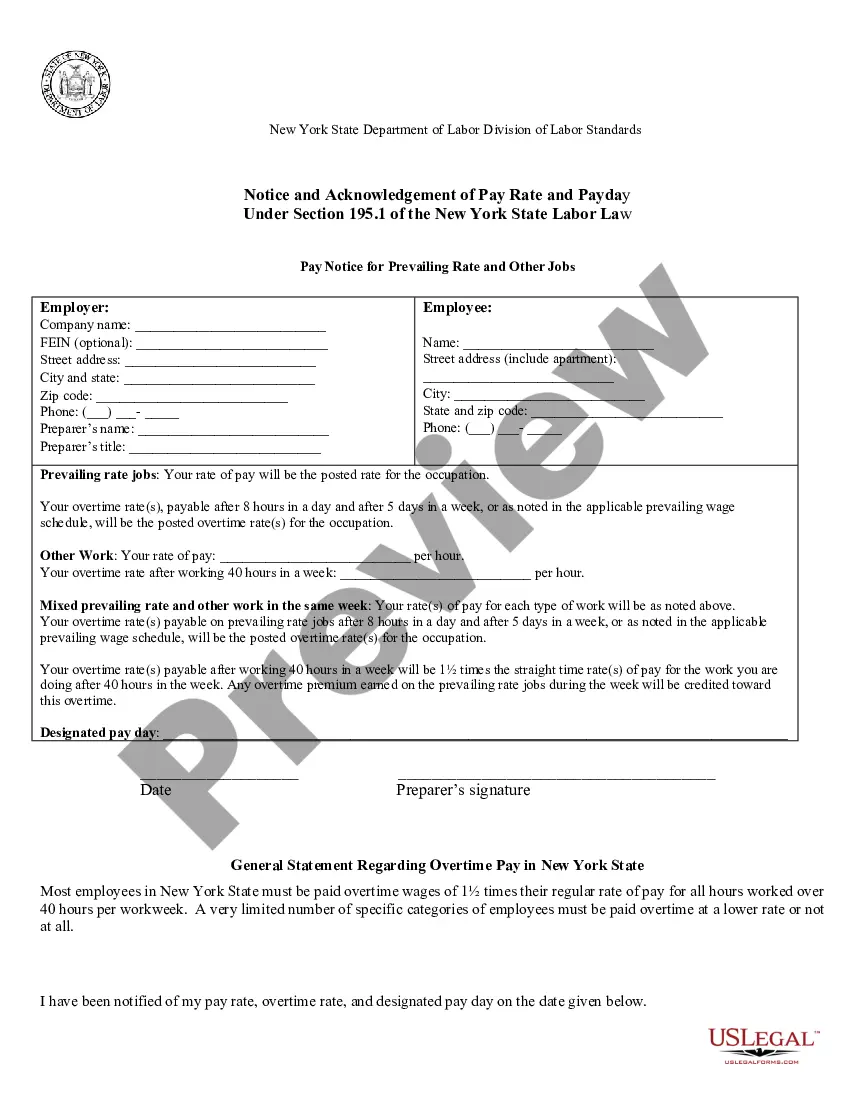

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

Labor Law Section 191 outlines the frequency by which employees must be paid. Manual Workers: Wages must be paid weekly and not later than seven calendar days after the end of the week in which the wages are earned.

Employers must pay their employees within seven days of their particular pay period, whether it is on a weekly or biweekly basis. While some exceptions exist, most employers cannot engage in untimely wage payments. Unfortunately, many New York employers do not pay their employees on time.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)