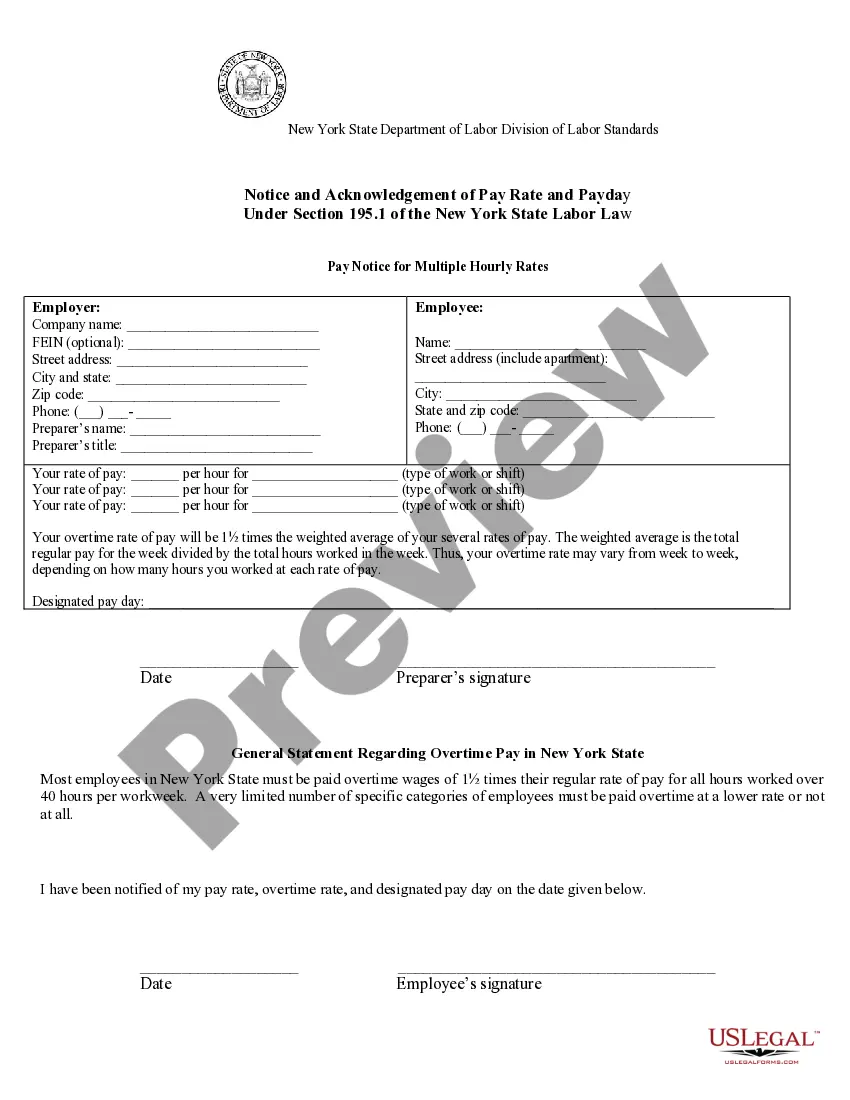

Yonkers New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Exempt Employees - Notice And Acknowledgement Of Pay Rate And Payday?

Finding authenticated templates that are tailored to your state regulations can be difficult unless you utilize the US Legal Forms database.

This platform offers an extensive collection of over 85,000 legal documents suitable for personal and professional use in various real-world situations.

All materials are systematically categorized by field of application and jurisdiction, making it simple to find the Yonkers New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday as straightforward as 1-2-3.

Maintaining organized documents that adhere to legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any needs!

- Review the Preview mode and form description.

- Ensure you have chosen the accurate document that aligns with your requirements and fully complies with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If any discrepancies arise, use the Search tab above to find the appropriate one. If it's a match, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

New York employers who make an untimely wage payment may do so in violation of state and federal laws. Employers must pay their employees within seven days of their particular pay period, whether it is on a weekly or biweekly basis.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Employers are not required by federal law to give a former employee his or her final paycheck immediately. Also, an employer is not required to pay an exempt employee his or her full salary in the terminal week of employment.

Non-payment of wages is against the law under the Employment Rights Act 1966. If you delay payment, your staff could take you to court for breach of contract. Alternatively, you may face an employment tribunal for unlawful deduction of wages, and face a pay-out of up to £25,000.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

The State of New York requires that employers tell their employees what their compensation will be in plain terms. The compensation could be paid out hourly, daily, weekly, or monthly. If the salary is paid weekly, then the employer should clearly explain to the employee the number of hours covered by the weekly rate.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.