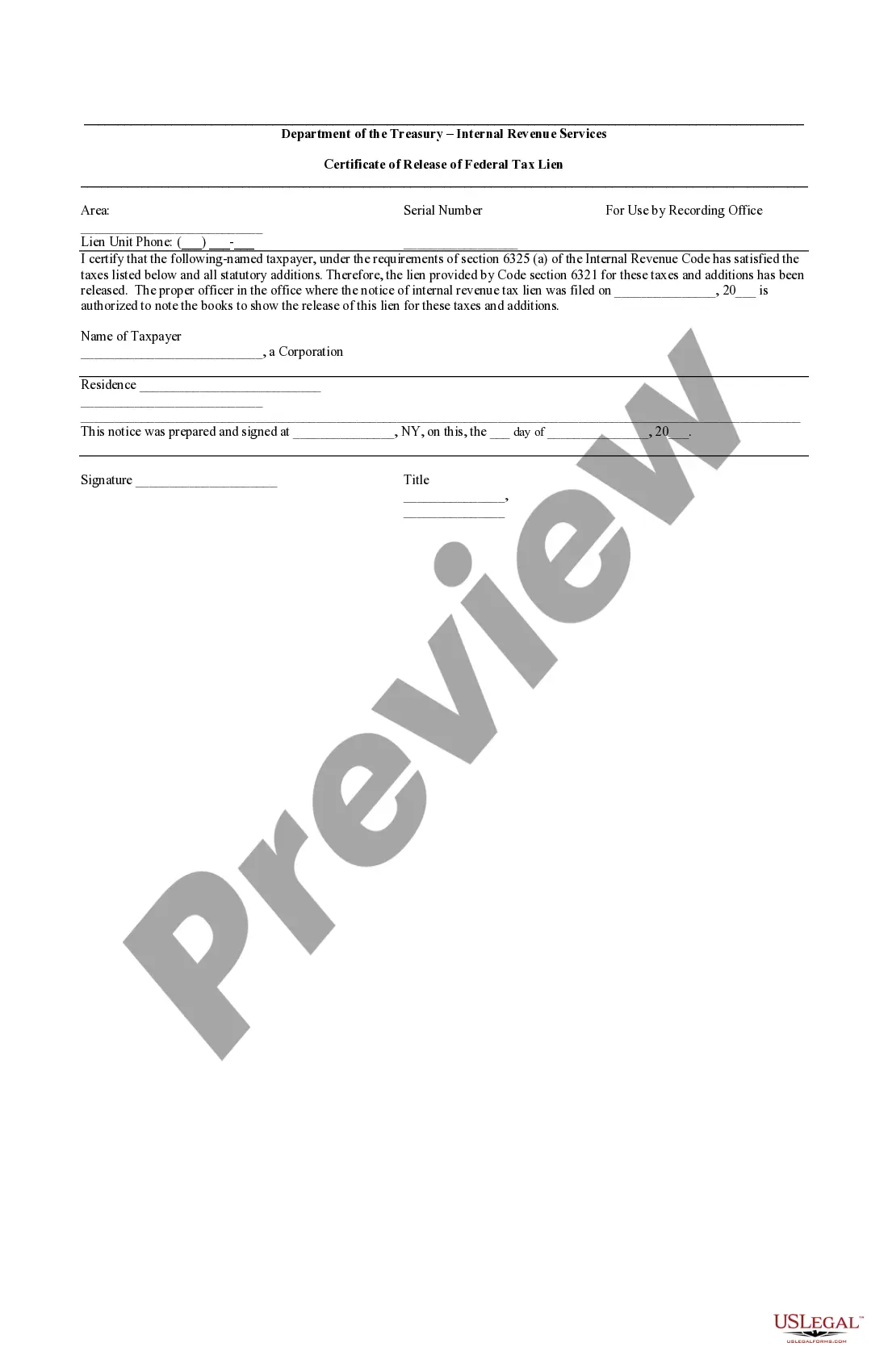

The Queens New York Certificate of Release of Federal Tax Lien is an important document that signifies the release of a federal tax lien imposed on a property or an individual by the Internal Revenue Service (IRS) in Queens, New York. A federal tax lien is filed by the IRS when a taxpayer fails to pay their federal income taxes or neglects to fulfill their tax obligations. This lien serves as a legal claim against the taxpayer's assets, including real estate, cars, bank accounts, and other valuable possessions, ensuring that the government has priority over other creditors in case of nonpayment. The Certificate of Release of Federal Tax Lien, commonly known as a Release, is obtained once the outstanding tax liability is fully satisfied, or the IRS deems it appropriate to withdraw the lien due to certain circumstances. This document provides evidence that the taxpayer's property is no longer encumbered by the federal tax lien, making it crucial for individuals or businesses to clear their tax debts effectively. In Queens, New York, the Certificate of Release of Federal Tax Lien can be categorized into several types, depending on the specific circumstances or actions taken by the taxpayer. These types include: 1. Full Release: This form is issued when the taxpayer has successfully paid the entire outstanding tax debt, including any accrued penalties and interests. It signifies the complete release of the federal tax lien and proves that the taxpayer has fulfilled their tax obligations. 2. Partial Release: In some cases, the IRS may agree to release the federal tax lien on specific properties or assets if the taxpayer has paid off a significant portion of the outstanding tax debt. The partial release allows the taxpayer to regain control over certain assets, while the lien might still remain on other properties until fully paid. 3. Withdrawal of Lien: The IRS may withdraw a filed federal tax lien if there were errors in the filing process, the liability has been resolved, or the taxpayer agrees to alternative payment arrangements, such as an installment agreement or an offer in compromise. A withdrawal ensures that the lien is removed from public records, providing substantial benefits to the taxpayer's creditworthiness. 4. Subordination: When a taxpayer requires additional financing, such as a mortgage or loan, the IRS may allow the federal tax lien to take a secondary position to the new creditor's interest. By subordinating the lien, the taxpayer can obtain the necessary funds while the government's claim remains in place. It is essential for individuals and businesses in Queens, New York, to understand the intricacies of the Certificate of Release of Federal Tax Lien and consult tax professionals or attorneys specializing in tax matters to ensure proper compliance with the IRS regulations and procedures. Resolving federal tax liens promptly and obtaining the appropriate release or withdrawal documents can help reestablish financial stability and protect one's asset rights in Queens, New York, while avoiding any negative consequences associated with unresolved tax debts.

Queens New York Certificate of Release of Federal Tax Lien

Description

How to fill out Queens New York Certificate Of Release Of Federal Tax Lien?

Make use of the US Legal Forms and have immediate access to any form template you require. Our helpful website with a huge number of documents makes it simple to find and get almost any document sample you want. It is possible to download, fill, and certify the Queens New York Certificate of Release of Federal Tax Lien in just a few minutes instead of browsing the web for hours searching for the right template.

Utilizing our collection is a great strategy to improve the safety of your record filing. Our professional lawyers on a regular basis review all the records to make certain that the templates are relevant for a particular region and compliant with new acts and polices.

How can you get the Queens New York Certificate of Release of Federal Tax Lien? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Open the page with the form you require. Ensure that it is the template you were hoping to find: check its title and description, and utilize the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Export the file. Choose the format to get the Queens New York Certificate of Release of Federal Tax Lien and change and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy template libraries on the internet. We are always happy to help you in any legal procedure, even if it is just downloading the Queens New York Certificate of Release of Federal Tax Lien.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!