Suffolk New York Notice of Lending is an essential legal document that is used in the lending process to provide notice to borrowers regarding the terms and conditions of their loan agreement. This notice is typically sent by the lender to the borrower to ensure transparency and compliance with applicable laws and regulations. It serves as a written statement that outlines crucial details about the loan, including interest rates, repayment terms, and any associated fees or penalties. There are several types of Suffolk New York Notice of Lending, each serving a specific purpose depending on the nature of the loan. These include: 1. Suffolk New York Notice of Mortgage Lending: This notice is specific to mortgage loans and contains information about the property being mortgaged, loan amount, interest rate, mortgage duration, and other relevant details. It informs the borrower of their legal obligations, such as making timely payments, maintaining homeowner's insurance, and complying with any applicable local laws or regulations. 2. Suffolk New York Notice of Personal Loan Lending: This type of notice pertains to personal loans, which are generally unsecured loans provided by lenders based on the borrower's creditworthiness. It includes information about the loan amount, interest rate, repayment schedule, and any additional terms and conditions that may apply. It clarifies the borrower's responsibilities and the consequences of defaulting on the loan. 3. Suffolk New York Notice of Business Loan Lending: Designed for loans provided to businesses, this notice outlines crucial details related to the loan agreement, such as loan purpose, amount, interest rate, collateral if any, repayment terms, and any specific covenants or conditions that the borrower must adhere to. It informs the borrower about the potential consequences for non-compliance or defaulting on the loan. 4. Suffolk New York Notice of Student Loan Lending: This notice is specific to student loans and is typically sent to borrowers upon approval of their loan application. It contains vital information about the loan amount, interest rate, repayment options, deferment or forbearance possibilities, and any other terms and conditions associated with the loan. It serves to inform the borrower about their financial obligations and the expected timeline for loan repayment. Overall, Suffolk New York Notice of Lending encompasses various types of notices that facilitate transparency and ensure borrowers are fully aware of the terms and conditions of their loans. These notices are crucial legal documents that protect the rights of both lenders and borrowers and promote responsible lending practices.

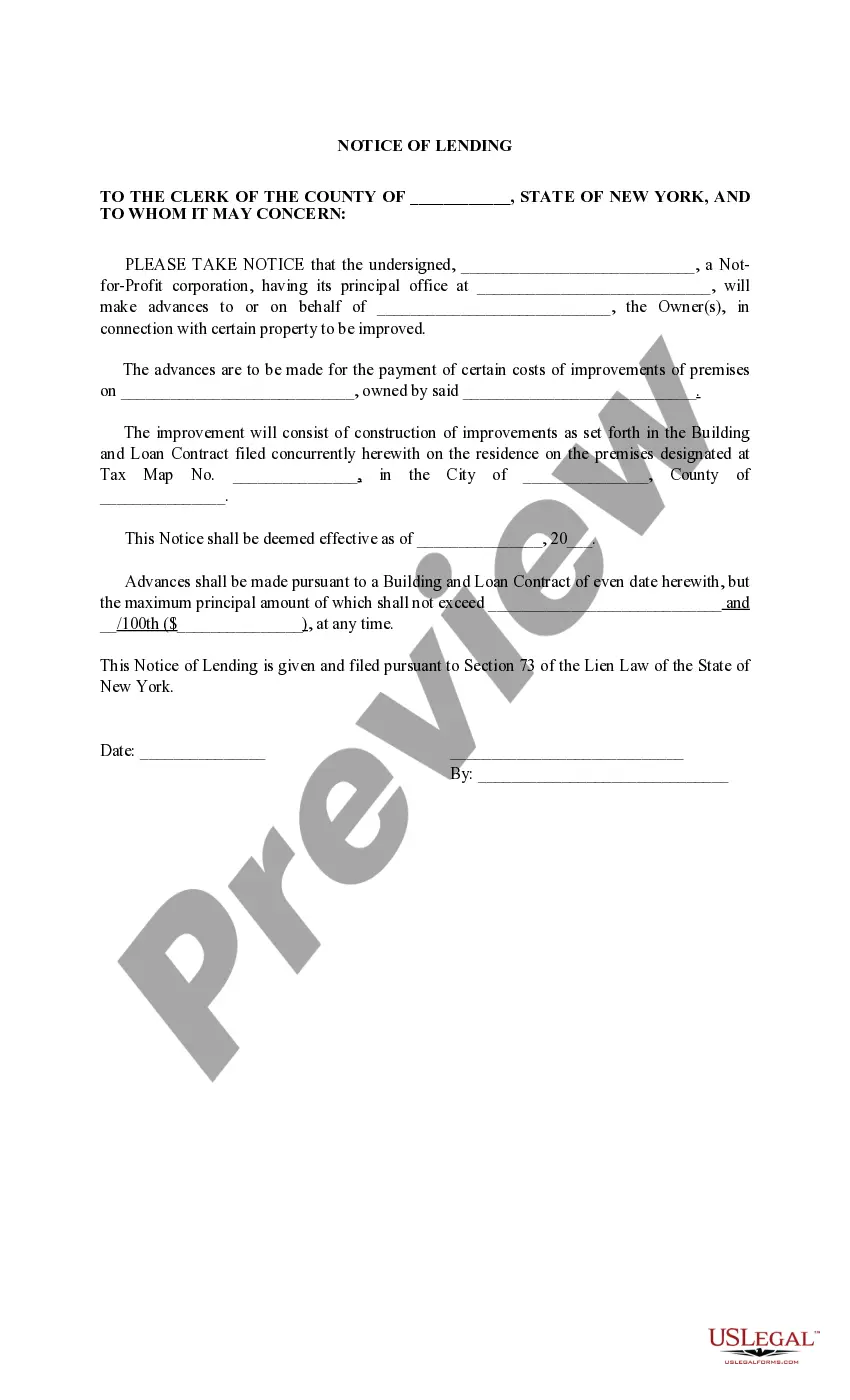

Suffolk New York Notice of Lending

Description

How to fill out Suffolk New York Notice Of Lending?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no law background to draft such papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Suffolk New York Notice of Lending or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Suffolk New York Notice of Lending in minutes using our trustworthy service. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

However, in case you are a novice to our platform, make sure to follow these steps prior to downloading the Suffolk New York Notice of Lending:

- Ensure the form you have chosen is specific to your area considering that the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of cases the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or register for one from scratch.

- Select the payment method and proceed to download the Suffolk New York Notice of Lending once the payment is through.

You’re all set! Now you can go ahead and print out the form or complete it online. If you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.