Syracuse Report and Account to Settle Small Estate in New York

Description

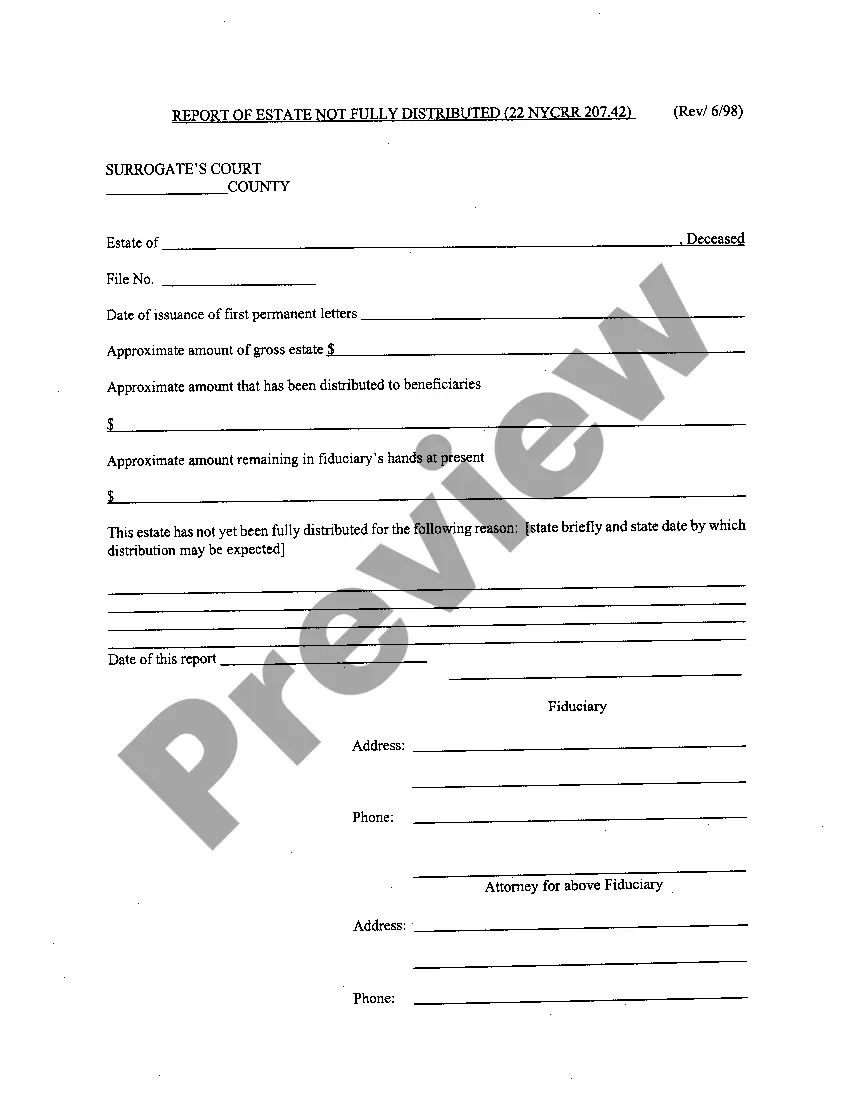

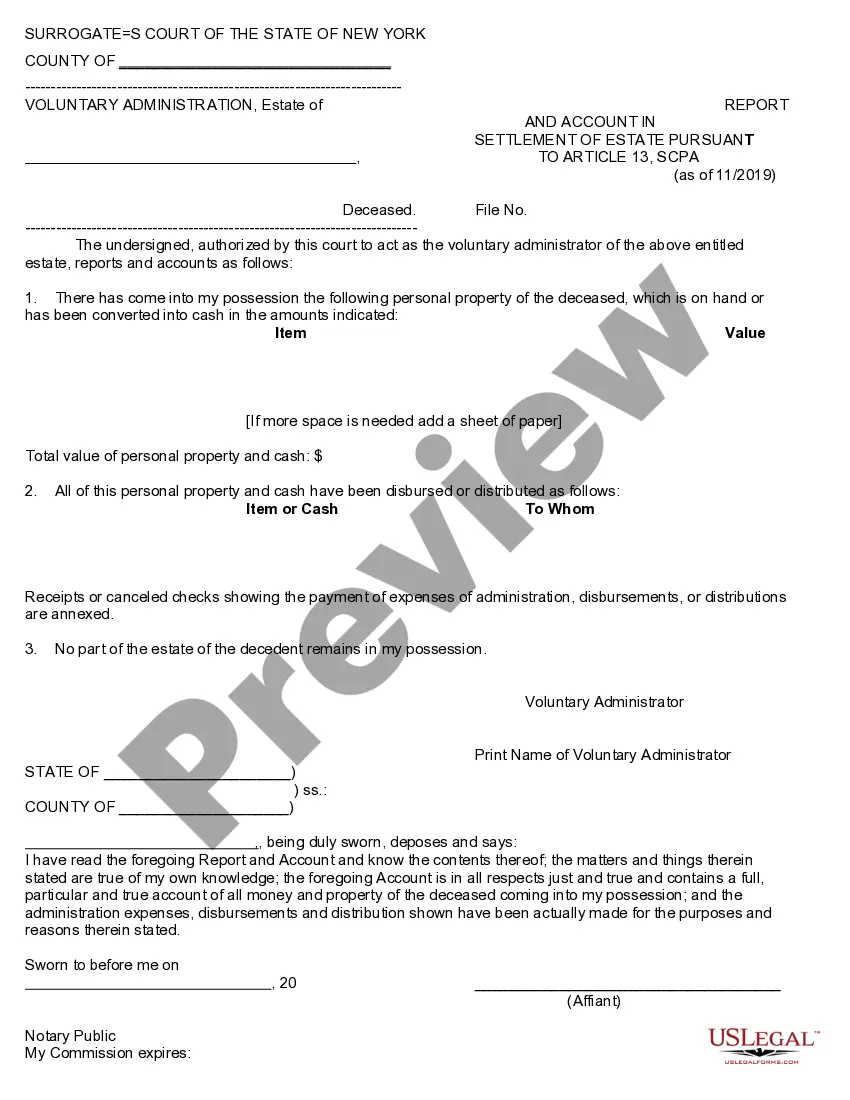

How to fill out Report And Account To Settle Small Estate In New York?

We consistently seek to diminish or avert legal complications when handling intricate legal or financial issues.

To achieve this, we enroll in legal services that are often quite costly.

However, not every legal situation is equally intricate; the majority can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. Should you lose the document, you can always re-download it in the My documents section. The procedure is just as simple if you are new to the website! You can set up your account in a few minutes. Ensure that the Syracuse Report and Account to Settle Small Estate in New York conforms to the laws and regulations of your state and locality. Furthermore, it is essential to review the form’s outline (if available), and if you find any inconsistencies with your original requirements, look for an alternative template. Once you confirm that the Syracuse Report and Account to Settle Small Estate in New York is suitable for your situation, you can select your subscription choice and process your payment. Then, you can download the document in any of the available formats. Over our 24-year existence, we’ve assisted millions by providing customizable and current legal forms. Leverage US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your issues independently without requiring a lawyer's assistance.

- We provide access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Syracuse Report and Account to Settle Small Estate in New York or any other document safely and easily.

Form popularity

FAQ

In New York, the amount for a small estate affidavit is limited to $50,000 for personal property. This affidavit allows heirs to collect assets without formal probate proceedings. It is essential to follow the correct procedures to ensure a smooth process. By leveraging the Syracuse Report and Account to Settle Small Estate in New York, you can efficiently manage the requirements of the small estate affidavit.

New York has specific rules that govern small estates, allowing for a simplified procedure for estates valued under a certain threshold, currently set at $50,000 in personal property. This process generally involves filing a small estate affidavit rather than going through full probate. It simplifies the settling of estates, making it easier for heirs to access funds quickly. Using the Syracuse Report and Account to Settle Small Estate in New York can facilitate navigation through these rules.

In New York, the time an executor takes to settle an estate can vary depending on the complexity of the estate. Generally, it may take a few months to over a year to complete the process. Factors such as the need for appraisals, creditor claims, and the distribution of assets can impact the timeline. Utilizing the Syracuse Report and Account to Settle Small Estate in New York can help streamline this process and ensure timely closure.

Filling out a small estate affidavit form involves providing details about the deceased, their assets, and beneficiaries. The form requires straightforward information, ensuring clarity in the affidavit. When utilizing the Syracuse Report and Account to Settle Small Estate in New York, you gain access to helpful resources and templates that guide you through the completion process. This ensures your affidavit is accurate and complies with state requirements.

In New York, estates valued at over $50,000 must typically go through probate. However, if the estate qualifies as a small estate, you can avoid probate altogether. The Syracuse Report and Account to Settle Small Estate in New York is beneficial for estates below this threshold, simplifying the transfer of assets without the need for lengthy legal processes. Always evaluate the estate's value to determine the necessary steps.

Yes, New York has IRS Form 1310, which is used when filing a tax return for a deceased person. This form helps claim a refund if the deceased had withheld taxes during their lifetime. If you're managing the estate, understanding the intricacies of taxes is essential. Ensure you have the necessary documents, including the Syracuse Report and Account to Settle Small Estate in New York, to streamline the tax process.

In New York, a small estate affidavit does not require filing with the court unless specifically requested. Instead, you present the affidavit directly to the financial institutions or other entities holding the estate's assets. Utilizing the Syracuse Report and Account to Settle Small Estate in New York can ease this process. It allows you to collect and distribute assets efficiently without extensive legal hurdles.

To settle an estate in New York, start by determining whether probate is necessary. If the estate qualifies as a small estate, you may use the Syracuse Report and Account to Settle Small Estate in New York. This process simplifies settling the estate, enabling you to pass assets to beneficiaries without lengthy court proceedings. Always consider seeking guidance from professionals to ensure compliance with local laws.

In Georgia, the limit for a small estate affidavit is set at $10,000 in net worth, excluding certain assets. This limit allows individuals to settle estates more easily without lengthy probate processes. If you're dealing with a small estate in New York, remember that different states have different limits, but services like USLegalForms can help you navigate these differences, especially for the Syracuse Report and Account to Settle Small Estate in New York.

Yes, there is a time limit to settle an estate in New York, though it can vary depending on the circumstances surrounding the estate. Generally, executors are expected to distribute estates promptly while adhering to New York laws. By using tools like USLegalForms, you can facilitate the prompt completion of the Syracuse Report and Account to Settle Small Estate in New York, helping you meet any deadlines.