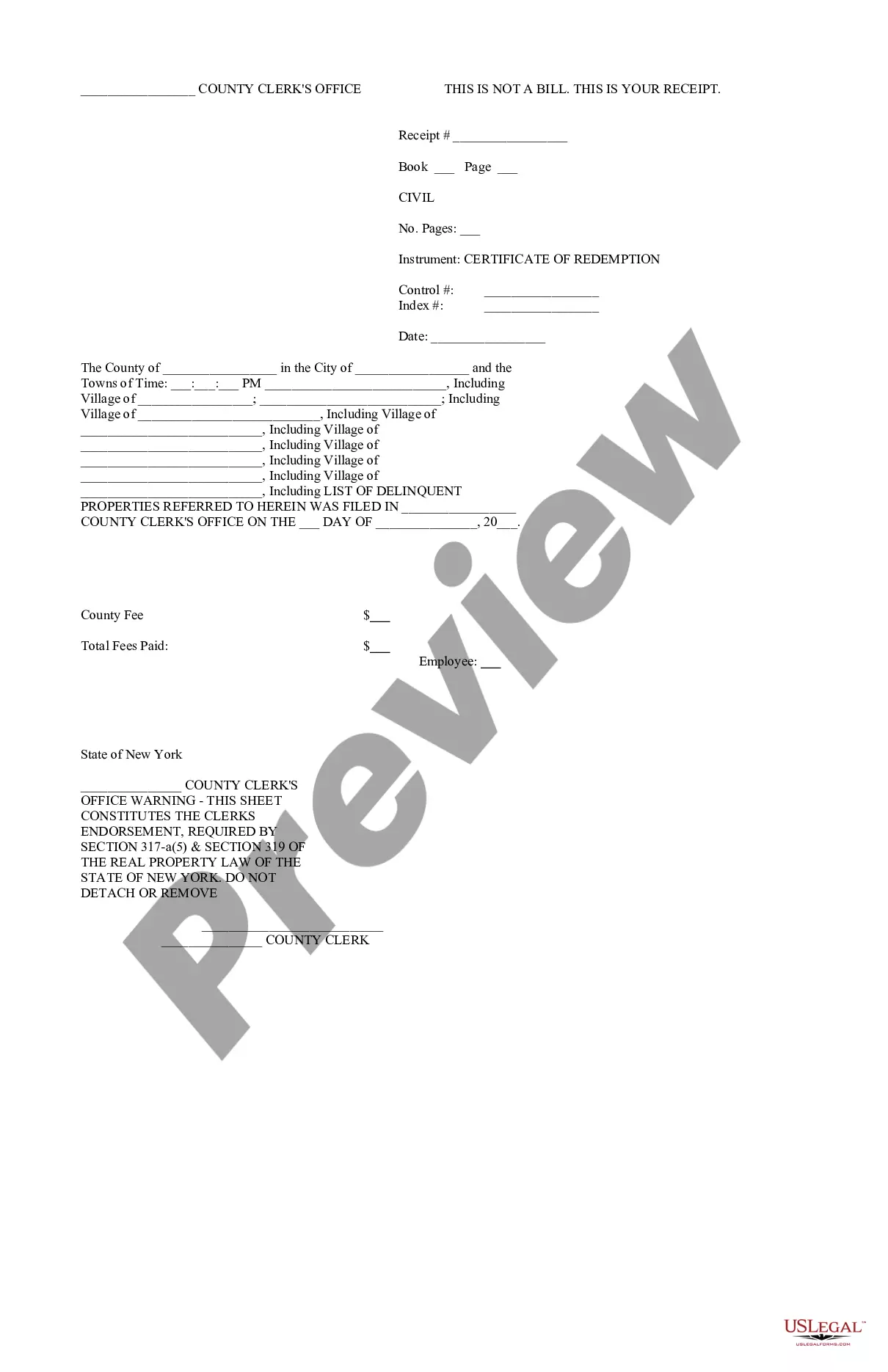

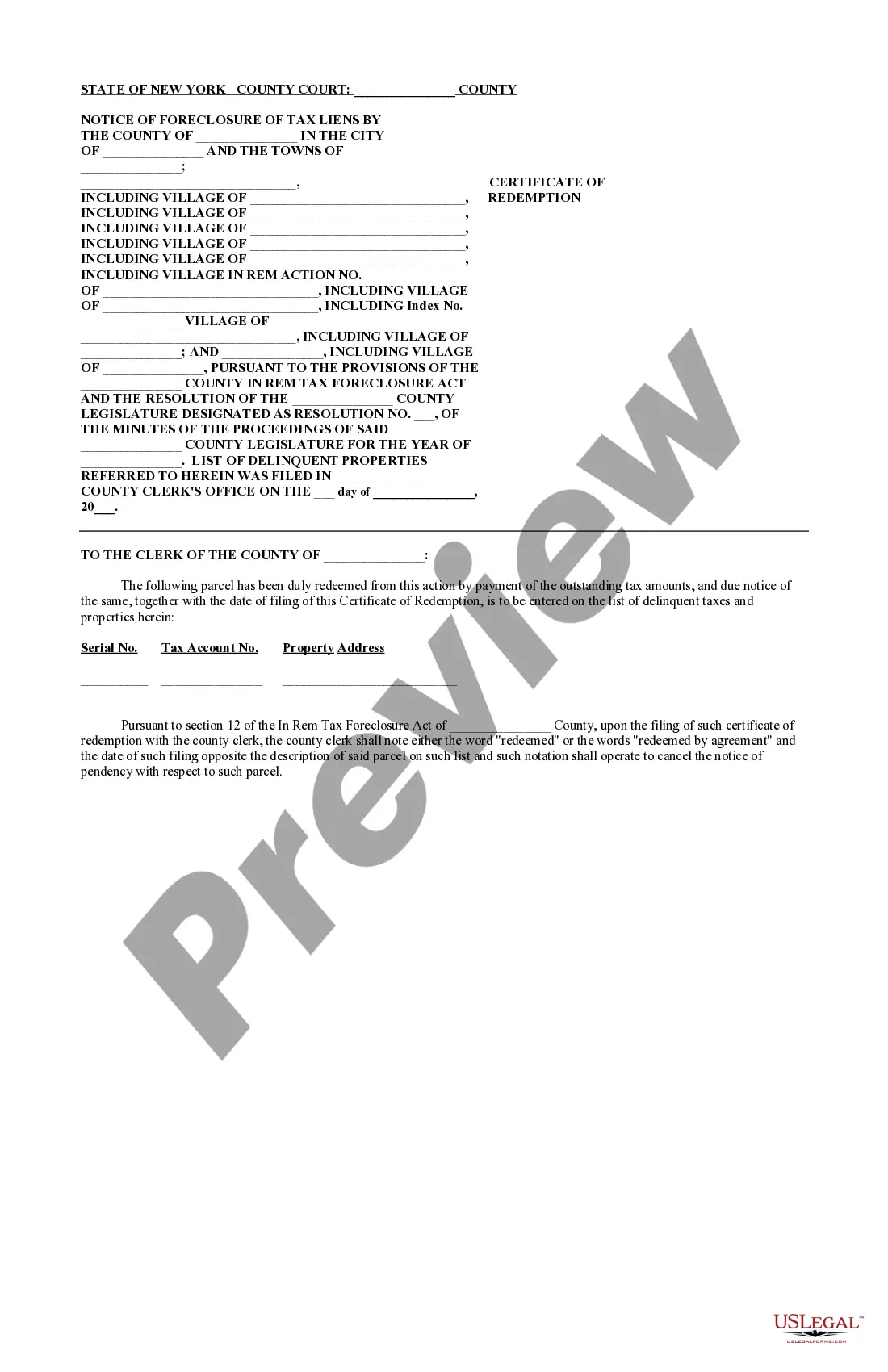

Queens New York Certificate of Redemption is a legal document issued to individuals or entities who have previously defaulted on the payment of property taxes in Queens, New York. It represents a means for the redemption of such delinquent tax payments and serves as proof that the outstanding taxes have been paid in full. The certificate is typically issued by the Office of the Queens County Treasurer or the Department of Finance in Queens, New York. It is an essential document for property owners looking to clear their tax obligations and regain complete ownership rights over their properties. There are several types of Queens New York Certificate of Redemption, each depending on the specific circumstances and requirements. Some common types include: 1. Residential Property Certificate of Redemption: This type of certificate is issued for properties classified as residential, including single-family homes, condos, townhouses, and multi-family dwellings. 2. Commercial Property Certificate of Redemption: Designed for properties categorized as commercial, such as office spaces, retail buildings, industrial facilities, and warehouses, this certificate allows property owners to redeem their delinquent taxes. 3. Vacant Land Certificate of Redemption: If the property in question is vacant land, there is a unique certificate issued for its redemption. It covers undeveloped land parcels and allows owners to settle their outstanding taxes and claim full ownership. 4. Mixed-Use Property Certificate of Redemption: This certificate applies to properties that combine residential and commercial use, providing owners with a means to redeem both residential and commercial tax liabilities. Regardless of the type, obtaining a Queens New York Certificate of Redemption requires fulfilling certain criteria, such as paying all outstanding tax principal, interest, penalties, and any associated fees. Property owners must follow the redemption procedure stipulated by the Office of the Queens County Treasurer or the Department of Finance to successfully obtain the certificate. In conclusion, the Queens New York Certificate of Redemption is a crucial document for property owners in Queens, New York, who have fallen behind on their property tax payments. By obtaining this certificate, individuals can redeem their delinquent taxes, clear their obligations, and regain complete ownership rights over their properties. Whether it is a residential, commercial, vacant land, or mixed-use property, owners must adhere to the redemption procedure to secure the appropriate certificate.

Queens New York Certificate of Redemption

Description

How to fill out Queens New York Certificate Of Redemption?

If you are searching for a relevant form template, it’s extremely hard to find a better place than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can get a large number of form samples for company and personal purposes by types and regions, or key phrases. With our advanced search feature, finding the most up-to-date Queens New York Certificate of Redemption is as elementary as 1-2-3. In addition, the relevance of each record is verified by a group of expert attorneys that on a regular basis review the templates on our website and revise them in accordance with the newest state and county laws.

If you already know about our system and have a registered account, all you need to get the Queens New York Certificate of Redemption is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the sample you want. Check its explanation and utilize the Preview option (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to get the needed record.

- Affirm your choice. Select the Buy now option. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the form. Indicate the file format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the received Queens New York Certificate of Redemption.

Every single form you save in your user profile does not have an expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you need to receive an extra copy for enhancing or printing, you may return and download it once again anytime.

Make use of the US Legal Forms professional catalogue to get access to the Queens New York Certificate of Redemption you were seeking and a large number of other professional and state-specific samples on one platform!