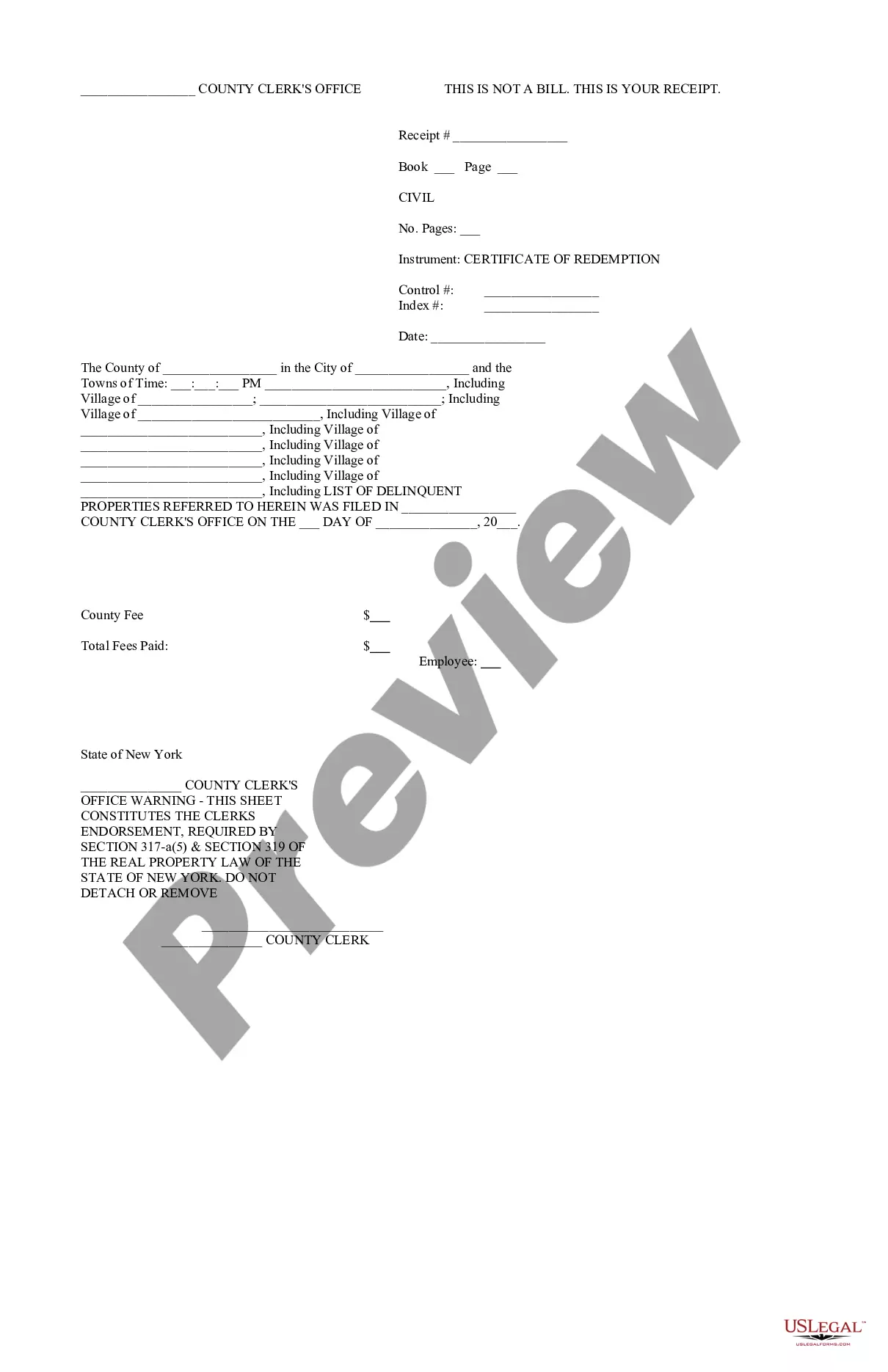

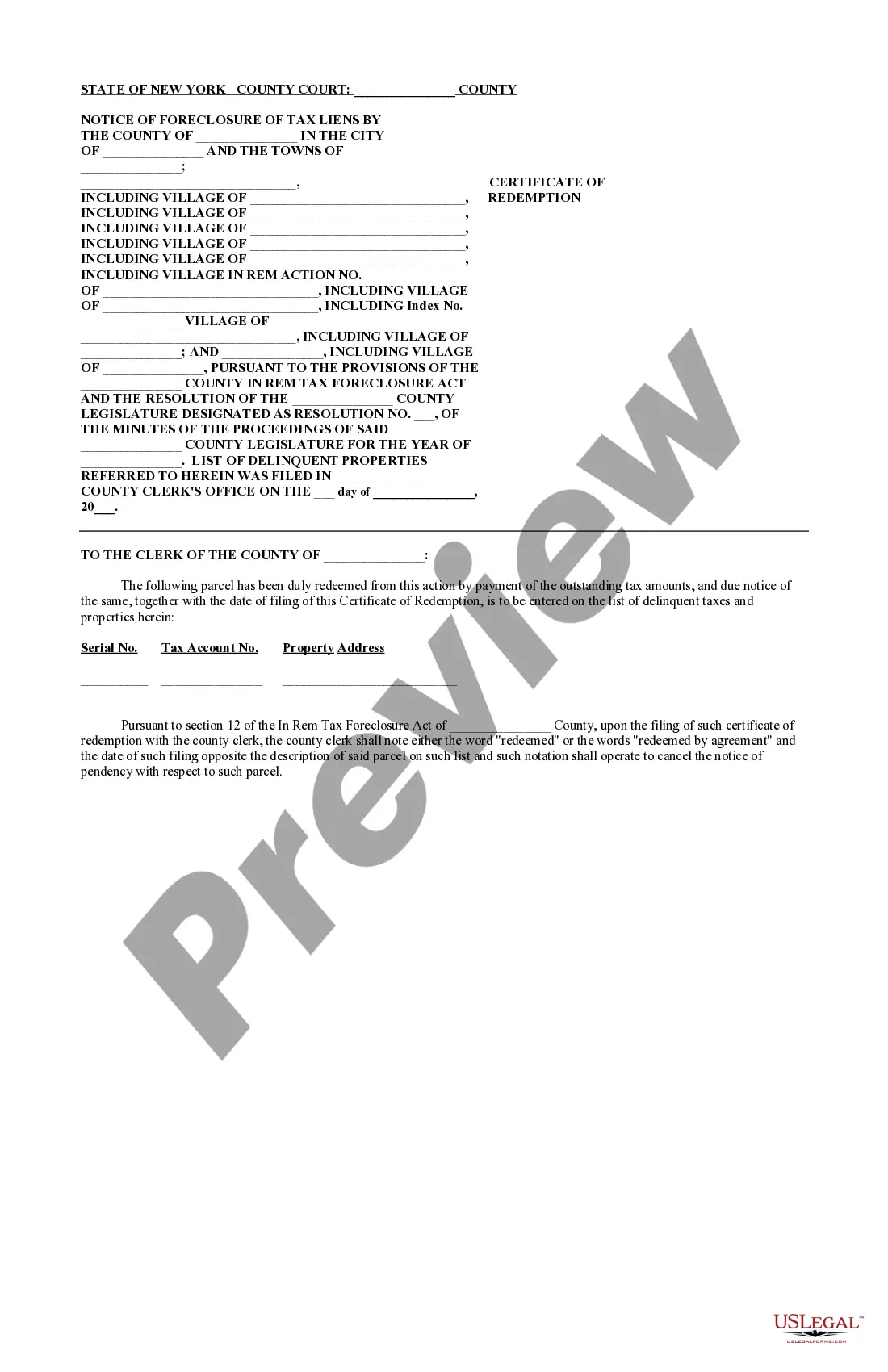

The Kings New York Certificate of Redemption is a legal document that allows property owners in the county of Kings, New York, to redeem their real estate from tax liens. This process is crucial for individuals or businesses facing foreclosure due to unpaid property taxes. With regard to different types, the Kings New York Certificate of Redemption includes several variations based on the specific circumstances of the property owner. These can include: 1. Residential Certificate of Redemption: This type of certificate applies to homeowners who have fallen behind on their property tax payments for residential properties such as houses, apartments, or condominiums. 2. Commercial Certificate of Redemption: For individuals or businesses that own commercial properties, such as office buildings, retail spaces, or warehouses, the commercial certificate of redemption provides a means to redeem the property and prevent foreclosure. 3. Vacant Land Certificate of Redemption: In cases where the property in question is undeveloped land, the vacant land certificate of redemption allows owners to reclaim their property despite unpaid taxes. 4. Industrial Certificate of Redemption: For properties classified as industrial, such as manufacturing plants or distribution centers, the industrial certificate of redemption can save owners from losing their assets and provide an opportunity to catch up on tax payments. The process of obtaining a Kings New York Certificate of Redemption involves several steps. Property owners must first contact the Kings County Clerk's Office or visit their website to access the necessary forms and documentation. They will need to fill out the required forms, which include details about the property, the outstanding tax amounts, and any additional fees. Once the forms are completed, property owners must submit them along with the required redemption amount, which typically includes the total amount of unpaid taxes, accrued interest, penalties, and any other associated costs. It's important to provide accurate and up-to-date information to ensure a smooth redemption process. After the submission, the Kings County Clerk's Office will review the application for completeness and verification. If all requirements are met, the office will issue the Kings New York Certificate of Redemption, certifying the successful redemption of the property. Property owners can then regain full ownership rights and prevent any further legal action related to tax liens. In summary, the Kings New York Certificate of Redemption is a vital instrument that offers property owners in Kings County the opportunity to redeem their real estate from tax liens. Through various types, such as residential, commercial, vacant land, and industrial certificates, property owners can reclaim their assets and avoid foreclosure. By understanding the redemption process and fulfilling the necessary requirements, individuals and businesses can navigate their way back to financial stability.

The Kings New York Certificate of Redemption is a legal document that allows property owners in the county of Kings, New York, to redeem their real estate from tax liens. This process is crucial for individuals or businesses facing foreclosure due to unpaid property taxes. With regard to different types, the Kings New York Certificate of Redemption includes several variations based on the specific circumstances of the property owner. These can include: 1. Residential Certificate of Redemption: This type of certificate applies to homeowners who have fallen behind on their property tax payments for residential properties such as houses, apartments, or condominiums. 2. Commercial Certificate of Redemption: For individuals or businesses that own commercial properties, such as office buildings, retail spaces, or warehouses, the commercial certificate of redemption provides a means to redeem the property and prevent foreclosure. 3. Vacant Land Certificate of Redemption: In cases where the property in question is undeveloped land, the vacant land certificate of redemption allows owners to reclaim their property despite unpaid taxes. 4. Industrial Certificate of Redemption: For properties classified as industrial, such as manufacturing plants or distribution centers, the industrial certificate of redemption can save owners from losing their assets and provide an opportunity to catch up on tax payments. The process of obtaining a Kings New York Certificate of Redemption involves several steps. Property owners must first contact the Kings County Clerk's Office or visit their website to access the necessary forms and documentation. They will need to fill out the required forms, which include details about the property, the outstanding tax amounts, and any additional fees. Once the forms are completed, property owners must submit them along with the required redemption amount, which typically includes the total amount of unpaid taxes, accrued interest, penalties, and any other associated costs. It's important to provide accurate and up-to-date information to ensure a smooth redemption process. After the submission, the Kings County Clerk's Office will review the application for completeness and verification. If all requirements are met, the office will issue the Kings New York Certificate of Redemption, certifying the successful redemption of the property. Property owners can then regain full ownership rights and prevent any further legal action related to tax liens. In summary, the Kings New York Certificate of Redemption is a vital instrument that offers property owners in Kings County the opportunity to redeem their real estate from tax liens. Through various types, such as residential, commercial, vacant land, and industrial certificates, property owners can reclaim their assets and avoid foreclosure. By understanding the redemption process and fulfilling the necessary requirements, individuals and businesses can navigate their way back to financial stability.