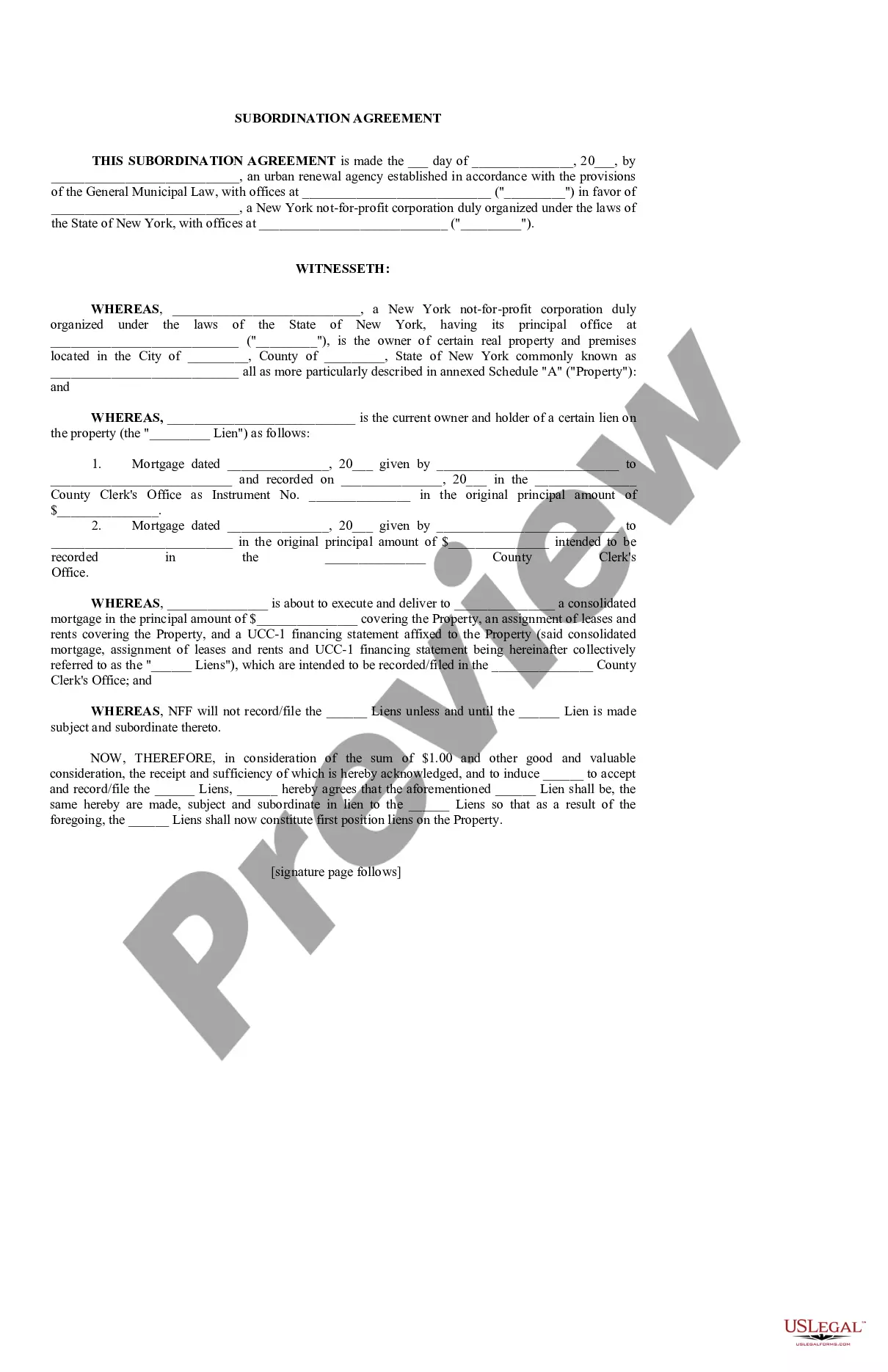

A Nassau New York Subordination Agreement is a legal document that outlines the priority of different liens against a property located in Nassau County, New York. This agreement is commonly used in real estate transactions when there are multiple mortgages or other liens on a property. In simple terms, a subordination agreement determines the order in which these liens will be paid off if the property is sold or foreclosed upon. By signing this agreement, the lender or lien holder voluntarily reduces their lien priority to allow another lender or lien holder to move into a higher priority position. There are several types of Nassau New York Subordination Agreements, depending on the specific circumstances and parties involved. Here are a few common types: 1. First Mortgage Subordination Agreement: This agreement is used when a property owner wishes to take out a second mortgage while maintaining the priority of their existing first mortgage. The first mortgage holder agrees to subordinate their lien to the new lender, allowing the second mortgage to take precedence in case of default or foreclosure. 2. Second Mortgage Subordination Agreement: In contrast to the first mortgage subordination agreement, this type is used when a property owner wants to refinance their first mortgage and obtain a second mortgage with a new lender. The existing second mortgage holder agrees to subordinate their lien to the new first mortgage, preserving the priority of the newly refinanced loan. 3. Intercreditor or Co-Lender Subordination Agreement: This agreement typically involves multiple lenders who have different lien positions on a property. It establishes the priority of payments in the event of default or foreclosure, ensuring that each lender receives their respective share based on their lien position. Nassau New York Subordination Agreements are crucial in real estate transactions as they provide clarity and protection for all parties involved. It is essential to consult with legal professionals experienced in New York real estate laws to draft and execute these agreements accurately. By doing so, lenders, property owners, and lien holders can avoid disputes and ensure their rights are protected in the event of default or foreclosure.

Nassau New York Subordination Agreement

Description

How to fill out Nassau New York Subordination Agreement?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law education to draft such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you require the Nassau New York Subordination Agreement or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Nassau New York Subordination Agreement in minutes employing our trustworthy platform. In case you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Nassau New York Subordination Agreement:

- Ensure the form you have found is specific to your area since the rules of one state or area do not work for another state or area.

- Preview the form and read a quick description (if provided) of cases the paper can be used for.

- In case the form you picked doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Choose the payment method and proceed to download the Nassau New York Subordination Agreement once the payment is completed.

You’re all set! Now you can go ahead and print out the form or complete it online. Should you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.