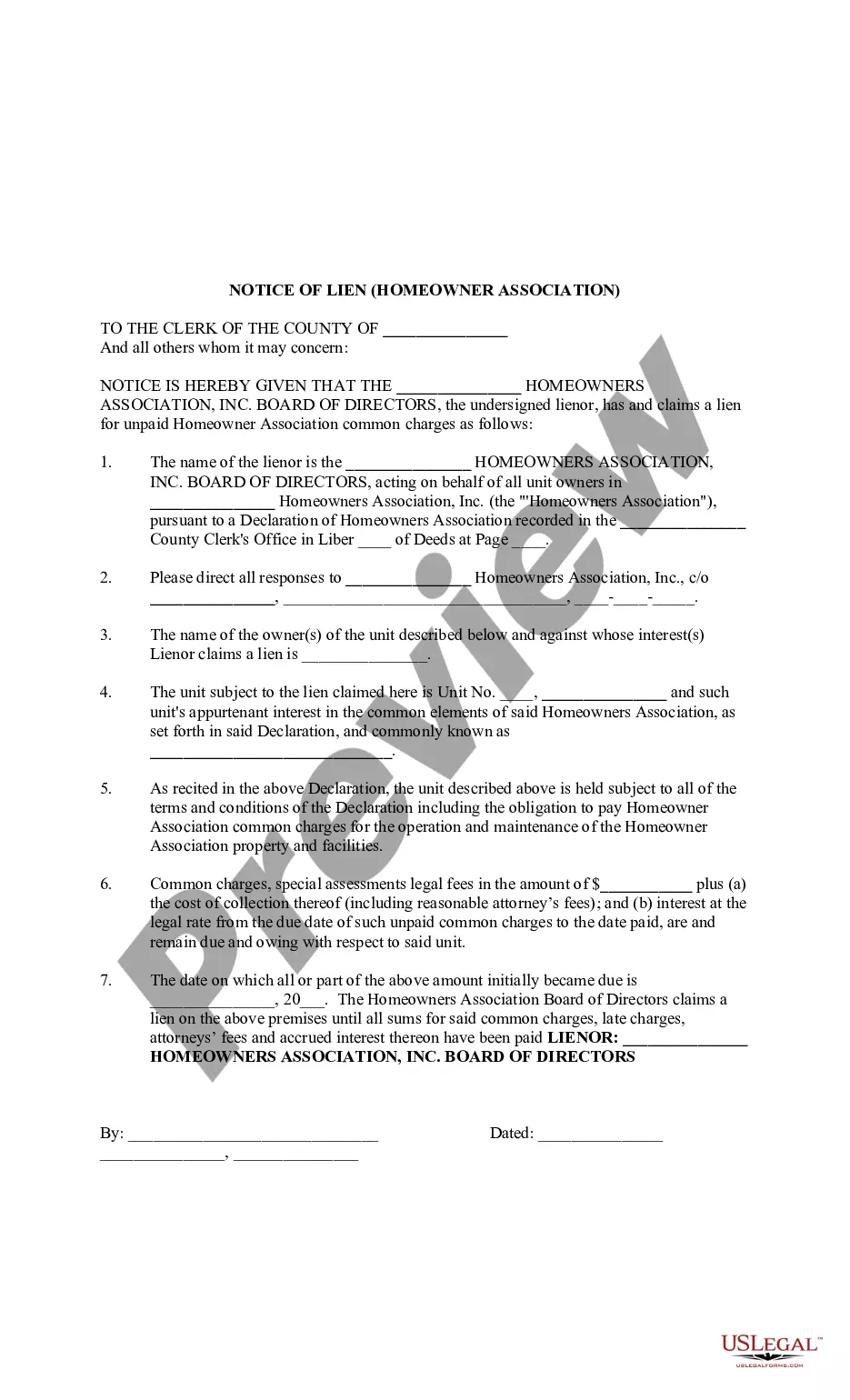

Nassau New York Notice of Lien from Homeowner Association — Understanding Your Rights and Legal Responsibilities In Nassau County, New York, a Notice of Lien from a Homeowner Association is a legal document that a homeowner association (HOA) may file against a property owner for unpaid fees or assessments. This notice serves as a formal warning to owners who have neglected their financial obligations to the HOA and outlines the consequences of continued non-payment. The Notice of Lien from Homeowner Association contains important information regarding the terms of the lien, including the outstanding amount owed, the due date, and any interest or late fees that may have accrued. This document is typically sent by certified mail to guarantee it reaches the property owner and serves as official notice of the HOA's intent to pursue legal action if the debts remain unpaid. It is crucial for homeowners who receive this notice to carefully review its contents and understand their rights and obligations. Failure to respond or resolve the unpaid fees within a designated timeframe can result in severe consequences, such as foreclosure or the sale of the property to satisfy the outstanding debt. Different types of Nassau New York Notice of Lien from Homeowner Association may include: 1. Non-payment of Monthly Maintenance Fees: This type of lien is filed when a property owner fails to remit their monthly maintenance fees to the HOA. These fees are typically used to cover common expenses such as landscaping, security, and community amenities. 2. Special Assessments: Special assessments are one-time fees imposed by the HOA to cover unexpected expenses or capital improvements within the community. If a property owner neglects to pay these assessments, the HOA may file a lien against them. 3. Unpaid Penalties: Homeowner associations often establish rules and regulations to maintain a harmonious living environment. When homeowners violate these rules, they may face penalties or fines. Failure to pay these penalties can result in a Notice of Lien being filed against the property. 4. Legal Fees and Costs: In some cases, when a homeowner breaches the terms of their agreement with the HOA, legal disputes may arise. If the HOA prevails in court or reaches a settlement, the homeowner may be responsible for reimbursing the association's legal fees and costs. An unpaid balance in this regard may also trigger a Notice of Lien. It is essential for homeowners who find themselves in receipt of a Nassau New York Notice of Lien from a Homeowner Association to act promptly. Options for resolution may include paying the outstanding balance in full, negotiating a payment plan, or disputing the lien through legal means if there are valid grounds for doing so. Protecting your property and maintaining a positive relationship with the homeowner association is crucial. By staying informed, fulfilling your financial obligations, and seeking legal advice if needed, you can navigate the Nassau County, New York, HOA lien process effectively and prevent further legal complications.

Nassau New York Notice of Lien from Homeowner Association

Description

How to fill out Nassau New York Notice Of Lien From Homeowner Association?

If you are searching for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms site – one of the most extensive online libraries. Here you can get thousands of form samples for business and personal purposes by categories and regions, or keywords. With our advanced search feature, getting the newest Nassau New York Notice of Lien from Homeowner Association is as elementary as 1-2-3. Furthermore, the relevance of every file is verified by a group of professional lawyers that regularly review the templates on our platform and revise them in accordance with the most recent state and county demands.

If you already know about our platform and have an account, all you should do to receive the Nassau New York Notice of Lien from Homeowner Association is to log in to your user profile and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the form you want. Check its information and use the Preview feature (if available) to explore its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the needed document.

- Affirm your selection. Choose the Buy now option. Following that, pick the preferred pricing plan and provide credentials to register an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired Nassau New York Notice of Lien from Homeowner Association.

Every single form you save in your user profile does not have an expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to get an extra version for modifying or printing, you can come back and export it once more anytime.

Make use of the US Legal Forms extensive collection to get access to the Nassau New York Notice of Lien from Homeowner Association you were looking for and thousands of other professional and state-specific samples on one website!