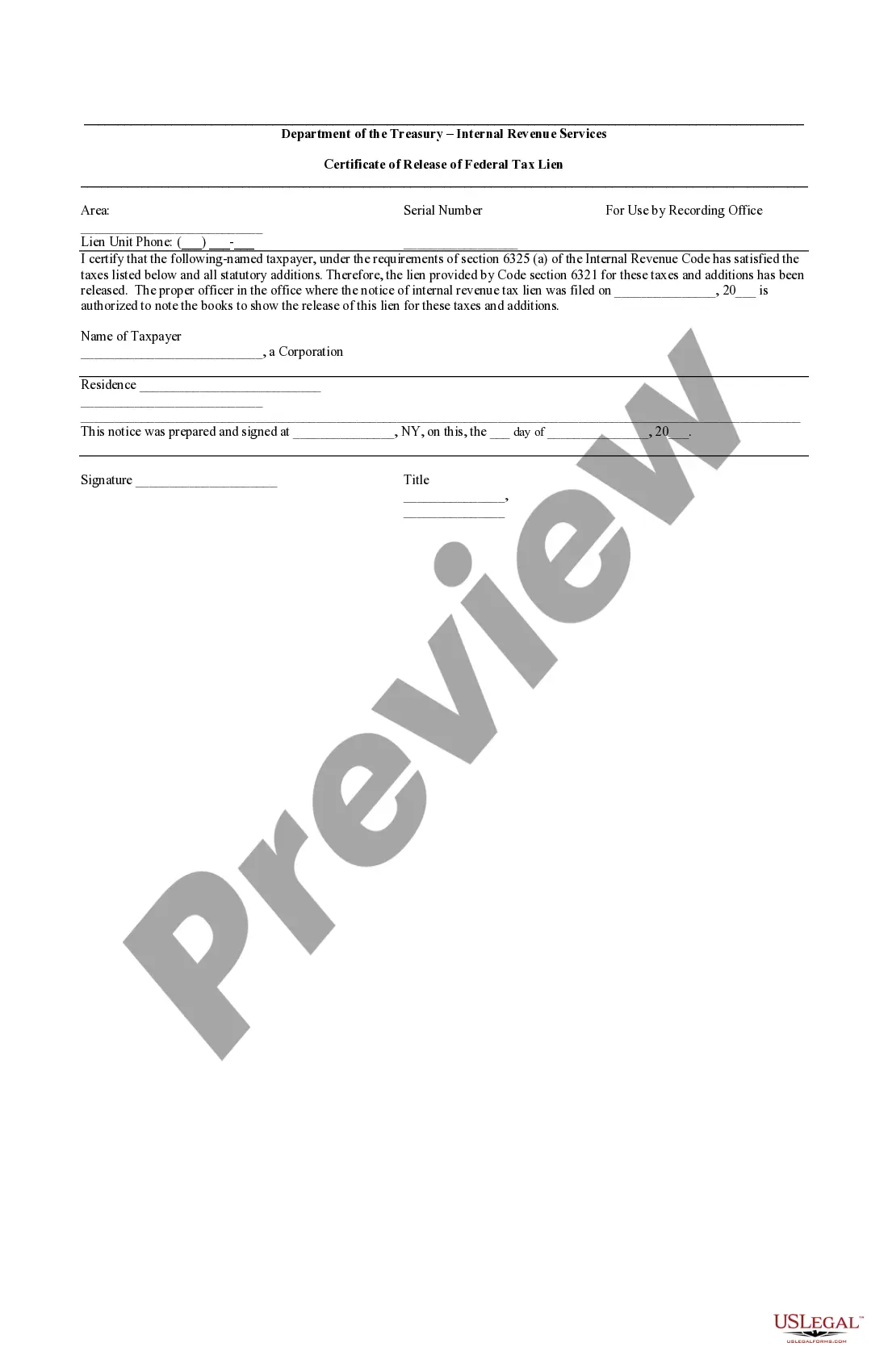

The Kings New York Certificate of Release of Federal Tax Lien is an important legal document that releases a taxpayer from the burden of a federal tax lien placed upon their property or assets. This certificate serves as proof that the taxpayer's outstanding tax debt has been fully repaid or otherwise satisfied, and that the lien is no longer in effect. It is a critical document for individuals or businesses seeking to resolve their tax issues and regain control over their assets. In Kings County, New York, there are two different types of Certificates of Release of Federal Tax Lien that taxpayers may encounter: 1. Voluntary Release: A voluntary release is issued when a taxpayer has fully paid their outstanding tax debt, typically by settling their tax liability or fulfilling a payment plan. It signifies that the taxpayer has satisfied all the requirements of the Internal Revenue Service (IRS) and the lien against their property is being released voluntarily. 2. Certificate of Nonattachment: A Certificate of Nonattachment is issued when a federal tax lien has been filed erroneously against a taxpayer's property or assets. It indicates that the taxpayer's property is not subject to the federal tax lien, and therefore, the lien has no legal attachment or claim to the taxpayer's assets. It is important to note that the Kings New York Certificate of Release of Federal Tax Lien only pertains to federal tax liens and does not address any local or state tax liabilities. Individuals or businesses should address any outstanding local or state tax debts with the appropriate tax authorities. Obtaining a Kings New York Certificate of Release of Federal Tax Lien requires diligent effort and compliance with the IRS's procedures. Taxpayers must first resolve their tax debt or dispute the lien, gather all necessary documentation, and file the appropriate forms with the IRS. The IRS will then review the request and, if satisfied, issue the Certificate of Release of Federal Tax Lien. It is crucial to keep this certificate safe and readily accessible as it is often required during property transactions, loan applications, or other financial transactions involving the taxpayer's assets. Without the certificate, potential buyers or lenders may hesitate to proceed with the transaction due to concerns about the outstanding tax lien. In conclusion, the Kings New York Certificate of Release of Federal Tax Lien is a vital document that releases a taxpayer from the burden of a federal tax lien. It signifies that the taxpayer has repaid their tax debt or that the lien has been filed in error. By obtaining this certificate, individuals or businesses can regain control over their assets and proceed with their financial endeavors without hindrance from the federal tax lien.

Kings New York Certificate of Release of Federal Tax Lien

Description

How to fill out Kings New York Certificate Of Release Of Federal Tax Lien?

If you are searching for a relevant form, it’s impossible to find a more convenient service than the US Legal Forms website – probably the most considerable libraries on the web. With this library, you can get thousands of templates for company and individual purposes by types and states, or keywords. With our high-quality search function, discovering the latest Kings New York Certificate of Release of Federal Tax Lien is as elementary as 1-2-3. Moreover, the relevance of each file is confirmed by a team of expert lawyers that on a regular basis check the templates on our platform and update them according to the most recent state and county requirements.

If you already know about our system and have a registered account, all you need to get the Kings New York Certificate of Release of Federal Tax Lien is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the sample you need. Check its explanation and utilize the Preview function to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the proper document.

- Confirm your choice. Choose the Buy now option. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the acquired Kings New York Certificate of Release of Federal Tax Lien.

Each and every template you add to your account has no expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you want to have an additional copy for editing or creating a hard copy, you may come back and export it once more at any moment.

Make use of the US Legal Forms professional catalogue to get access to the Kings New York Certificate of Release of Federal Tax Lien you were looking for and thousands of other professional and state-specific samples on one platform!