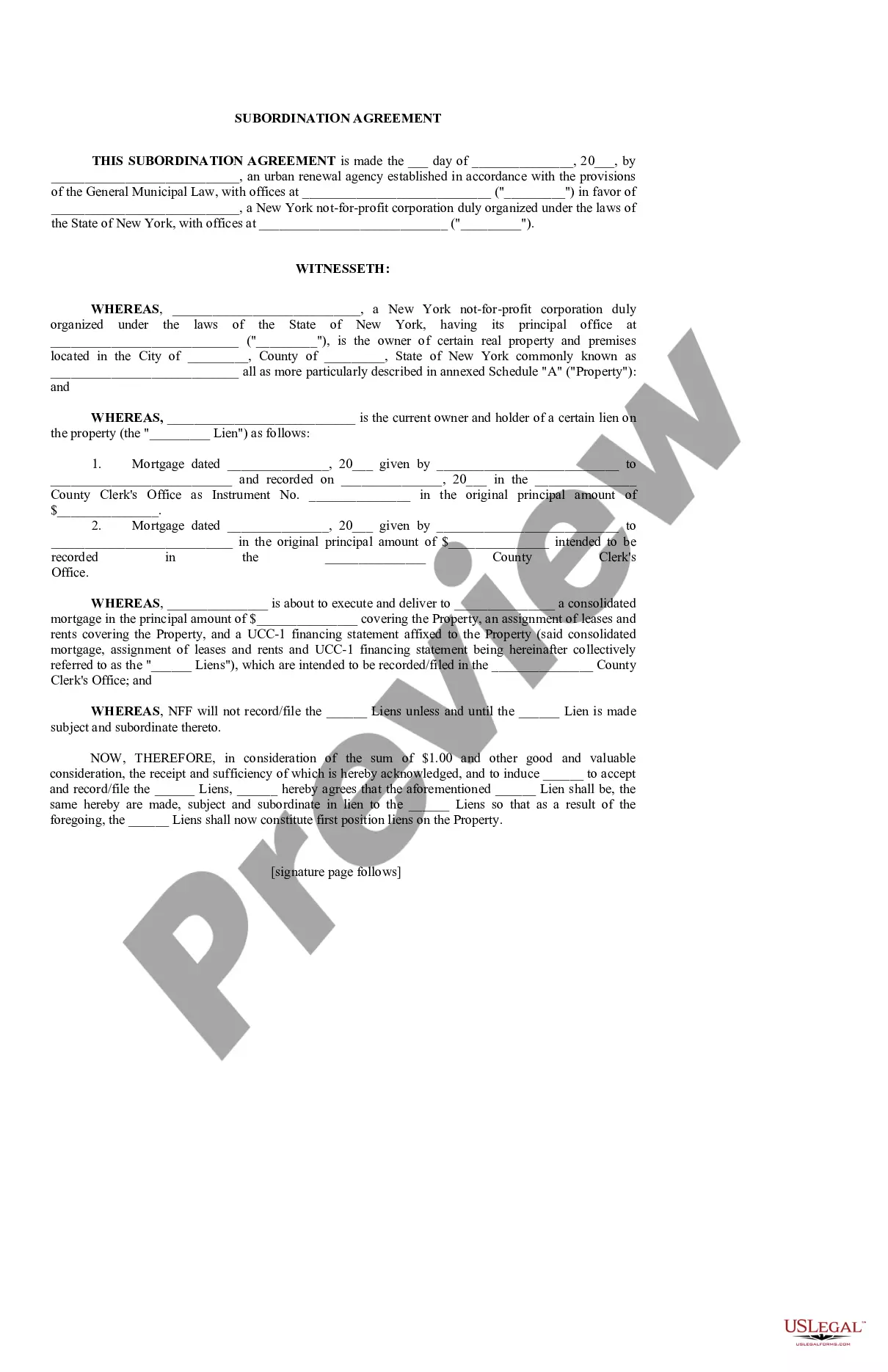

A Queens New York Subordination Agreement is a legal document that outlines the arrangement between multiple creditors or lien holders regarding the priority of their claims on a specific property or asset located in Queens, New York. This agreement establishes the order in which the creditors will be repaid in the event of a foreclosure or sale of the property. A subordination agreement is particularly important when there are multiple loans or liens against a property, as it clarifies the rights and priorities of each party involved. By signing this agreement, the parties acknowledge that one creditor's claim is superior (or subordinate) to another creditor's claim. There are different types of Queens New York Subordination Agreements, including: 1. Mortgage Subordination Agreement: This type of agreement is typically used when there is a primary mortgage on a property and the homeowner wants to take out a second mortgage. The primary mortgage lender must agree to subordinate its lien to the new lender, allowing the second mortgage to take priority in the event of default or foreclosure. 2. Construction Subordination Agreement: In cases where a property owner seeks to obtain additional financing for construction or renovation purposes, a construction subordination agreement may be required. This agreement ensures that the construction lender's claim takes precedence over all other liens, including the original mortgage, during the construction period. 3. Lease Subordination Agreement: When a tenant wishes to lease a property that already has a mortgage, the landlord may require the tenant to sign a lease subordination agreement. This agreement prioritizes the mortgage lender's claim over the leasehold interest, protecting the mortgage lender's rights in the event of default or foreclosure. 4. Judgment Subordination Agreement: If a judgment lien has been placed on a property due to a court ruling or legal judgment, a judgment subordination agreement may be utilized. This agreement allows the judgment lien holder to subordinate their claim, enabling another creditor to take priority over the judgment lien. In summary, a Queens New York Subordination Agreement is a crucial legal document used to establish the priority of claims in case of foreclosure or sale of a property. It ensures clarity and protection for all parties involved, particularly when multiple loans or liens exist.

Queens New York Subordination Agreement

Description

How to fill out Queens New York Subordination Agreement?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Queens New York Subordination Agreement? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and area.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Queens New York Subordination Agreement conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is good for.

- Restart the search if the template isn’t good for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Queens New York Subordination Agreement in any available file format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online for good.