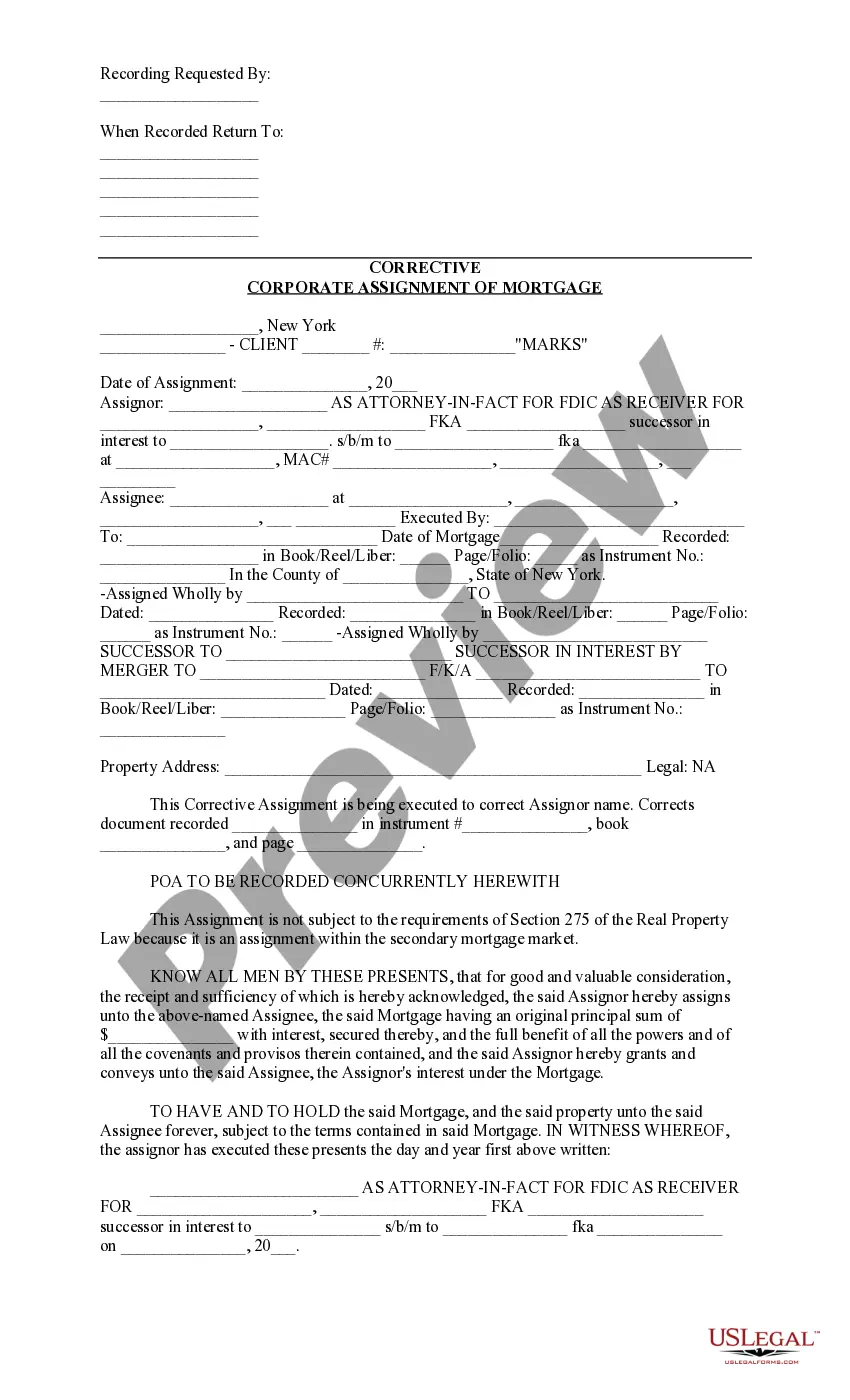

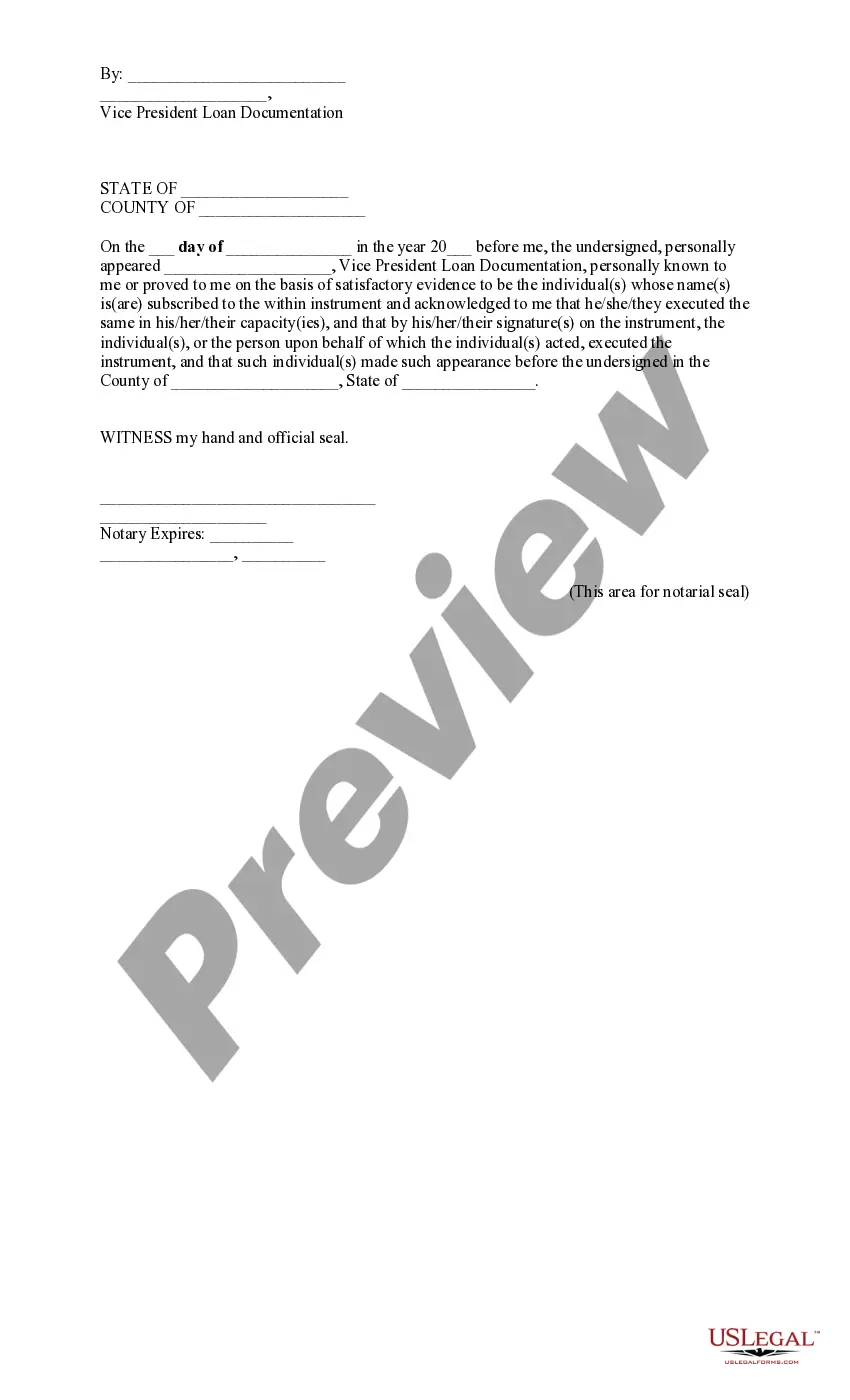

Suffolk New York Corrective Corporate Assignment of Mortgage is a legal document used in the real estate industry that allows a mortgage lender to transfer ownership rights of a mortgage loan to another party. This document is primarily used to correct any errors or deficiencies in the original assignment of mortgage. A Suffolk New York Corrective Corporate Assignment of Mortgage is necessary when there are mistakes or omissions in the initial assignment that can render it invalid or incomplete. It is essential to rectify these errors to ensure the smooth transfer of ownership and to protect the rights of all parties involved. One type of Suffolk New York Corrective Corporate Assignment of Mortgage is the Corrective Assignment of Mortgage due to a typographical or clerical error. This occurs when there are mistakes in the borrower's name, the mortgage amount, or any other crucial details. The correction document will be filed with the appropriate county office to ensure the accuracy of the assignment. Another type is the Corrective Assignment of Mortgage due to an error in the legal description of the property. This situation arises when there is an error in the property address, legal description, or any other related information that affects the validity of the original assignment. The corrective document is prepared to rectify these inaccuracies and ensure a proper transfer of ownership. Sometimes, a Corrective Assignment of Mortgage is required when the original assignment does not comply with specific legal requirements or regulations. This can include missing signatures, incorrect notarization, or failure to include all necessary parties in the assignment. The corrective document will address these issues to ensure compliance with the applicable laws. In summary, a Suffolk New York Corrective Corporate Assignment of Mortgage is a legal document used to rectify errors, deficiencies, or non-compliance issues in the original assignment of a mortgage loan. By correcting these issues, the document ensures a valid transfer of ownership and protects the rights of all parties involved in the transaction.

Suffolk New York Corrective Corporate Assignment of Mortgage

State:

New York

County:

Suffolk

Control #:

NY-LR146T

Format:

Word;

Rich Text

Instant download

Description

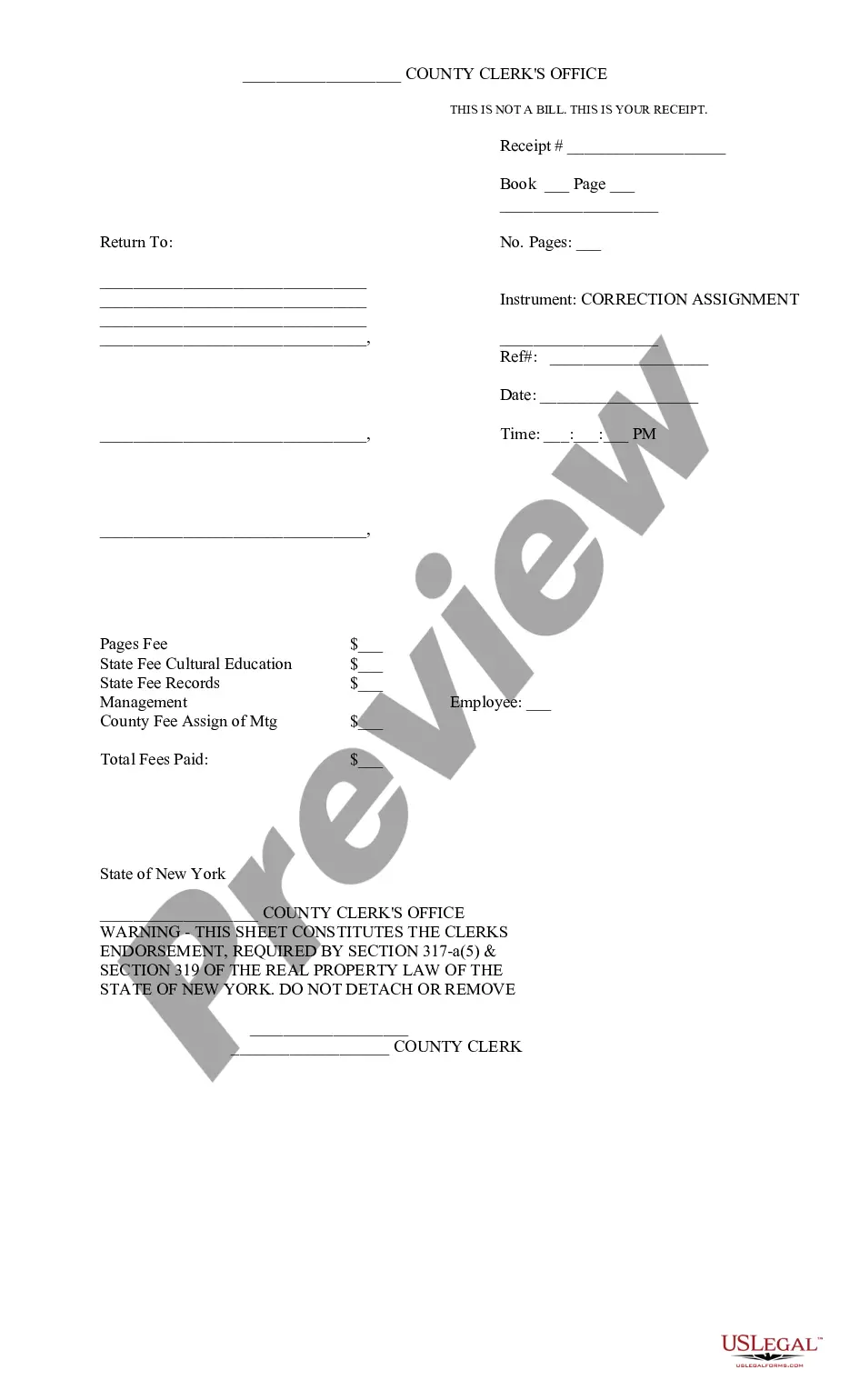

This form corrects the name of the assignor of a mortgage document that has already been recorded.

Suffolk New York Corrective Corporate Assignment of Mortgage is a legal document used in the real estate industry that allows a mortgage lender to transfer ownership rights of a mortgage loan to another party. This document is primarily used to correct any errors or deficiencies in the original assignment of mortgage. A Suffolk New York Corrective Corporate Assignment of Mortgage is necessary when there are mistakes or omissions in the initial assignment that can render it invalid or incomplete. It is essential to rectify these errors to ensure the smooth transfer of ownership and to protect the rights of all parties involved. One type of Suffolk New York Corrective Corporate Assignment of Mortgage is the Corrective Assignment of Mortgage due to a typographical or clerical error. This occurs when there are mistakes in the borrower's name, the mortgage amount, or any other crucial details. The correction document will be filed with the appropriate county office to ensure the accuracy of the assignment. Another type is the Corrective Assignment of Mortgage due to an error in the legal description of the property. This situation arises when there is an error in the property address, legal description, or any other related information that affects the validity of the original assignment. The corrective document is prepared to rectify these inaccuracies and ensure a proper transfer of ownership. Sometimes, a Corrective Assignment of Mortgage is required when the original assignment does not comply with specific legal requirements or regulations. This can include missing signatures, incorrect notarization, or failure to include all necessary parties in the assignment. The corrective document will address these issues to ensure compliance with the applicable laws. In summary, a Suffolk New York Corrective Corporate Assignment of Mortgage is a legal document used to rectify errors, deficiencies, or non-compliance issues in the original assignment of a mortgage loan. By correcting these issues, the document ensures a valid transfer of ownership and protects the rights of all parties involved in the transaction.

Free preview

How to fill out Suffolk New York Corrective Corporate Assignment Of Mortgage?

If you’ve already used our service before, log in to your account and download the Suffolk New York Corrective Corporate Assignment of Mortgage on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Suffolk New York Corrective Corporate Assignment of Mortgage. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!