Nassau New York Notice of Lending is a legal document that serves as official notification to parties involved in a lending transaction in Nassau County, New York. This notice provides important details regarding the terms and conditions of the loan, as well as the rights and responsibilities of the borrower and lender. It helps ensure transparency and legal compliance throughout the lending process, protecting both parties' interests. Keyword: Nassau New York Nassau County is located in the state of New York. It is one of the most populous counties in the state and is known for its beautiful beaches, vibrant communities, and rich history. With its proximity to New York City, Nassau County offers a mix of suburban living and urban opportunities. The county is home to various cultural attractions, including museums, parks, and historical sites. It is also a hub for business and commerce, offering a wide range of services to its residents and visitors. Keyword: Notice of Lending The Notice of Lending is a legal document required in various lending transactions, including mortgages, personal loans, and commercial loans. Its purpose is to provide clear and concise information to the borrower and other relevant parties about the terms and conditions of the loan. This notice typically includes details such as the loan amount, interest rate, repayment terms, any collateral involved, and the consequences of defaulting on the loan. By ensuring that all parties are fully informed about the loan agreement, the Notice of Lending promotes transparency and helps prevent disputes or misunderstandings. Different types of Nassau New York Notice of Lending: 1. Mortgage Notice of Lending: This notice specifically pertains to mortgage loans, which are used to finance the purchase or refinance of real estate properties. It includes crucial information such as the property address, loan-to-value ratio, mortgage term, interest rate, and repayment schedule. The Mortgage Notice of Lending helps borrowers understand their obligations and rights related to the mortgage. 2. Personal Loan Notice of Lending: This type of notice applies to personal loans issued by lenders in Nassau County, New York. It outlines the terms, conditions, and repayment details for loans used for personal expenses, such as medical bills, education, or unexpected financial emergencies. The Personal Loan Notice of Lending ensures that borrowers have a clear understanding of their obligations and the consequences of non-payment. 3. Commercial Loan Notice of Lending: For businesses seeking financing in Nassau County, New York, the Commercial Loan Notice of Lending becomes relevant. It outlines the terms, conditions, and repayment schedule for loans used to fund business operations or expansions. This notice provides businesses with a comprehensive understanding of their financial obligations, helping them make informed decisions and manage their loans effectively. In conclusion, the Nassau New York Notice of Lending is a crucial legal document used in lending transactions throughout Nassau County, New York. It ensures that borrowers and lenders have a clear understanding of the loan agreement by providing detailed information about the terms, conditions, rights, and obligations involved. Different types of Notices of Lending exist, including those related to mortgages, personal loans, and commercial loans, catering to various financial needs and requirements.

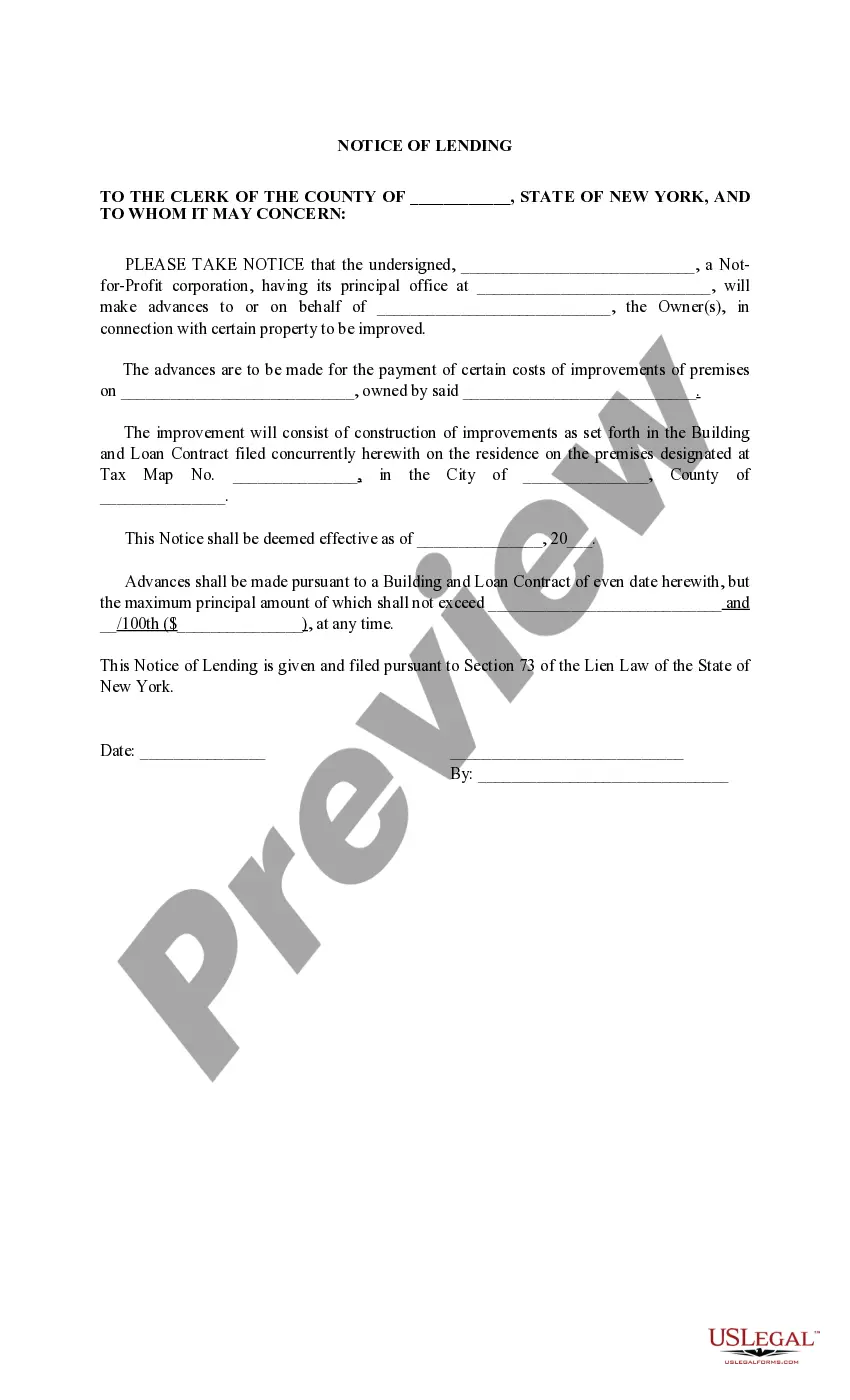

Nassau New York Notice of Lending

Description

How to fill out Nassau New York Notice Of Lending?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any law background to create this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our service offers a huge collection with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Nassau New York Notice of Lending or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Nassau New York Notice of Lending in minutes using our trusted service. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, in case you are a novice to our library, ensure that you follow these steps before downloading the Nassau New York Notice of Lending:

- Be sure the template you have found is good for your area since the rules of one state or area do not work for another state or area.

- Preview the form and read a quick description (if available) of scenarios the document can be used for.

- If the one you selected doesn’t suit your needs, you can start over and look for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Nassau New York Notice of Lending once the payment is done.

You’re all set! Now you can go ahead and print out the form or complete it online. Should you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

Nassau County Public Records Nassau Treasurer. (516) 571-2090. Go to Data Online. Nassau Assessor. (516) 571-1500. Go to Data Online. Nassau County Clerk. (516) 571-2660. Go to Data Online. Town of Hempstead Tax. (516) 538-1500. Go to Data Online.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

Tax Map Verification Fee: Currently, this $350 fee is charged by the Assessor for the verification of the section, block and lot information contained in any deeds, mortgages or satisfactions, or any modifications or consolidations that are presented for recording.

Typically, it takes roughly 10 to 14 days for the title search. It will rarely ever extend past the normal two-week period. However, some key factors play a role in this. This involves the title professional who works at the title company to undertake a detailed inspection and search.

The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF). Read the instructions on the form and send in the appropriate fee.

In order to prove that you are a current resident of Nassau County, you must submit one of the following suggested forms of documentation with an issue-date that is within six (6) months of the date of your application: Bank Statement. Student loan. Credit card statement.

Without accounting for exemptions, the Nassau property tax rate is 5.15 per $1,000 of full value in 2021 plus town taxes of 0.03 to 18.05. School taxes range from 10.68 to 42.63 per $1,000 of full market value without considering STAR program benefits.

NY residents can usually find property records at their local county recorder's office. However, a county might sometimes store property deeds with the county clerk. The researcher must identify which office is responsible for managing and disseminating property records and then visit the office to request the records.

Nassau County Recording Fees: Deed (Residential) - $500.00Verification Fee - $355.00Deed Service Fee - $25.00253/255 AFFs$5.00Satisfaction of Judgment Filing Fee$25.00UCC-1/UCC-3 Filing$340.00 eachPower Attorney Recording Fee - $410.00Verification fee - $355.00Recording Service fee - $25.007 more rows

$15.00 per parcel. 7. VERIFICATION OF ASSESSMENT BY MAIL. N/A. A.