Title: Suffolk New York General Information and Instructions for Income Withholding for Support: A Comprehensive Guide Introduction: Suffolk County, located in New York, provides General Information and Instructions for Income Withholding for Support, ensuring the effective collection and enforcement of child support. These guidelines serve as a valuable resource for employers, payers, and recipients involved in income withholding for support. This article delves into the various aspects of Suffolk New York General Information and Instructions for Income Withholding for Support, explaining its importance and highlighting different types when applicable. 1. Understanding Income Withholding for Support: Income withholding for support, also known as wage garnishment, is a legal procedure whereby a portion of an individual's income is deducted to fulfill child support obligations. Suffolk County has established comprehensive guidelines to ensure proper implementation and compliance with income withholding requirements. 2. Suffolk New York General Information and Instructions: Suffolk County provides a detailed set of general information and instructions to facilitate income withholding for support, enabling employers, payers, and recipients to fulfill their respective roles effectively. These instructions cover important topics such as: a. Employer Responsibilities: Employers play a vital role in executing income withholding for support. Suffolk County's guidelines outline the responsibilities employers have in terms of receiving income withholding orders, calculating deductions, and remitting payments to the appropriate authorities. b. Payer Obligations: Payers, also known as obliges, are responsible for complying with income withholding orders promptly. Suffolk County's guidelines provide instructions for payers to ensure their obligations are met efficiently, including the proper documentation required and compliance with payment schedules. c. Recipient Rights and Procedures: Recipients, typically custodial parents or legal guardians, have rights and procedures outlined to ensure they receive the support payments they are entitled to. Suffolk County's guidelines provide clarity on recipient rights, documentation requirements, and the process for reporting non-compliance or issues related to income withholding. 3. Different Types of Suffolk New York General Information and Instructions: a. Income Withholding for Employees: Suffolk County offers specific instructions for employers on income withholding for employees, explaining how to handle withholding orders, calculate deductions, and remit payments to the appropriate entities. b. Income Withholding for Independent Contractors: For employers engaging independent contractors, there are specific guidelines provided by Suffolk County on income withholding. This ensures that even individuals who are not traditional employees are subject to appropriate income withholding for support. c. Modification and Termination of Income Withholding Orders: Suffolk County's guidelines outline the process for modifying or terminating income withholding orders, providing detailed instructions on when and how these changes can be requested or mandated. Conclusion: Suffolk New York General Information and Instructions for Income Withholding for Support serves as an all-encompassing guide for employers, payers, and recipients involved in income withholding procedures. These comprehensive instructions ensure seamless and efficient income withholding for support, benefiting the children and families who rely on these payments.

Suffolk New York Income Withholding For Support: General Information and Instructions (LDSS-5039)

State:

New York

County:

Suffolk

Control #:

NY-LDSS-5039

Format:

PDF

Instant download

Public form

Description

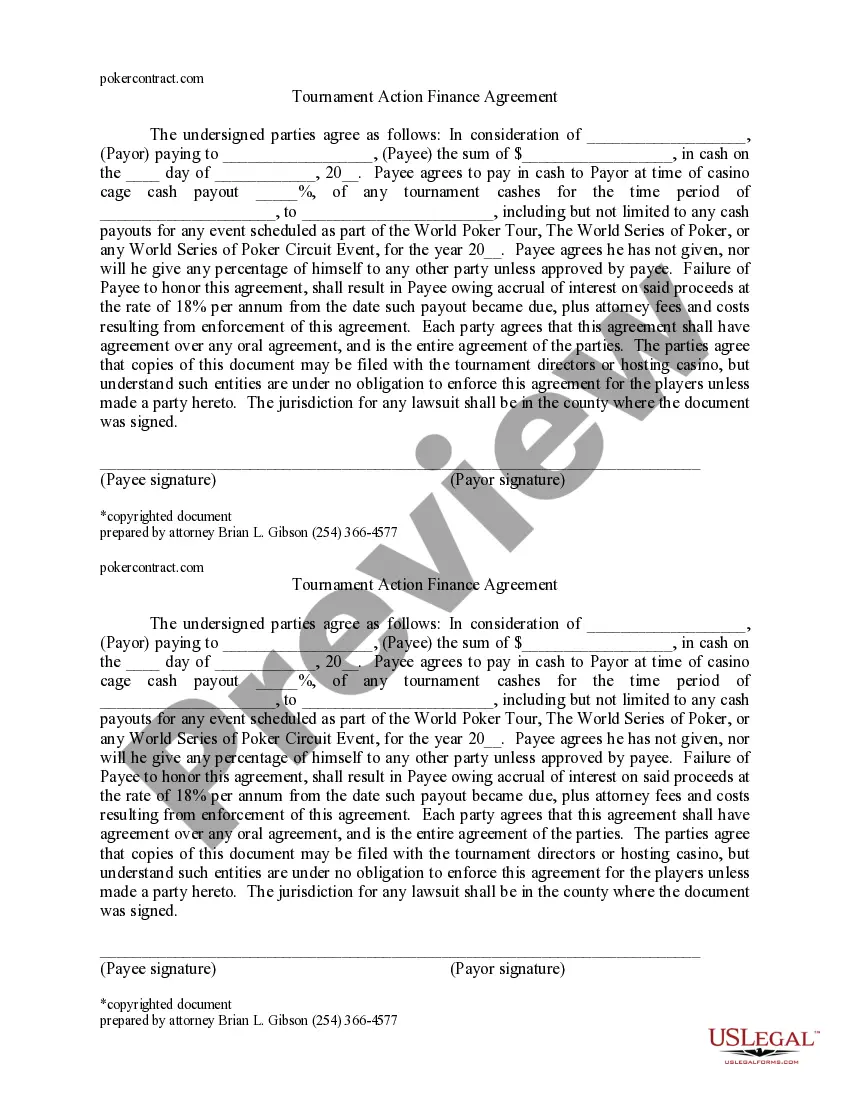

This form is a general information and instructions for the income withholding for support form.

Title: Suffolk New York General Information and Instructions for Income Withholding for Support: A Comprehensive Guide Introduction: Suffolk County, located in New York, provides General Information and Instructions for Income Withholding for Support, ensuring the effective collection and enforcement of child support. These guidelines serve as a valuable resource for employers, payers, and recipients involved in income withholding for support. This article delves into the various aspects of Suffolk New York General Information and Instructions for Income Withholding for Support, explaining its importance and highlighting different types when applicable. 1. Understanding Income Withholding for Support: Income withholding for support, also known as wage garnishment, is a legal procedure whereby a portion of an individual's income is deducted to fulfill child support obligations. Suffolk County has established comprehensive guidelines to ensure proper implementation and compliance with income withholding requirements. 2. Suffolk New York General Information and Instructions: Suffolk County provides a detailed set of general information and instructions to facilitate income withholding for support, enabling employers, payers, and recipients to fulfill their respective roles effectively. These instructions cover important topics such as: a. Employer Responsibilities: Employers play a vital role in executing income withholding for support. Suffolk County's guidelines outline the responsibilities employers have in terms of receiving income withholding orders, calculating deductions, and remitting payments to the appropriate authorities. b. Payer Obligations: Payers, also known as obliges, are responsible for complying with income withholding orders promptly. Suffolk County's guidelines provide instructions for payers to ensure their obligations are met efficiently, including the proper documentation required and compliance with payment schedules. c. Recipient Rights and Procedures: Recipients, typically custodial parents or legal guardians, have rights and procedures outlined to ensure they receive the support payments they are entitled to. Suffolk County's guidelines provide clarity on recipient rights, documentation requirements, and the process for reporting non-compliance or issues related to income withholding. 3. Different Types of Suffolk New York General Information and Instructions: a. Income Withholding for Employees: Suffolk County offers specific instructions for employers on income withholding for employees, explaining how to handle withholding orders, calculate deductions, and remit payments to the appropriate entities. b. Income Withholding for Independent Contractors: For employers engaging independent contractors, there are specific guidelines provided by Suffolk County on income withholding. This ensures that even individuals who are not traditional employees are subject to appropriate income withholding for support. c. Modification and Termination of Income Withholding Orders: Suffolk County's guidelines outline the process for modifying or terminating income withholding orders, providing detailed instructions on when and how these changes can be requested or mandated. Conclusion: Suffolk New York General Information and Instructions for Income Withholding for Support serves as an all-encompassing guide for employers, payers, and recipients involved in income withholding procedures. These comprehensive instructions ensure seamless and efficient income withholding for support, benefiting the children and families who rely on these payments.

How to fill out Suffolk New York Income Withholding For Support: General Information And Instructions (LDSS-5039)?

If you’ve already utilized our service before, log in to your account and save the Suffolk New York General Information and Instructions for Income Withholding for Support on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Suffolk New York General Information and Instructions for Income Withholding for Support . Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!