Syracuse, New York General Information and Instructions for Income Withholding for Support: Are you a resident of Syracuse, New York, involved in a child support case and wondering how income withholding for support works in your area? Look no further! This comprehensive guide aims to provide you with all the essential details and instructions regarding income withholding for support in Syracuse, New York. General Information: Syracuse, known as the Salt City, is a vibrant city located in Onondaga County, New York. With a population of over 140,000 residents, it is the fifth-largest city in the state. Syracuse offers a rich cultural scene, excellent education institutions, and a diverse array of employment opportunities. Instructions for Income Withholding for Support: 1. Understanding Income Withholding: Income withholding for support is a legal process where funds are deducted directly from the earnings of an individual to fulfill their child support obligations. It ensures that children receive the financial support they require. 2. Obliges and Obliges: In income withholding for support, the person responsible for providing child support is known as the "obliged," while the individual receiving the support is referred to as the "obliged." 3. Notification and Implementation: In Syracuse, New York, income withholding for support is generally ordered by the Family Court or the Support Collection Unit (SCU). Employers are served with a notice requiring them to withhold a specific portion of the obliged's wages and transmit it to the appropriate agency. 4. Income Withholding Order: An income withholding order is issued by the Family Court or SCU, and it contains vital information such as the amount to be withheld, the frequency of deductions, and where the funds should be sent. 5. Wage Withholding Limits: According to New York State law, income withholding cannot exceed a certain percentage of an obliged's income, ensuring they have a portion available for basic living expenses. 6. Obligations of Employers: Employers play a crucial role in income withholding for support. They must comply with the order by deducting the specified amount from the obliged's paycheck and forwarding it to the designated agency within the required time frame. 7. Reporting Changes: It is important for obliges and obliges to promptly report any changes that may affect income withholding, such as changes in employment or income level. This ensures accurate and timely support payments. Different Types of Syracuse New York General Information and Instructions for Income Withholding for Support: 1. Regular Income Withholding: This type of income withholding occurs when the obligatory payments are deducted from the obliged's paycheck on a regular basis, typically every pay period. 2. Lump-Sum Income Withholding: In certain cases, such as a one-time bonus or a lump-sum payment, income withholding can be a bit different. Guidelines on how to handle such situations are provided by the Syracuse, New York Family Court or SCU. By familiarizing yourself with Syracuse, New York General Information and Instructions for Income Withholding for Support, you can navigate the process more effectively. Remember, it's crucial to seek legal advice and engage with the appropriate agencies for personalized guidance tailored to your specific situation.

Syracuse New York Income Withholding For Support: General Information and Instructions (LDSS-5039)

Description

How to fill out Syracuse New York Income Withholding For Support: General Information And Instructions (LDSS-5039)?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, as a rule, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

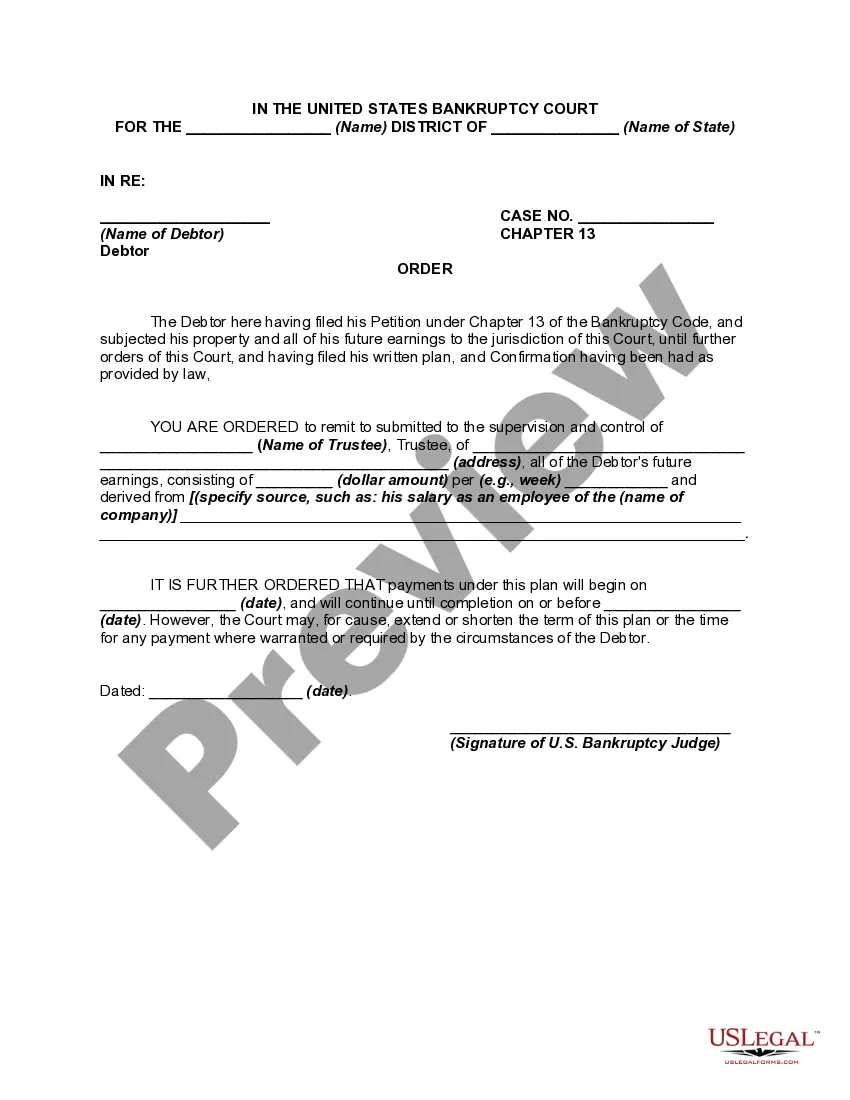

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Syracuse New York General Information and Instructions for Income Withholding for Support or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Syracuse New York General Information and Instructions for Income Withholding for Support complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Syracuse New York General Information and Instructions for Income Withholding for Support is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!