Rochester New York Notice of Lending: A Comprehensive Overview In Rochester, New York, the Notice of Lending is a crucial legal document that plays an important role in loan transactions. It serves as a formal notice provided by the lender to the borrower, declaring the terms and conditions of the loan being offered. This document is designed to ensure transparency and protect both parties involved in the lending process. Key features of the Rochester New York Notice of Lending: 1. Loan Details: The Notice of Lending clearly outlines the specifics of the loan, including the principal amount, interest rate, duration, and any applicable fees. This information provides the borrower with a comprehensive understanding of their financial obligations. 2. Repayment Schedule: It includes a detailed repayment schedule that specifies the due dates, installment amounts, and the method of repayment—be it monthly, bi-monthly, or a customized plan agreed upon by the lender and borrower. 3. Collateral Requirements: The Notice of Lending may highlight any collateral required to secure the loan. This can be in the form of property, assets, or other valuable items that act as security for the lender in case of default. 4. Termination and Prepayment: The document may address the conditions under which the loan can be terminated or prepaid without incurring any penalties. This provides flexibility to the borrower to settle the loan earlier or renegotiate the terms if necessary. 5. Amendment or Modification: If there is a possibility of modifying or amending the loan terms in the future, the Notice of Lending may include provisions to address such changes. This ensures that any alterations to the agreement are done with mutual consent. Various types of Rochester New York Notice of Lending: 1. Personal Loan Notice: This notice is applicable when an individual borrows money from a financial institution or private lender for personal use, such as home improvement, medical expenses, or debt consolidation. 2. Business Loan Notice: This notice specifically caters to lending transactions between lenders and business entities. It outlines the terms for funding business operations, expanding infrastructure, purchasing equipment, or any other financial requirements. 3. Mortgage Loan Notice: When an individual or business obtains a loan for purchasing real estate or refinancing an existing mortgage, this notice is issued to document the terms of the mortgage loan, including interest rates, repayment schedules, and rights of the lender in case of non-compliance. 4. Student Loan Notice: Education loans are vital for individuals pursuing higher education. This notice details the terms related to funding, repayment options, interest accrual, and grace periods associated with student loans. In summary, the Rochester New York Notice of Lending is an essential document serving to notify borrowers about the terms, conditions, and obligations concerning the loan. It ensures transparency and legal compliance, helping both parties establish a mutually agreeable lending arrangement. Whether it's a personal, business, mortgage, or student loan, the Notice of Lending plays a vital role in structuring and safeguarding loan transactions in Rochester, New York.

Rochester New York Notice of Lending

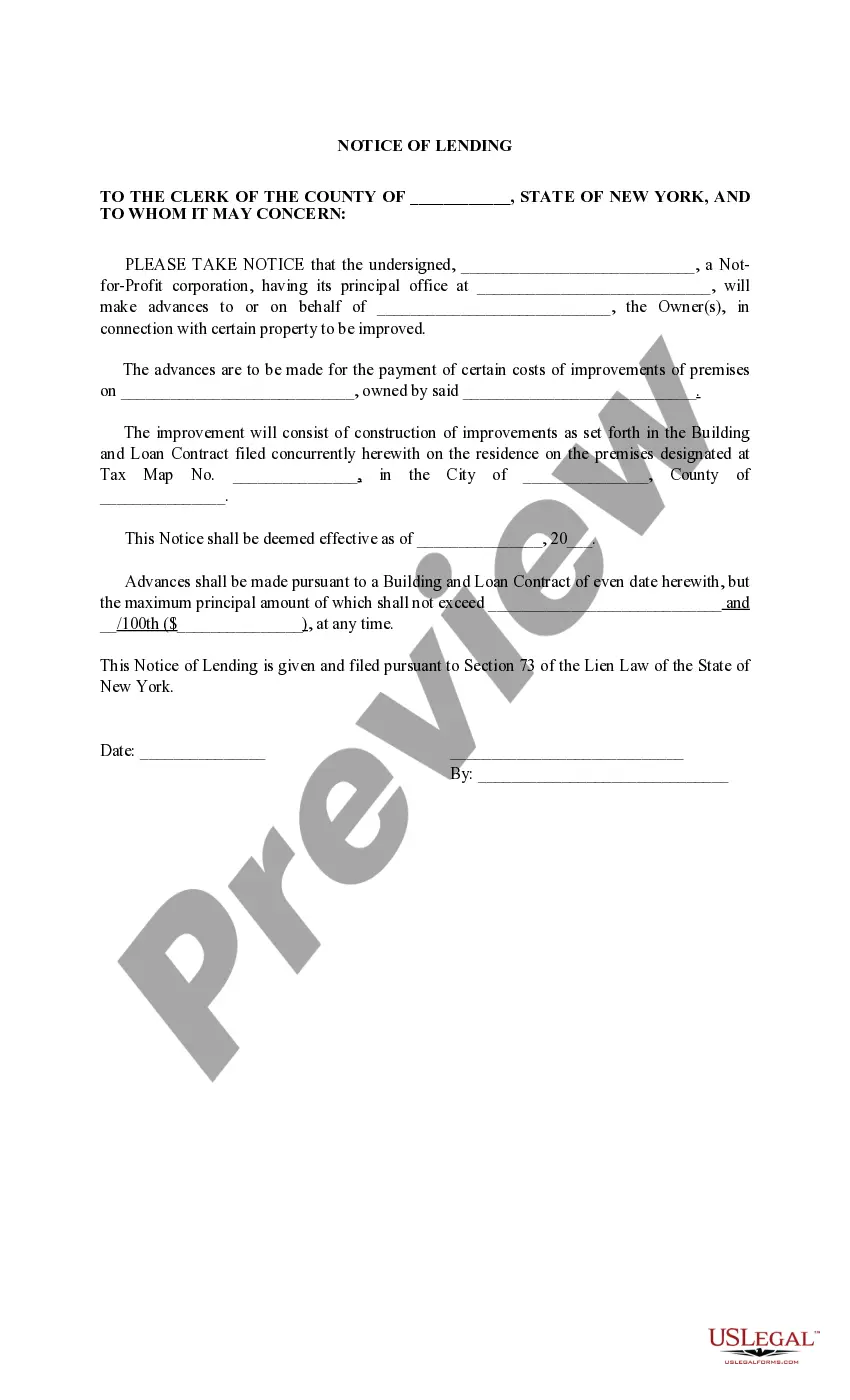

Description

How to fill out Rochester New York Notice Of Lending?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Rochester New York Notice of Lending becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Rochester New York Notice of Lending takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Rochester New York Notice of Lending. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!