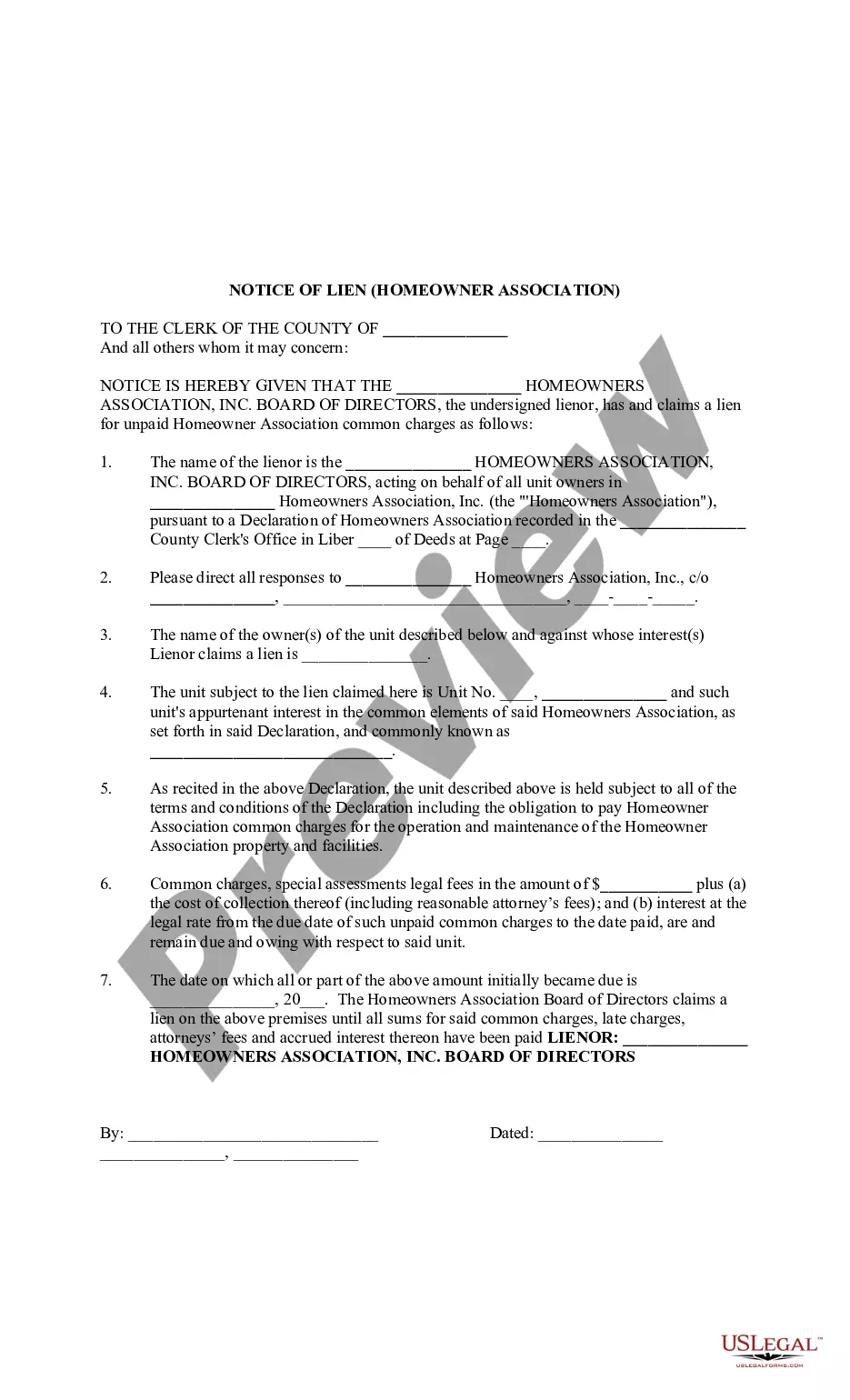

Queens New York Notice of Lien from Homeowner Association

Description

How to fill out New York Notice Of Lien From Homeowner Association?

Irrespective of societal or occupational rank, completing legal-related documents is a regrettable requirement in today's work landscape.

Frequently, it’s nearly unfeasible for an individual with no legal expertise to generate this type of paperwork independently, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Ensure that the document you have selected is appropriate for your area, as the laws of one state or county may not apply to another.

Review the document and examine a brief description (if available) of the scenarios for which the document can be utilized.

- Our service provides an extensive catalog containing over 85,000 ready-to-utilize state-specific forms suitable for nearly any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time with our DIY documents.

- Whether you require the Queens New York Notice of Lien from Homeowner Association or any other form applicable in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how to swiftly obtain the Queens New York Notice of Lien from Homeowner Association using our dependable service.

- If you are already a registered user, you can proceed to Log In to your account to access the relevant form.

- However, if you are new to our database, make sure you follow these instructions before downloading the Queens New York Notice of Lien from Homeowner Association.

Form popularity

FAQ

Finding out if there is a lien on a property in New York involves searching public records through county offices. You can look online or visit in person to access these records. This is crucial for anyone considering purchasing or refinancing property. Additionally, uslegalforms offers reliable services to ensure you are informed about any outstanding liens against properties in Queens, New York.

You can find out if a lien has been filed on your property by checking with your local government office, such as the county clerk or recorder’s office. Online property records are often available, allowing you to search for liens by property address or owner's name. This proactive approach helps you stay ahead of potential issues. Our platform, uslegalforms, makes it convenient to search for any liens against your property in Queens, New York.

Yes, liens are public record in New York, which means they are accessible for anyone to view. This transparency helps potential buyers and lenders assess the risk associated with a property. You can easily obtain information about any existing liens filed against a property through your local clerk's office or online databases. To streamline your search, uslegalforms offers tools to help you track the history of your property, including any liens.

In New York, a lien generally remains on your property for a period of 10 years. However, it can be renewed if the debt remains unpaid. Knowing the duration a lien stays on your property can assist you in strategizing your repayment plans. For additional information regarding the Queens New York Notice of Lien from Homeowner Association, consider consulting resources on uslegalforms to understand your obligations.

Yes, a lien can be placed on your property without your immediate knowledge. Homeowner associations often file liens when dues remain unpaid, and you might not receive any direct notice until the lien is recorded. It is essential to monitor your property records to stay informed. Utilizing services from uslegalforms can help you keep track of any liens on properties in Queens, New York.

A notice of intent to lien in New York serves as a formal warning from a homeowner association that a lien may be placed on your property due to unpaid dues. This notice provides you with an opportunity to settle your debt before further action is taken. Generally, this notice stipulates the amount owed and the consequences of not addressing the issue. Understanding the Queens New York Notice of Lien from Homeowner Association can help you avoid costly legal ramifications.

To put a lien on your property in New York, file a Notice of Lien form in the county where your property is located. Make sure that the lien is properly formatted and includes all necessary details. If you seek to create a Queens New York Notice of Lien from Homeowner Association, you can utilize platforms like uslegalforms for assistance and templates tailored to your needs.

To file a lien for HOA dues, you first need to verify that the dues remain unpaid. After confirming, complete a Notice of Lien and submit it to the appropriate county clerk's office. This process is essential for establishing a Queens New York Notice of Lien from Homeowner Association effectively.

In New York, you generally have one year to file a lien after the debt becomes due. This timeline is important to remember! Ensure that you take timely action to secure your claim. For a Queens New York Notice of Lien from Homeowner Association, staying within this timeframe allows for better protection of your financial interests.

Yes, you can file a lien on your own, but it's important to understand the process and requirements involved. While the steps might seem straightforward, having support can ensure accuracy and compliance. If you're looking to manage a Queens New York Notice of Lien from Homeowner Association, consider leveraging platforms like uslegalforms for guidance.