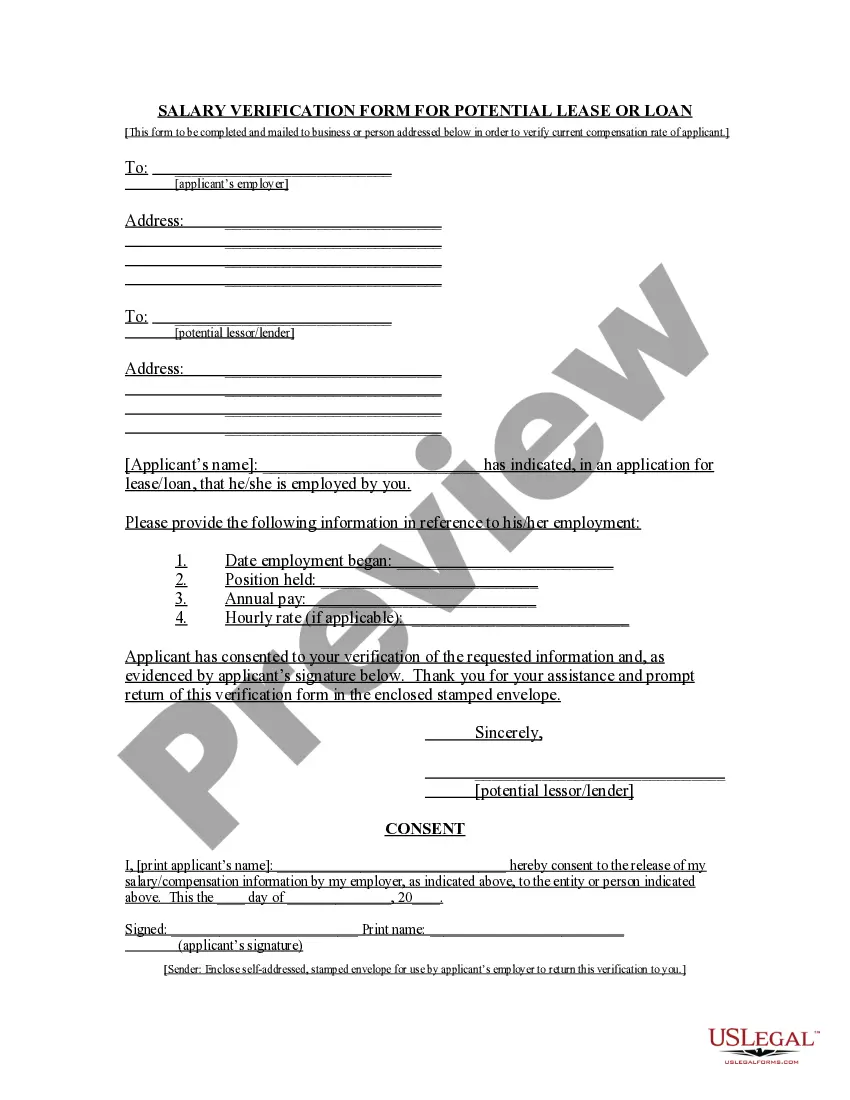

Kings New York General Information and Instructions for Income Withholding for Support is a comprehensive resource that provides essential information and guidelines for employers and individuals involved in income withholding for support in Kings County, New York. Income withholding for support refers to the process of deducting a portion of an individual's income to fulfill their child or spousal support obligations. This document serves as a detailed guide, addressing various aspects related to income withholding for support in Kings County. It covers topics such as the legal framework, responsibilities of employers, and procedures to ensure seamless execution of income withholding orders. The content emphasizes the importance of compliance with state and federal laws, aiming to create a fair and efficient system for support enforcement. The main types of Kings New York General Information and Instructions for Income Withholding for Support include: 1. Employers' Responsibilities: This section outlines the role and obligations of employers when it comes to income withholding for support. It explains the steps employers need to take upon receiving an income withholding order, including verifying the legitimacy of the order, calculating the correct amount to withhold, and specifying the frequency of payments. It also highlights the potential penalties for non-compliance. 2. Income Withholding Procedure: This part details the step-by-step process of income withholding for support in Kings County. It covers actions to be taken by both custodial and noncustodial parents, including the filing of support petitions, court orders, and subsequent notifications to employers. The content emphasizes the importance of timely communication and cooperation to ensure accurate and consistent support payments. 3. Exemptions and Limits: This section addresses various exemptions and limitations associated with income withholding for support. It explains situations where withholding may not be applicable or where the amount withheld may be subject to certain limits, such as caps on the percentage of income that can be withheld. 4. Recipient Information: This subsection provides guidelines for individuals receiving support payments. It includes instructions on setting up direct deposit and keeping their contact information up-to-date, enabling efficient disbursement of funds. 5. Additional Resources: Kings New York General Information and Instructions for Income Withholding for Support also provides links and contact information for additional resources. These resources may include legal aid organizations, support enforcement agencies, and online platforms that offer guidance and assistance to individuals involved in income withholding for support. Overall, Kings New York General Information and Instructions for Income Withholding for Support offers a comprehensive overview of income withholding procedures and guidelines in Kings County. This resource serves to ensure that all parties involved are well-informed, enabling the smooth implementation of income withholding orders and the consistent provision of child and spousal support.

Kings New York Income Withholding For Support: General Information and Instructions (LDSS-5039)

Description

How to fill out Kings New York Income Withholding For Support: General Information And Instructions (LDSS-5039)?

Do you need a trustworthy and affordable legal forms provider to get the Kings New York General Information and Instructions for Income Withholding for Support ? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Kings New York General Information and Instructions for Income Withholding for Support conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the document is good for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Kings New York General Information and Instructions for Income Withholding for Support in any available format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal papers online once and for all.

Form popularity

FAQ

According to the New York Civil Practice Law and Rules (CPLR) section 5241 and the Consumer Credit Protection Act (CCPA), the maximum amount that can be withheld for child support is between 50% - 65% of your disposable earnings, depending on your situation.

New York City Tax (NYC1) is a resident tax. If an employee lives in NYC and works anywhere, then the employer must withhold the NYC resident tax, which is remitted with the state income tax.

The withholding limits set by the federal CCPA are: 50 percent - Supports a second family with no arrearage or less than 12 weeks in arrears. 55 percent - Supports a second family and more than 12 weeks in arrears.

According to the New York Civil Practice Law and Rules (CPLR) section 5241 and the Consumer Credit Protection Act (CCPA), the maximum amount that can be withheld for child support is between 50% - 65% of your disposable earnings, depending on your situation.

If you are an employer as described in federal Publication 15, Circular E, Employer's Tax Guide, and you maintain an office or transact business within New York State, whether or not a paying agency is maintained within the state, you must withhold personal income tax.

Employers paying wages or other payments subject to New York State withholding must file a return and pay the New York State, New York City, and Yonkers taxes required to be withheld.

An employee's disposable earnings are considered to be your gross income minus any legally required deductions such as taxes and Social Security. The remaining income is eligible for wage garnishments and is considered disposable earnings.

As of March 21, 2022, the federal minimum wage is $7.25, and 30 times that is $217.50.

For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employee's disposable earnings, or the amount by which an employee's disposable earnings are greater than 30 times the federal minimum wage (currently

Withholding orders are legal orders we issue to collect past due income taxes or a bill owed to local or state agencies. There are 3 different types of withholding orders we issue: Earnings withholding order (EWOT or EWO) Order to withhold (OTW) Continuous order to withhold (COTW)