Yonkers, New York Certificate of Release of Federal Tax Lien serves as an essential document that releases a property or individual from the burden of a federal tax lien in Yonkers, New York. When a taxpayer owes unpaid taxes to the Internal Revenue Service (IRS), they may place a lien against the taxpayer's property as a form of collateral for the outstanding debt. However, once the tax liability is satisfied, the IRS issues a Certificate of Release of Federal Tax Lien to officially remove the lien from the taxpayer's property records. This certificate signifies that the taxpayer has settled their tax obligations, allowing them to regain full control over their property rights without any encumbrances. It provides legal proof that the lien no longer attaches to a specific property or individual, thereby enabling the taxpayer to freely transfer, sell, or refinance their property without any hindrance. Different types of Yonkers New York Certificate of Release of Federal Tax Lien include: 1. Individual Release: This type of release is issued to individual taxpayers who have successfully resolved their outstanding tax liabilities with the IRS related to personal income taxes. Once the individual release is obtained, the taxpayer can proceed with property-related transactions without any concern of the tax lien affecting their property rights. 2. Business Release: These releases are granted to businesses or entities that have settled their federal tax obligations related to corporate income taxes, payroll taxes, or any other applicable business taxes. Similar to an individual release, obtaining a business release allows smooth property transactions for the concerned entity. 3. Partial Release: In some cases, the IRS may issue a partial release of federal tax lien. This occurs when the taxpayer has paid a specific portion of the outstanding tax debt, and the lien is released against a specific property or properties. This allows the taxpayer to proceed with transactions related to the released property while maintaining the lien on other properties. It is crucial for taxpayers in Yonkers, New York, to obtain the Certificate of Release of Federal Tax Lien as it serves as concrete evidence that the lien has been removed. Without this document, potential buyers, lenders, and other interested parties may hesitate to engage in property transactions due to the uncertainty surrounding the property's title. Therefore, taxpayers should ensure they have the appropriate certificate to avoid any complications or delays when dealing with their properties.

Yonkers New York Certificate of Release of Federal Tax Lien

Category:

State:

New York

City:

Yonkers

Control #:

NY-LR055T

Format:

Word;

Rich Text

Instant download

Description

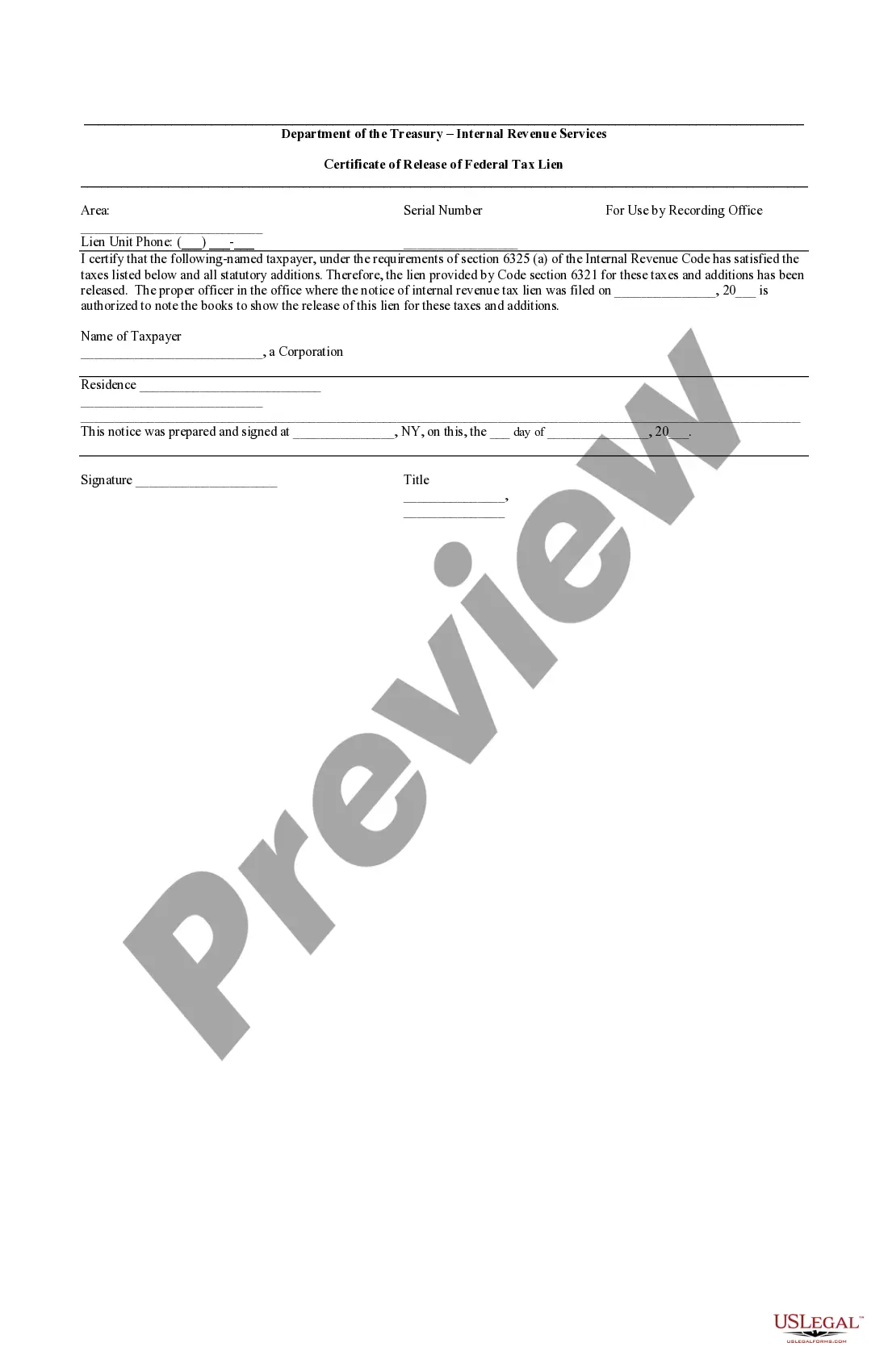

The Department of Treasury through the IRS certifies that the taxpayer has satisfied the taxes for which a lien was filed again real property.

Yonkers, New York Certificate of Release of Federal Tax Lien serves as an essential document that releases a property or individual from the burden of a federal tax lien in Yonkers, New York. When a taxpayer owes unpaid taxes to the Internal Revenue Service (IRS), they may place a lien against the taxpayer's property as a form of collateral for the outstanding debt. However, once the tax liability is satisfied, the IRS issues a Certificate of Release of Federal Tax Lien to officially remove the lien from the taxpayer's property records. This certificate signifies that the taxpayer has settled their tax obligations, allowing them to regain full control over their property rights without any encumbrances. It provides legal proof that the lien no longer attaches to a specific property or individual, thereby enabling the taxpayer to freely transfer, sell, or refinance their property without any hindrance. Different types of Yonkers New York Certificate of Release of Federal Tax Lien include: 1. Individual Release: This type of release is issued to individual taxpayers who have successfully resolved their outstanding tax liabilities with the IRS related to personal income taxes. Once the individual release is obtained, the taxpayer can proceed with property-related transactions without any concern of the tax lien affecting their property rights. 2. Business Release: These releases are granted to businesses or entities that have settled their federal tax obligations related to corporate income taxes, payroll taxes, or any other applicable business taxes. Similar to an individual release, obtaining a business release allows smooth property transactions for the concerned entity. 3. Partial Release: In some cases, the IRS may issue a partial release of federal tax lien. This occurs when the taxpayer has paid a specific portion of the outstanding tax debt, and the lien is released against a specific property or properties. This allows the taxpayer to proceed with transactions related to the released property while maintaining the lien on other properties. It is crucial for taxpayers in Yonkers, New York, to obtain the Certificate of Release of Federal Tax Lien as it serves as concrete evidence that the lien has been removed. Without this document, potential buyers, lenders, and other interested parties may hesitate to engage in property transactions due to the uncertainty surrounding the property's title. Therefore, taxpayers should ensure they have the appropriate certificate to avoid any complications or delays when dealing with their properties.

How to fill out Yonkers New York Certificate Of Release Of Federal Tax Lien?

If you’ve already used our service before, log in to your account and download the Yonkers New York Certificate of Release of Federal Tax Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Yonkers New York Certificate of Release of Federal Tax Lien. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!