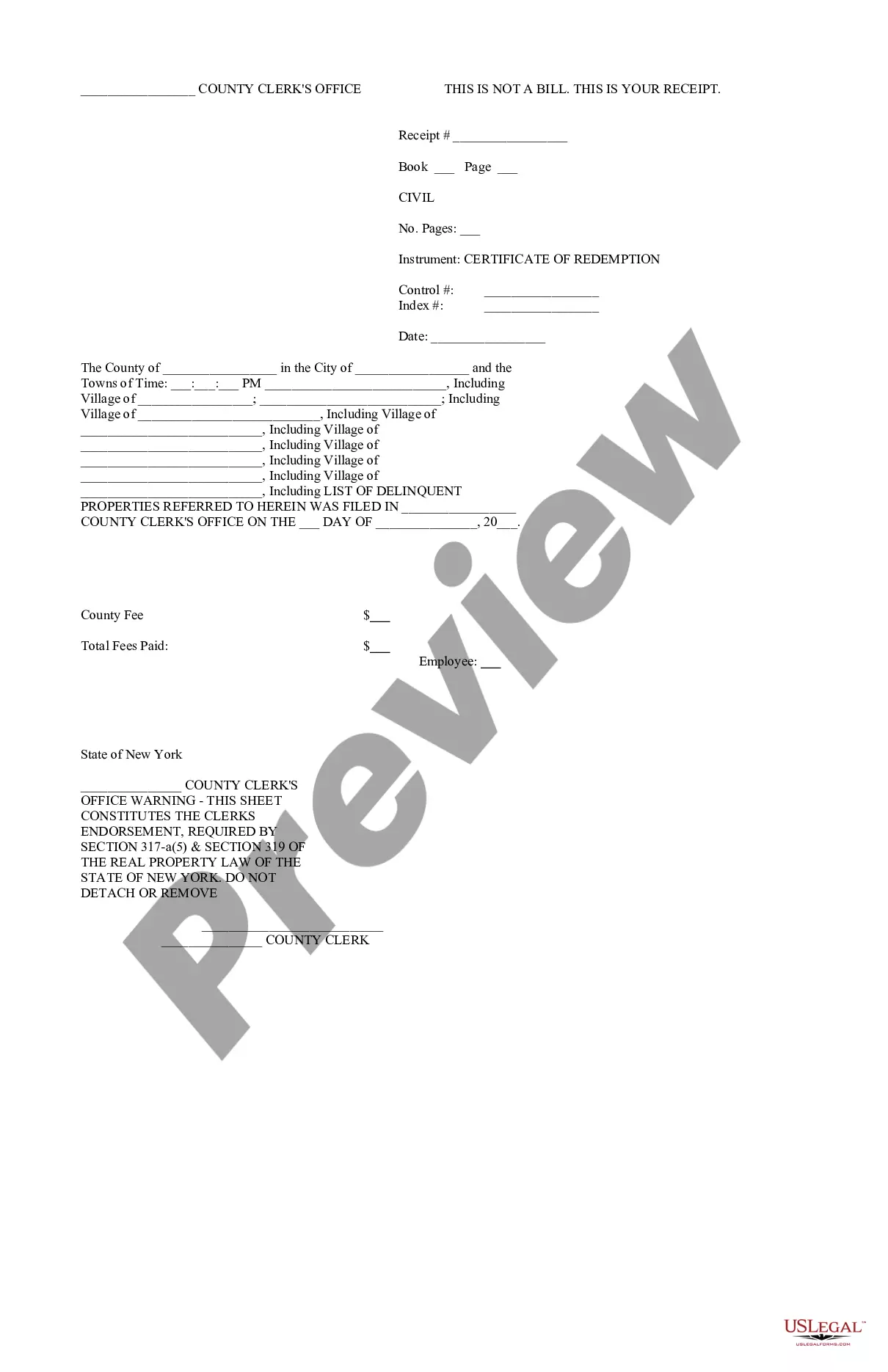

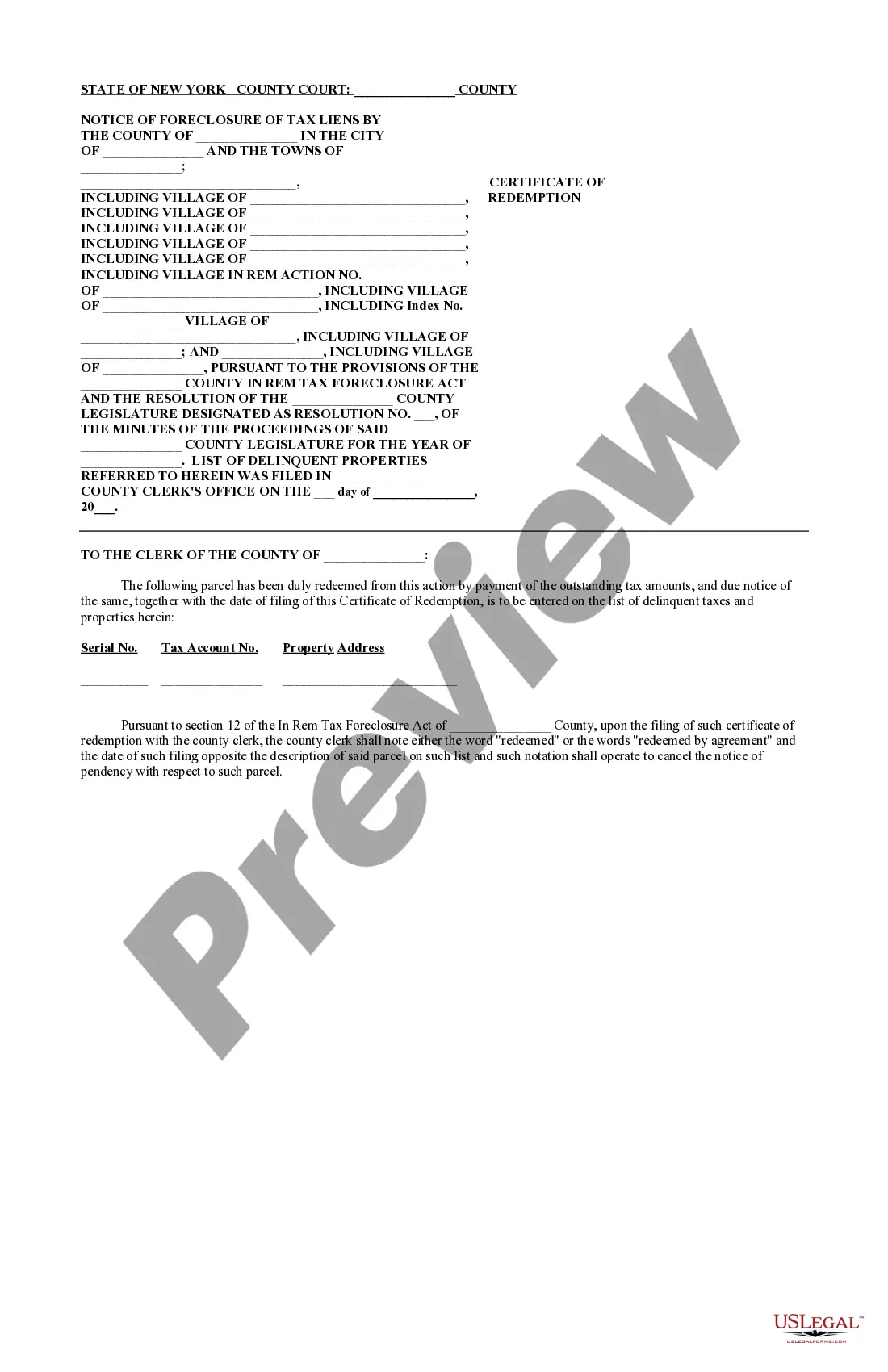

The Yonkers New York Certificate of Redemption is an essential document designed to provide property owners in the city of Yonkers with the opportunity to redeem their property after it has been sold at a tax lien auction. The certificate serves as proof of payment for outstanding taxes and allows property owners to regain control of their property. When a property owner in Yonkers fails to pay their property taxes, the city government takes action to recover the unpaid funds by holding a tax lien auction. At this auction, investors purchase the tax lien on the property. If the property owner fails to redeem the property within a specific time period, usually two years, the tax lien holder can begin the foreclosure process. At this stage, the Yonkers New York Certificate of Redemption becomes crucial. It allows property owners to pay off the outstanding taxes, accrued interest, penalties, and any additional fees associated with the tax lien. The certificate validates that the property owner has fully redeemed their property and can regain full ownership. There are two primary types of Yonkers New York Certificates of Redemption: 1. Property Tax Redemption Certificate: This type of certificate is issued when a property owner wishes to redeem their property after it has been sold at a tax lien auction. The certificate covers all unpaid taxes, interest, penalties, and additional fees. 2. Special Assessment Redemption Certificate: In some cases, property owners may also be subject to special assessments for services or improvements conducted within their area. If these assessments are unpaid, a separate certificate is issued to redeem the property from these liens. It is important to note that the Yonkers New York Certificate of Redemption must be obtained from the Yonkers City Treasurer's Office. Property owners are required to provide proof of payment for all outstanding amounts before the certificate can be issued. In summary, the Yonkers New York Certificate of Redemption is a crucial document for property owners to regain control of their property after it has been sold at a tax lien auction in Yonkers. This certificate offers a means to settle all outstanding taxes, interest, penalties, and fees, allowing property owners to redeem their property and restore ownership.

Yonkers New York Certificate of Redemption

Description

How to fill out Yonkers New York Certificate Of Redemption?

If you are searching for a relevant form, it’s impossible to choose a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the web. Here you can find a large number of document samples for business and personal purposes by types and regions, or keywords. Using our advanced search feature, getting the newest Yonkers New York Certificate of Redemption is as elementary as 1-2-3. In addition, the relevance of each and every document is proved by a group of skilled attorneys that regularly check the templates on our platform and revise them according to the most recent state and county demands.

If you already know about our system and have an account, all you should do to receive the Yonkers New York Certificate of Redemption is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the form you want. Read its explanation and make use of the Preview function to check its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to get the needed file.

- Affirm your choice. Select the Buy now option. Next, choose the preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the file format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Yonkers New York Certificate of Redemption.

Every form you add to your profile does not have an expiration date and is yours forever. You always have the ability to access them via the My Forms menu, so if you need to get an extra duplicate for enhancing or printing, you may come back and export it once again whenever you want.

Make use of the US Legal Forms professional collection to get access to the Yonkers New York Certificate of Redemption you were looking for and a large number of other professional and state-specific templates in one place!