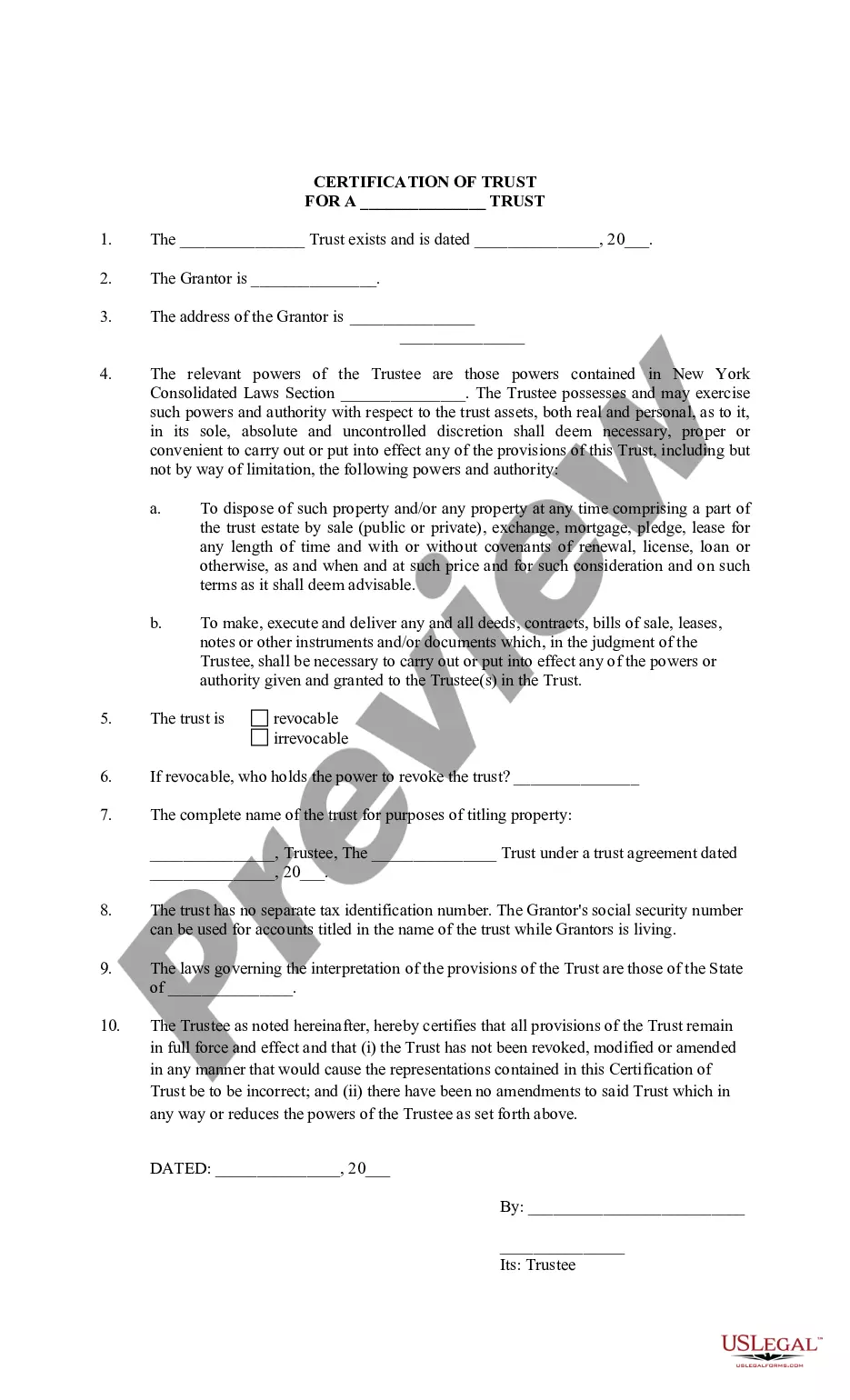

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Suffolk County, located in New York state, requires individuals to obtain a Certification of Trust as a legal document that verifies the existence and validity of a trust. A Certification of Trust is commonly used to provide proof of a trust's existence without revealing the full details contained within the trust agreement. This document ensures privacy and prevents the need for disclosing sensitive information to third parties. The Suffolk New York Certification of Trust typically includes essential details such as the name of the trust, the date it was established, and the names of the trustees. It also confirms that the trust is validly executed and in effect. Due to its importance and legal significance, this certification is often required when engaging in various trust-related transactions. There are different types of Suffolk New York Certification of Trust that serve specific purposes. These include: 1. Real Estate Certification of Trust: This type of certification is commonly used in property transactions where the trust holds real estate assets. It verifies the trust's authority to enter into the transaction and assures the involved parties that the trust is legally binding. 2. Financial Institution Certification of Trust: When a trustee wishes to access or manage the trust's funds held by a financial institution, such as a bank, a Financial Institution Certification of Trust is required. This certification ensures that the trustee has the right to act on behalf of the trust and conduct financial transactions. 3. Testamentary Certification of Trust: A trust created through a will is known as a testamentary trust. A Testamentary Certification of Trust is needed to establish the validity and existence of such trusts following the granter's death. This certification is often required during the probate process to facilitate the distribution of assets. 4. Business Certification of Trust: Trusts established for business purposes, such as family business trusts or employee benefit trusts, may require a Business Certification of Trust. This certification allows the trustee to conduct business transactions, enter contracts, or make decisions on behalf of the trust. In Suffolk County, securing a Certification of Trust is crucial to ensure compliance with legal requirements and maintain the privacy of trust details. Whether dealing with real estate, financial institutions, testamentary matters, or business affairs, obtaining the appropriate type of certification ensures that the trust can operate effectively while safeguarding the confidential information contained within its trust agreement.