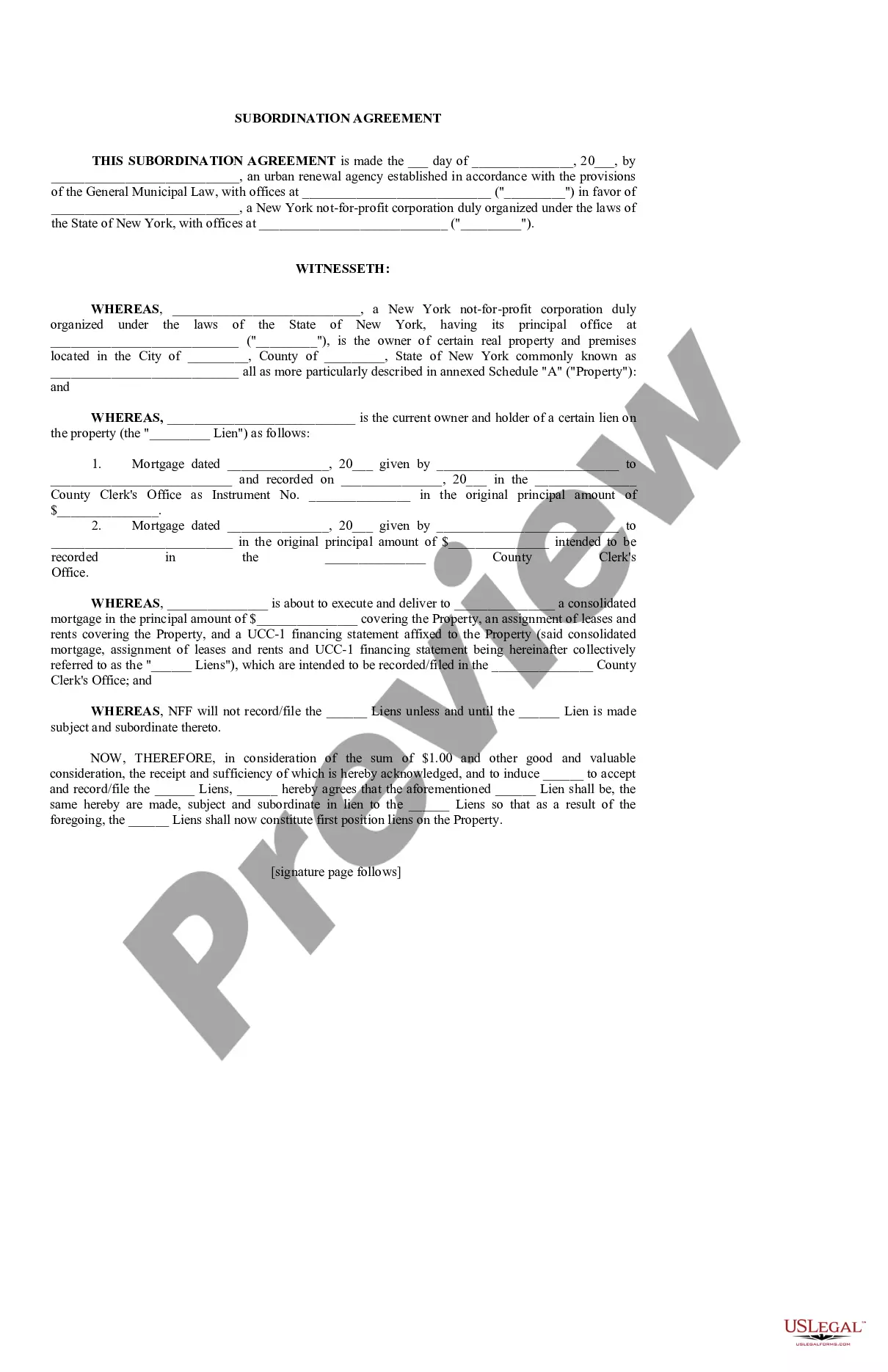

A Rochester New York Subordination Agreement is a legal document that establishes the order of priority for multiple debts or claims against a property or asset in Rochester, New York. It outlines the rights and priorities of different creditors in the event of foreclosure, bankruptcy, or default. In simpler terms, a subordination agreement determines which creditor will be paid first in case of a property's sale or liquidation to ensure that all parties involved are protected and receive their appropriate share. This agreement is commonly used in real estate transactions, where multiple loans or liens may exist on a property. There are several types of Rochester New York Subordination Agreements: 1. Mortgage Subordination Agreement: This is the most common type of subordination agreement used in real estate transactions. It occurs when a property owner wants to refinance their existing mortgage while keeping an existing second mortgage or home equity line of credit in place. The new lender requires the existing lien holder to subordinate their lien, allowing the new lender to take a first-position lien on the property. 2. Subordinated Debt Subordination Agreement: This type of subordination agreement occurs when a borrower has multiple loans or debts secured by the same collateral. In this scenario, the borrower obtains a loan with a junior lien, and the lender of the senior lien requires the borrower to sign a subordination agreement to establish their priority. 3. Intercreditor Subordination Agreement: This agreement is typically utilized in commercial real estate or complex financing transactions. It outlines the priority and relationship between different lenders with varying levels of debt. For example, it may clarify the rights and responsibilities of a first mortgage lender and a mezzanine lender. 4. UCC Subordination Agreement: This type of subordination agreement is related to personal property, rather than real estate. It occurs when multiple creditors have claims against a debtor's assets, such as inventory or equipment. The agreement specifies the priorities and rights of each creditor in the event of the debtor's default or bankruptcy. In conclusion, a Rochester New York Subordination Agreement is a crucial legal document that ensures the proper order of payment for multiple debts or claims against a property or asset. Different types of subordination agreements exist, including mortgage, subordinated debt, intercreditor, and UCC agreements, catering to various scenarios and contexts. These agreements provide clarity and protection to creditors and borrowers alike, promoting transparency and fairness in financial transactions in Rochester, New York.

Rochester New York Subordination Agreement

Description

How to fill out Rochester New York Subordination Agreement?

Finding approved templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both individual and professional requirements, addressing any real-life circumstances.

All documents are meticulously organized by category of use and jurisdictional areas, making the discovery of the Rochester New York Subordination Agreement as swift and simple as 1-2-3.

Maintain your paperwork tidy and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates for any needs right at your fingertips!

- Review the Preview mode and form explanation.

- Ensure that you have selected the correct one that aligns with your requirements and fully adheres to your local jurisdiction criteria.

- Seek another template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next stage.

- Acquire the document.

Form popularity

FAQ

The statute of limitations for New York State taxes is generally three years from the date the return was filed. However, this period can extend if you underreport income or if no return was filed at all. Understanding this can be crucial in managing any potential implications with a Rochester New York Subordination Agreement.

A New York State tax audit can be triggered by several factors, including discrepancies on your tax return, random selection, or specific high-risk deductions. Maintaining accurate financial records is crucial to reduce audit risks. If your audit relates to a Rochester New York Subordination Agreement, consulting with professionals can guide your steps.

In New York, a tax lien grants the state a legal claim over a taxpayer’s property when taxes remain unpaid. This lien can accrue interest and may even lead to the sale of the property to satisfy tax debts. If you need assistance with your Rochester New York Subordination Agreement in relation to tax liens, uslegalforms can provide valuable resources and templates.

A New York State tax warrant is a legal document that establishes a lien against your property for unpaid taxes. It allows the state to take action to collect the owed taxes, securing their interests. If you're facing a tax issue, understanding your Rochester New York Subordination Agreement is essential for protecting your assets.

A New York State tax warrant remains active for a period of 20 years unless satisfied or canceled. If you find yourself facing a tax warrant and need help navigating your Rochester New York Subordination Agreement, consider reaching out to uslegalforms for tailored solutions.

In New York, warrants may be subject to taxation based on the underlying income or property they represent. Specifically, if you are dealing with a Rochester New York Subordination Agreement, the income generated from warrants can be taxable as personal income, which must be reported on your tax returns.

If you need to reach the New York State Department of Taxation and Finance regarding tax liens, you can contact them at 1-518-457-5434. They can assist you with inquiries related to your Rochester New York Subordination Agreement and provide guidance on tax lien matters.

A subordination agreement in favor of a lender is a document that allows one lender to take a lower priority position in repayment compared to another lender. This Rochester New York Subordination Agreement benefits the senior lender by providing them with increased security on the debt owed. Such agreements can be critical during refinancing or restructuring, ensuring that the necessary capital is available without jeopardizing the senior debt.

An intercreditor agreement is a legal contract that defines the rights and responsibilities of multiple creditors involved in a lending situation. Within a Rochester New York Subordination Agreement context, this document is vital for establishing each lender's priority in case of a default. By clearly outlining these relationships, creditors can work cooperatively while protecting their financial interests.

Subordination, non-disturbance, and attornment refer collectively to the agreements that define the rights and responsibilities between tenants and lenders. These terms encompass how tenants maintain their leases when the property changes hands and alleviate concerns in the event of foreclosure. When exploring a Rochester New York Subordination Agreement, understanding these components helps safeguard your rights and promotes better relationships with lenders.