Title: Understanding the Kings New York Spousal Support Only Income Withholding Order Introduction: The Kings New York Spousal Support Only Income Withholding Order (SHOW) is a legal mechanism in the state of New York that ensures the timely and accurate payment of spousal support. SHOW is designed to enforce spousal support payments by withholding income directly from the paying spouse's wages, ensuring regular and consistent payment to the recipient spouse. Types of Kings New York Spousal Support Only Income Withholding Orders: 1. Temporary SHOW: A temporary SHOW is initiated during the pendency of a divorce or separation proceeding and remains effective until a final determination regarding spousal support is made. 2. Final SHOW: Once the final determination on spousal support is made, a final SHOW is issued, detailing the long-term obligations of the paying spouse in terms of support payments. Key Features and Requirements: 1. Withholding Income: The SHOW authorizes the New York State Support Collection Unit (SCU) to deduct the specified amount of spousal support directly from the paying spouse's income. 2. Income Sources: SHOW applies to all employers, including self-employed individuals, who pay income to the obliged spouse, ensuring consistent and regular payment collection. 3. Duration: A Kings New York SHOW remains in effect from the date of issuance until the spousal support obligation is fully satisfied as determined by the court or until an alternative agreement is reached. 4. Income Withholding Limits: The total amount withheld from the obliged spouse's income cannot exceed the maximum percentage allowed by federal and state law. The specific withholding percentage depends on factors such as the number of dependents and other existing support obligations. 5. Notification and Compliance: The employer receives an official copy of the SHOW, mandating compliance with the income withholding order and timely remittance of withheld payments to the SCU. 6. Modification and Termination: Either party can seek to modify or terminate the SHOW by filing a motion with the court, providing evidence of significant changes in financial circumstances or other relevant factors. Benefits of Kings New York SHOW: 1. Efficiency: SHOW eliminates the need for direct payment exchanges between spouses and ensures a streamlined process by directly deducting the support amount from the paying spouse's income. 2. Enhanced Collection: By involving the SCU, compliance rates for spousal support payments are generally higher, reducing the risk of delinquency or non-payment. 3. Accountability and Documentation: SHOW creates a reliable paper trail of income withholding and payment transactions, providing transparency for both parties and facilitating dispute resolution if necessary. Conclusion: The Kings New York Spousal Support Only Income Withholding Order is an effective tool to enforce spousal support obligations. It aims to maintain financial stability for the recipient spouse by facilitating regular, consistent, and hassle-free payments. Understanding the different types and features of SHOW is crucial for individuals involved in spousal support cases in Kings County, New York.

Kings New York Spousal Support Only Income Withholding Order (LDSS-5038)

Description

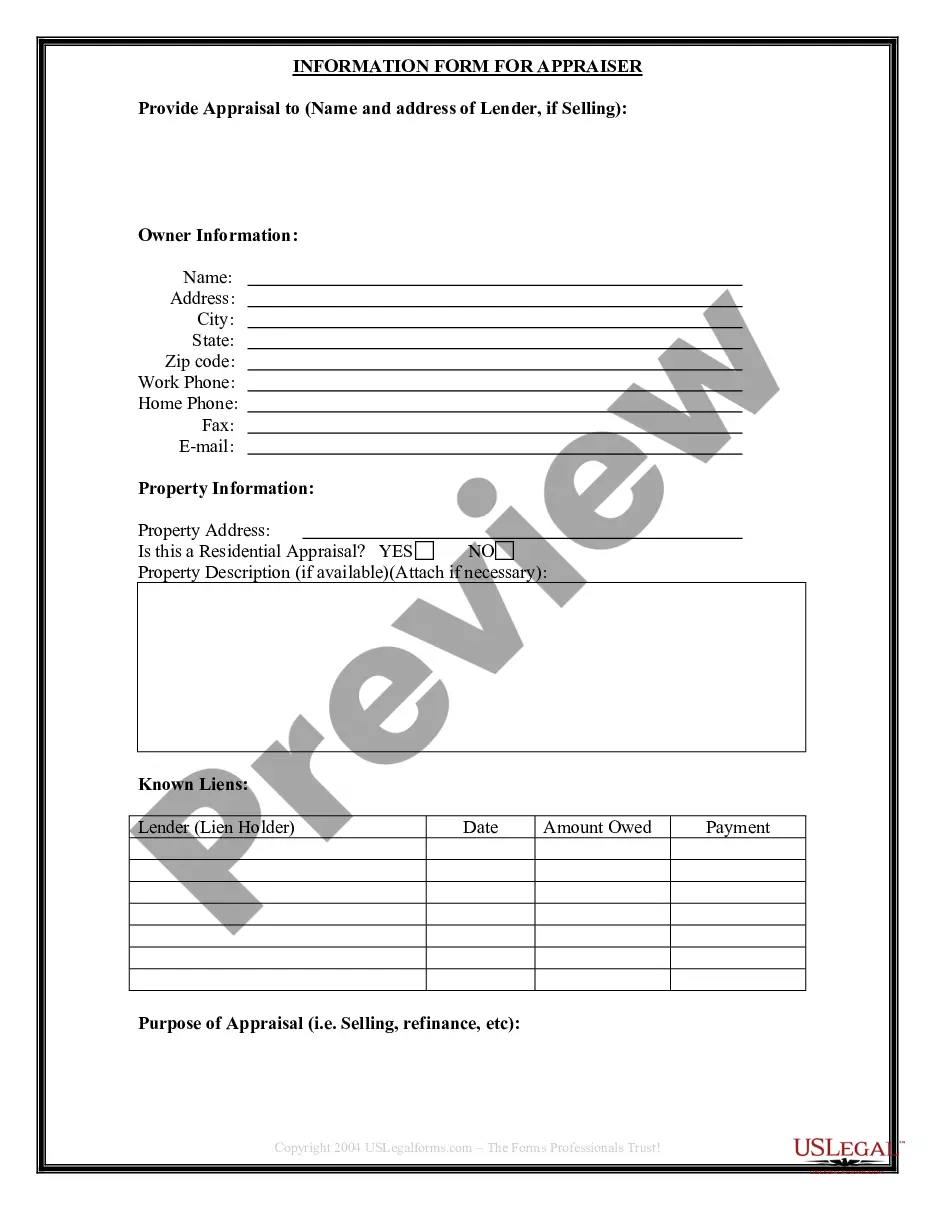

How to fill out Kings New York Spousal Support Only Income Withholding Order (LDSS-5038)?

Make use of the US Legal Forms and obtain instant access to any form sample you want. Our helpful platform with a huge number of documents makes it easy to find and get almost any document sample you need. You can save, complete, and sign the Kings New York Spousal Support Only Income Withholding Order in a few minutes instead of browsing the web for hours looking for an appropriate template.

Utilizing our library is a great strategy to raise the safety of your record filing. Our experienced attorneys on a regular basis review all the documents to make certain that the templates are appropriate for a particular region and compliant with new acts and regulations.

How can you get the Kings New York Spousal Support Only Income Withholding Order? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Find the form you need. Make sure that it is the form you were hoping to find: verify its title and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the file. Indicate the format to get the Kings New York Spousal Support Only Income Withholding Order and revise and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable form libraries on the internet. We are always happy to help you in any legal procedure, even if it is just downloading the Kings New York Spousal Support Only Income Withholding Order.

Feel free to benefit from our service and make your document experience as straightforward as possible!

Form popularity

FAQ

What factors will the judge consider when deciding whether to award alimony? ability to pay support; age; employment history and job potential; income history and income potential; education and training; retirement provisions and health insurance benefits; tax consequences for the sale of your marital property or home;

Alimony can be avoided if the husband remarries and has to take care of his second wife. 6. Alimony can be avoided if the husband is disabled and unable to earn a living. On the contrary, the wife can be asked to pay alimony by the court.

10 Factors That Affect Your Alimony Payments Standard of Living.Time Married.Condition of Both Parties.Financial Resources.Professional Capacity.Individual Contributions to the Marriage.Future Parenting Responsibilities.Tax Implications.

The General Rule for When There Will be a Maintenance (Alimony) Order in New York. One thing is that if the lower earning spouse's income ? if it's lower than 2/3rds of the higher-earning spouse's income ? there is probably going to be a maintenance order.

In each case, a judge must consider several factors to determine if spousal support should be paid, including: The financial means, needs and circumstances of both spouses; The length of time the spouses have lived together; The roles of each spouse during their marriage;

In evaluating ?reasonableness,? the court will usually review the current income of the supporting spouse. Generally speaking, a judge is more likely to award alimony that maintains the couple's standard of living if the supporting spouse would be able to afford it and if they are a high-income earner.

The guideline states that the paying spouse's support be presumptively 40% of his or her net monthly income, reduced by one-half of the receiving spouse's net monthly income. If child support is an issue, spousal support is calculated after child support is calculated.

Prove your spouse is cohabiting with someone else: If you can prove that your spouse is living with someone else, you may be able to get out of paying spousal support altogether. Likewise, if you can show that your spouse can earn a reasonable living, you may be able to have your alimony payments reduced or eliminated.

The court adds the income of both parents together. Second, the court multiplies the combined income by a percentage: 17% for one child. 25% for two children.

Interesting Questions

More info

This packet should only be used if there is an existing Hillsborough. If the form you need is fillable, you will be able to fill and print it out. DIRECTIONS FOR IN-DEPTH ISSUES. It is an important rule for everyone to follow. Children's legal protection is one key to their happiness. Children should, within reason, be able to exercise their right to independence and freedom, and should be protected from exploitation. The child, by necessity, always has a parent and a guardian to aid in the upbringing and protection of any person. This packet lists various options which may help protect a child from being exploited. This information is designed to guide you in determining who is the best potential guardian and which family system is best suited to take care of a child's needs. Child custody and visitation decisions are frequently final, in both state and federal court.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.