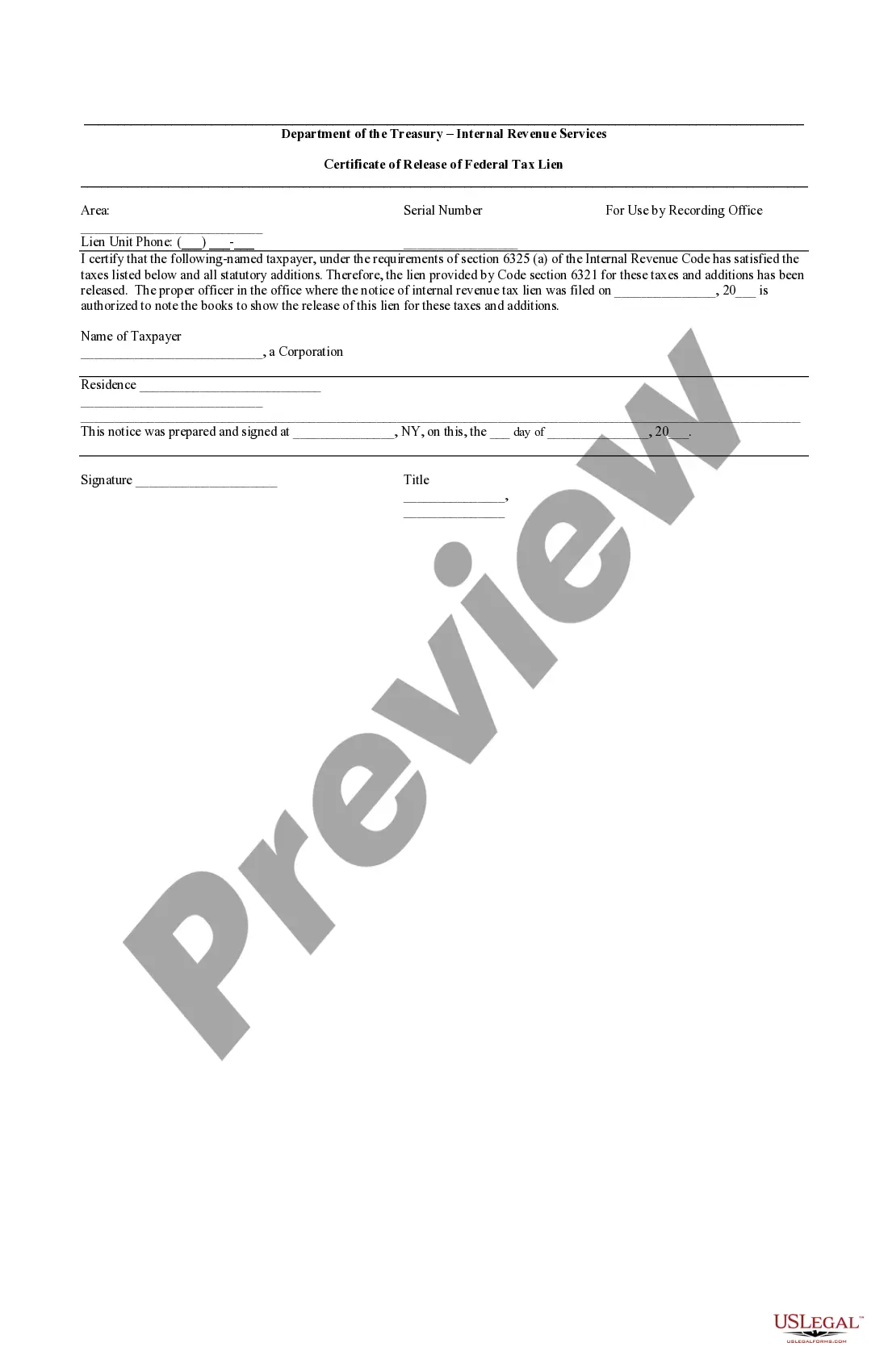

The Rochester New York Certificate of Release of Federal Tax Lien is a legal document issued by the Internal Revenue Service (IRS) which releases a previously filed federal tax lien on a taxpayer's property or assets located in Rochester, New York. This certificate is a significant indicator that the taxpayer has fulfilled their federal tax obligations and has settled their outstanding tax debt with the IRS. A federal tax lien is typically imposed when a taxpayer fails to pay their federal taxes, and it serves as a legal claim by the government against the taxpayer's property or assets. Once a taxpayer successfully resolves their tax debt, the IRS issues the Certificate of Release of Federal Tax Lien to acknowledge that the lien is no longer in effect. Keywords: Rochester, New York, Certificate of Release of Federal Tax Lien, IRS, federal tax lien, taxpayer, property, assets, tax debt, legal document, outstanding tax debt, tax obligations, tax payments, taxpayer's rights, lien release, settling tax debt. Different types of Rochester New York Certificate of Release of Federal Tax Lien may include: 1. Partial Release: This type of release occurs when the IRS removes the tax lien on specific property or assets, allowing the taxpayer to sell or transfer them freely while the lien may still be in effect on other properties or assets. It signifies a partial resolution of the taxpayer's tax debt. 2. Full Release: A full release of a federal tax lien declares that the taxpayer has successfully satisfied their tax debt obligations, and the lien is entirely lifted from all their properties and assets in Rochester, New York. This release grants the taxpayer complete freedom to manage their assets without any remaining federal tax encumbrances. 3. Withdrawal: In certain situations, the IRS may decide to withdraw a filed tax lien, indicating that it is no longer valid or enforceable. This withdrawal typically occurs if the lien was filed in error or if the taxpayer establishes an alternative arrangement for satisfying their tax debt. 4. Subordination: The government may choose to subordinate a federal tax lien, which means that the lien is still in effect, but its priority as a claim on the taxpayer's assets is lowered. This subordination allows other creditors to gain priority in recovering their debts from the taxpayer's assets. Remember that each Rochester New York Certificate of Release of Federal Tax Lien will have its specific details and terms, depending on the individual taxpayer's situation and the IRS's assessment of their tax debt. It is crucial to consult with a tax professional or the IRS directly for accurate information regarding specific cases.

Rochester New York Certificate of Release of Federal Tax Lien

Description

How to fill out Rochester New York Certificate Of Release Of Federal Tax Lien?

We consistently endeavor to minimize or avert legal harm when addressing intricate legal or financial issues.

To achieve this, we enroll in attorney services that are typically quite costly.

Nevertheless, not all legal problems are equally complicated. The majority can be resolved independently.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you lose the form, you can always re-download it from the My documents tab. The process is just as simple even if you are new to the site! You can set up your account in minutes. Ensure the Rochester New York Certificate of Release of Federal Tax Lien aligns with the laws and regulations of your state and area. Additionally, it's important to review the form's outline (if available), and if you notice any inconsistencies with your initial search, look for another template. Once you've confirmed that the Rochester New York Certificate of Release of Federal Tax Lien is appropriate for you, you can select the subscription option and process your payment. Then you can download the form in any convenient file format. For over 24 years, we have been assisting millions by delivering customizable and current legal documents. Take advantage of US Legal Forms now to save time and resources!

- Our collection empowers you to manage your affairs without seeking a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you need to locate and download the Rochester New York Certificate of Release of Federal Tax Lien or any other document efficiently and securely.

Form popularity

FAQ

To eliminate a lien on your property in New York, start by settling any outstanding tax debts. Once your debt is cleared, you can obtain a Rochester New York Certificate of Release of Federal Tax Lien, which will formally remove the lien from public records. If you need further assistance, consider using the services of uslegalforms to navigate the paperwork required for lien removal.

To inquire about a tax lien in New York State, you can contact the New York State Department of Taxation and Finance at their official phone number. They provide assistance regarding tax liens, including the Rochester New York Certificate of Release of Federal Tax Lien. Ensure you have your tax information ready to receive specific help.

Releasing a lien means that a creditor gives up their legal claim against your property due to a debt. When a lien is released, you regain full ownership and control over your asset. The process typically requires obtaining a Certificate of Release of Federal Tax Lien and filing it with the appropriate authorities. Understanding this process is crucial for anyone looking to clear their financial obligations efficiently.

After a lien is released in New York, obtaining a title involves submitting the Certificate of Release of Federal Tax Lien to your local Department of Motor Vehicles (DMV) or relevant authority. You may also need to provide identification and any additional paperwork related to the lien. Once the certificate is verified, you will receive a clear title for your property, allowing you full ownership rights.

While many states offer tax lien certificates, Florida is often considered one of the best due to its favorable interest rates and clear laws. However, it’s essential to conduct thorough research on states like Arizona and Michigan as well. Purchasing tax lien certificates in Rochester, New York, may also be beneficial, especially when understanding the requirements for the Rochester New York Certificate of Release of Federal Tax Lien.

A release of lien in New York State is an official document that indicates the removal of a lien from a property. This release is critical for property owners wishing to clear their title and promote the sale or refinancing of their property. The Rochester New York Certificate of Release of Federal Tax Lien serves as proof that the lien has been satisfied, allowing the owner to move forward without encumbrances.

To remove a lien from your property in New York, you must obtain a Rochester New York Certificate of Release of Federal Tax Lien. Start by ensuring that the lien has been satisfied by paying any outstanding debts. After payment, file the certificate with your county clerk's office. Completing these steps will officially release the lien from your property.